Trending Assets

Top investors this month

Trending Assets

Top investors this month

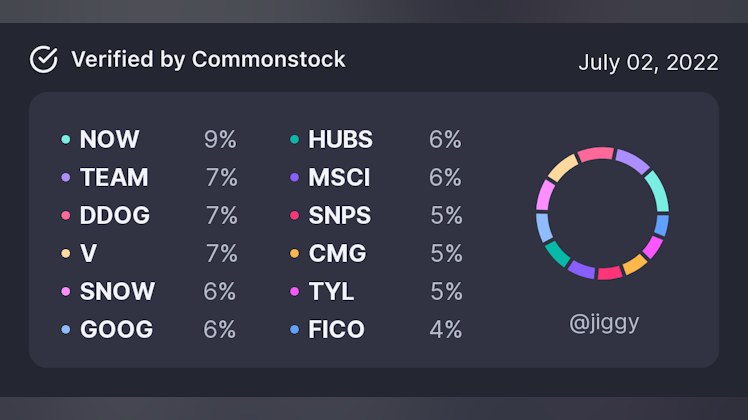

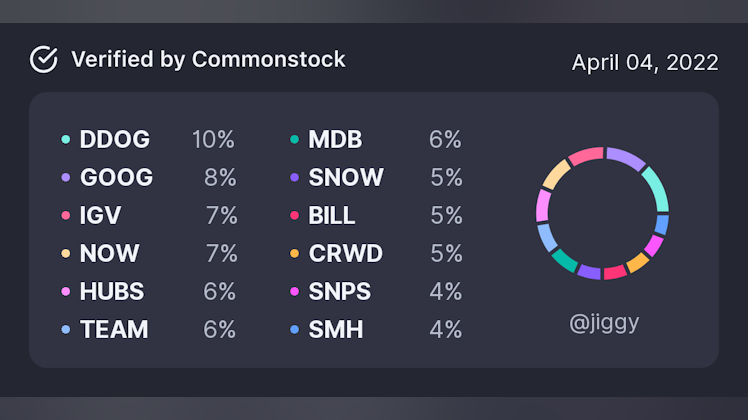

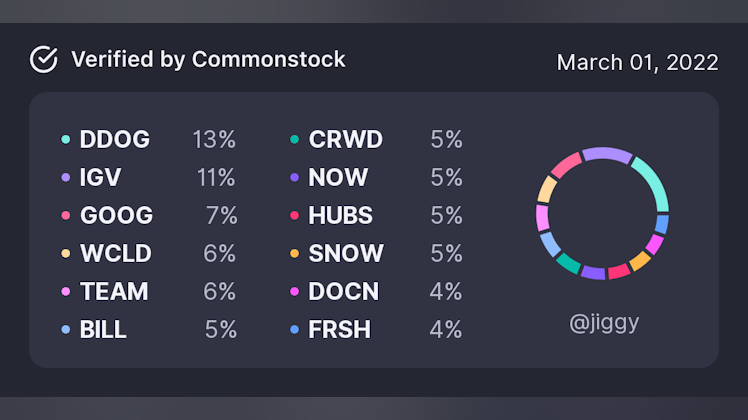

@jiggy

Sean

$16.5M follower assets

45 following364 followers

New Substack Post: Q3 2022 Sector Analysis

t.co

Q3 2022: Sector Analyis

The Jiggy Capital Newsletter #16

Portfolio Earnings Review Pt2

t.co

Q1 2022: Earnings Review Part 2

The Jiggy Capital Newsletter #14

Operating Expense Analysis

jiggy.substack.com

Q1 2022: Operating Expense Analysis

The Jiggy Capital Newsletter #13

+ 2 comments

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?