A reasonably quiet week trading wise but a solid week for the portfolios with some nice gains across the board. Monthly wrap up to follow later this weekend. I have a 10 year reunion for a team sports championship we won in 2012 so unlikely to be in any condition to crunch the numbers today or tomorrow :)

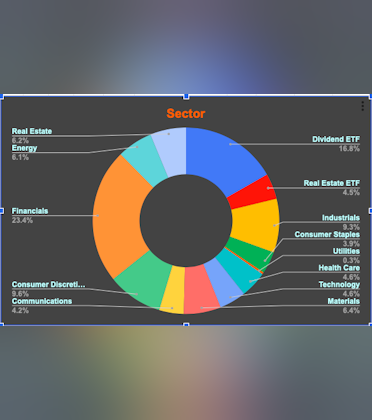

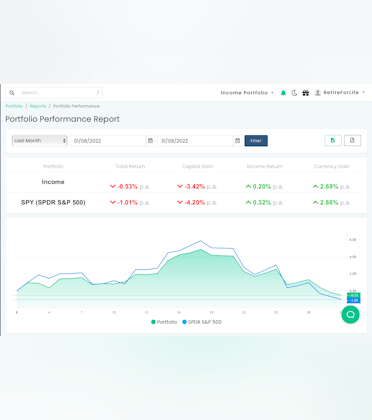

Income Portfolio: Opened new positions in

$DVN and

$LCII . Collected dividends on

$ROP $OZK $AFG and

$CMCSA . Trimmed

$PCAR with a view to being all out over the next few weeks. Sold all

$JEF for a negligible gain.

Growth Portfolio: Added

$SWAV to my portfolio holdings. Up 25% on my

$ETH.X purchase last week. I will be keeping a close eye on this and have set a tight trailing SL.

Speculative: Nil activity once again but

$MARA had a nice bounce as did

$NOTV