Trending Assets

Top investors this month

Trending Assets

Top investors this month

Initiating coverage on my portfolio - Jan 2021

tl;dr: I invest, usually for the long term, in digital payments, e-commerce, and the internet. I currently own a lot of $PINS.

Background:

I used to work at Pinterest and $PINS decent chunk of $PINS at $19/share in Oct 2019 after their IPO. I've been taking some out as cash or rotating into other investments since mid-2020. Sharing my portfolio publicly for the first time in hopes of thinking through strategies in public and getting feedback. Comments welcome!

Portfolio

Cash 56.16%

$PINS 25.38%

$SNAP 3.32%

$PYPL 2.92%

$SHOP 2.58%

$ADYYF 2.49%

$ARKF 1.92%

$TWLO 1.27%

$DDOG 0.97%

$SQ 0.56%

$FSLY 0.51%

$BTC.X 0.42%

OTIS 0.39%

$ADBE 0.26%

$ETH.X 0.23%

$NCNO 0.19%

$SNOW 0.06%

Cash / Real Estate

I have had a rather large (5 homes, pool, etc) multi-generational real estate development project in the works with my family for the past 2 years. I also recently bought a new house and am in the process of renovating and selling my old home. As a result, I've been holding a large cash balance. I use CDs, high-interest savings accounts, and have even converted some to $USDC.X to access 8%+ interest rates that some of the exchanges/lenders offer. Other low-risk cash strategies are welcomed.

Digital Advertising / Social Commerce

$PINS 25.38%

$SNAP 3.32%

I plan to significantly trim back on Pinterest after the Q420 earnings, but currently, it makes up almost 60% of my non-cash assets. Snap is my second-largest non-cash position. I've essentially bought into the @turner bull case for Snap and see similar dynamics in Pinterest.

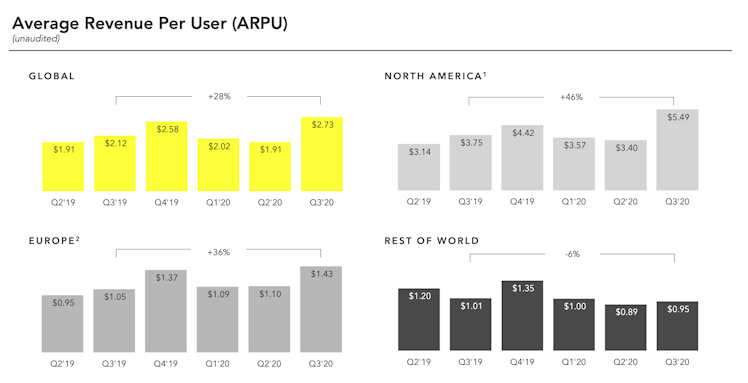

Looking at ARPU, these two are under-monetized relative to an industry benchmark, such as $FB, and are better managed than a peer, like $TWTR. ARPU numbers from Nov. 2020:

- Facebook: $7.89, up 9% year over year

- Twitter: $4.30 and declining (estimate)

- Snap: $2.73, up 28% year over year

- Pinterest: $1.03, up 15% year over year

Pinterest has considerable ARPU upside when you consider its mix of US and international usage vs. monetization:

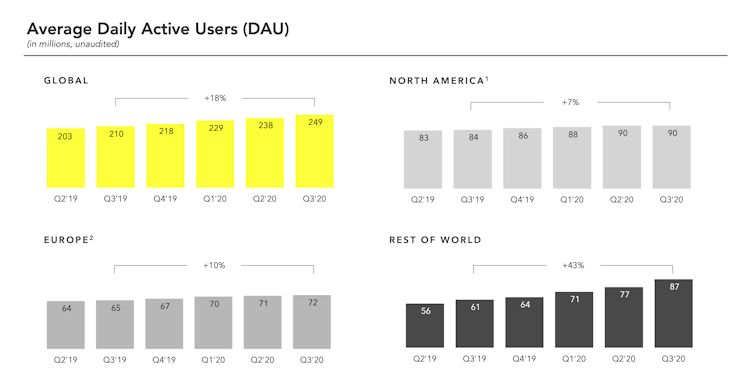

Similar story for Snap:

Facebook is a $735B company, Pinterest and Snap are $42B and $78B companies respectively. I see lots of room for both to significantly increase valuation just based on ARPU upside, increasing usage, and maturing ad tech stacks.

But the long-term growth for each platform is more interesting. First off, I think both companies and their users are misunderstood by Wall St. and Silicon Valley and are therefore mispriced [1]. Snap has a better chance of building a new social platform while Pinterest isn't a social network but is Google for emotional and image-based searches. Both companies also have compelling social commerce and computer vision opportunities they've just begun tapping into. I plan to write a memo on why Pinterest, in particular, is underrated soon.

Digital Payments & Ecommerce

$PYPL 2.92%

$SHOP 2.58%

$ADYYF 2.49%

$ARKF 1.92%

$SQ 0.56%

I've been working at payments and e-commerce tech companies for over a decade and only in the past year have I truly internalized how large and fast-growing this market is (estimated at $2T in revenue per year growing at 6%+ y/y). My strategy is to bet on stocks and ETFs that represent the plumbing behind the shift to digital payments and e-commerce (Adyen, Shopify, PayPal/Braintree, ARKF). When I invest in companies with consumer-facing plays (PayPal/Venmo, Square/Cash App, ARKF), I generally look for crypto or emerging market exposure.

Square is an interesting company that is both under and over valued. Their expansion to international markets and transition to online payments have been slower than I can explain. Today, Square's core point-of-sale (POS) card acceptance offering is available in only 5 countries (US, Canada, Japan, Australia, and the UK). Adyen, by comparison, offers POS acquiring in 13 countries plus the EU. And Square's most significant endeavors to power online and in-app payments have come only in the past two years despite showing interest in this market since at least 2017, as evidenced by the $EB deal:

- Oct 2020: Terminal API

- Aug 2019: Orders API

- Jan 2019: In-app payments SDK

- Sep 2017: Square powers Eventbrite's omni-channel payments

- Jun 2013: Square Market

I believe, like Max Friedrich at ARK Invest, that Cash App is the shining jewel [2] of Square's valuation. I've written before about how difficult it is to start up a closed-loop network [3] so the fact that Cash App is thriving is remarkable. The fact they haven't even moved outside the US yet also presents a significant upside. Square's posture on crypto, specifically $BTC, also presents good exposure to the emerging category without directly holding. Square is ARKF's largest holding at 9%, so I have more exposure there.

I've literally bet my career on this sector and as a result have the majority of my net worth tied up in two high-growth digital payments startups. Still, I plan to increase my positions in Adyen, PayPal, $MELI, and $SE to get exposure to digital payments growth outside of the US and am considering a hedge by investing into $V, $MA, $FIS, $FISV, and $GPN.

If you want a primer on investing in payments equities, I highly recommend John Street Capital's recent coverage: https://john-street-capital.medium.com/payments-the-trillion-dollar-market-opportunity-3f52b481b6e5

Internet Infrastrucutre

$TWLO 1.27%

$DDOG 0.97%

$FSLY 0.51%

$ADBE 0.26%

Cloud and SaaS are two major and growing trends that are here to say and I like to bet on companies that are powering that trend. When I have high-conviction, I'll pay crazy multiples but when given the chance, I'll opt for the relative value investment (i.e. Fastly over Cloudflare). I also believe AWS and Azure will continue to grow but I'm well exposed to them through my 401(k).

Adobe is my lowest-conviction pick for this strategy but I was intrigued because it's pretty masterfully pivoted from shrink-wrapped software to SaaS and cloud services over its 25 years. It powers a decent amount of digital ad spend on the Internet, so I'm double-counting it as part of my social media play.

Two things seem true about Cloud and Saas:

- It's about 100x bigger than anyone thought it was 10-15 years ago

- The migration to cloud/SaaS is at most 50% finished.

This brings me to my final strategy...

Enterprise cloud companies with large financial institutions as customers

$NCNO 0.19%

$SNOW.X 0.06%

I've just dipped my toe in here but I have a strong conviction that financial institutions are the laggards of the cloud transformation. If a SaaS company can get public with a significant number of banks and financial institutions as customers, I assume they have a real business today with significant upside tomorrow. Ncino sells exclusively to banks and Capital One accounts for 11% of Snowflake's revenue.

Crypto & Cultural Artifacts

$BTC.X 0.42%

OTIS 0.39%

$ETH.X 0.23%

I've been aware of and researching cryptocurrencies since 2014 when my payments startup did a partnership with Coinbase but I never bought much because I think it's a terrible payments instrument. Maybe this is a case of me not being able to see beyond what I know about digital payments. Regardless, daps and DAOs were interesting to me so I bought a bit of Ethereum. But in general, my passion and risk appetite never got me big into crypto. I think I get it now (it's digital gold, not a payments instrument) and plan to increase my positions here.

Otis calls itself a stock market for culture. I currently own a few shares in some art, comic books, and trading cards. This is the most fun asset I own (I was geeked when I got to buy shares in the first comic book appearance of Black Panther) and it's performi$SNAPll but I'm not sure how$PINSthis will ever become in my portf$SNAP

Up next:

- Trim: $PINS

- $PYPLD: $SNAP, $$BTC.XPYPLASSET/FIS:e$BTC.X $FISV, $$GPNMA$BTC.X, $FISV, $GPN, $MELIX, $$SE.X

- Buy: $MELI, $SE

Research:

- To go along with my internet infrastructure thesis, I plan on researching chip and semiconductors stocks/ETFs like $XLK and $AMD.

- There are also a number of recent fintech and commerce IPO/SPACs I'd like to learn more about: $AFRM, $ROOT, $INAQ, $BTRS, $ABNB, $POSH, $WISH, $OPEN.

- Finally, I am intrigued by $DIS and think over the next 10 years it will continue to grow. Their digital/media story seems obvious but I need to get more familiar with the rest of their business (i.e. theme parks).

Already have an account?