Earnings Week (April 18) 1-day price action

We are up for another busy week of earnings! Here are the reports I will look into and how the stocks performed historically, 1 day after the earnings release.

My favorite earning plays this week are $JNJ $PG and $DHR. $SNAP is a good "lottery" play for the more courageous among us!

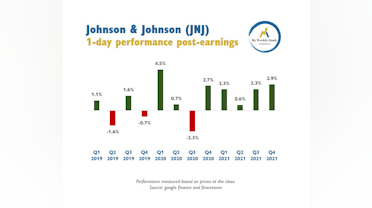

Jonhson & Johnson $JNJ - April 19 before the open.

1-day performance in the past 12 quarters:

- Average returns = +1.2% 🟢

- Average price move = + / - 1.9%

- % of positive returns = 75% 🟢

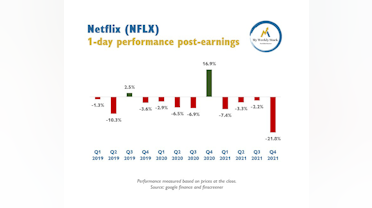

Netflix $NFLX - April 19 after the close

1-day performance in the past 12 quarters:

- Average returns = -3.9% 🔴

- Average price move = + / - 7.1% ⚠️

- % of positive returns = 17% 🔴

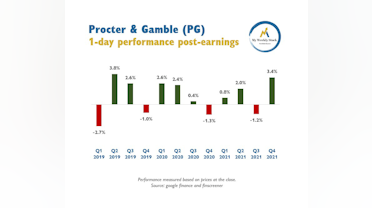

Procter & Gamble $PG - April 20 before the open

1-day performance in the past 12 quarters:

- Average returns = +1.0% 🟢

- Average price move = + / - 2.0%

- % of positive returns = 67% 🟢

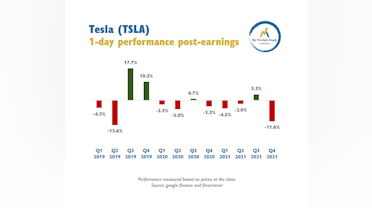

Tesla $TSLA - April 20 after the close

1-day performance in the past 12 quarters:

- Average returns = -1.2% 🔴

- Average price move = + / - 6.5% ⚠️

- % of positive returns = 33% 🔴

United Airlines $UAL - April 20 after the close

1-day performance in the past 12 quarters:

- Average returns = -2.3% 🔴

- Average price move = + / - 4.2%

- % of positive returns = 33% 🔴

Danaher $DHR - on April 21 before the open

1-day performance in the past 12 quarters:

- Average returns = +1.6% 🟢

- Average price move = + / - 2.1%

- % of positive returns = 75% 🟢

American Airlines $AAL - April 21 before the open

1-day performance in the past 12 quarters:

- Average returns = +0.3% 🟢

- Average price move = + / - 4.2%

- % of positive returns = 50% 🟢

$SNAP - April 21 after the close

1-day performance in the past 12 quarters:

- Average returns = +10.3% 🟢

- Average price move = + / - 20% ⚠️ 🎢 ⚠️

- % of positive returns = 58% 🟢