Trending Assets

Top investors this month

Trending Assets

Top investors this month

Stocks patterns post Earnings - Week April 11th

The earnings season starts this week! Here are the reports I will look into and how the stocks performed historically, 1 day after the earnings release.

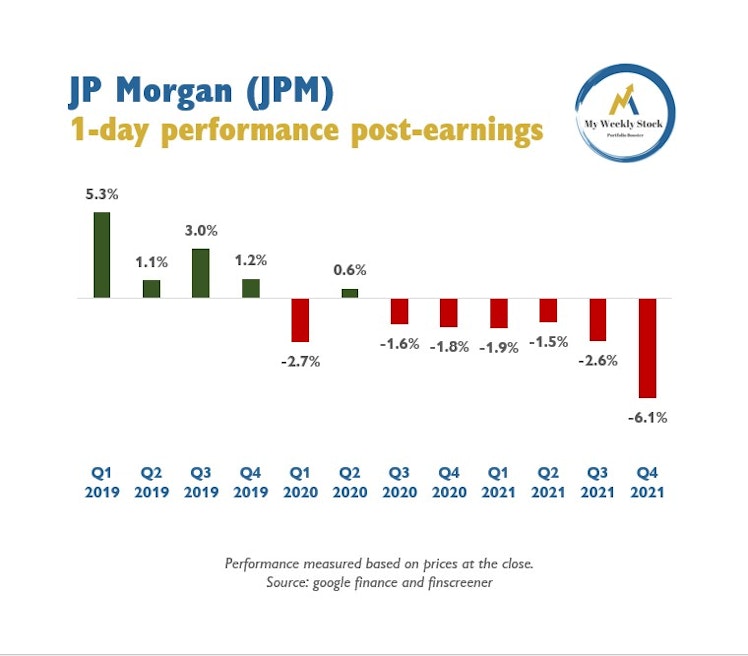

JP Morgan $JPM - April 13th before the open

1-day performance in the past 12 quarters:

- Average returns = -0.6% 🔴

- Average price move = + / - 2.4%

- % of positive returns = 42% 🔴

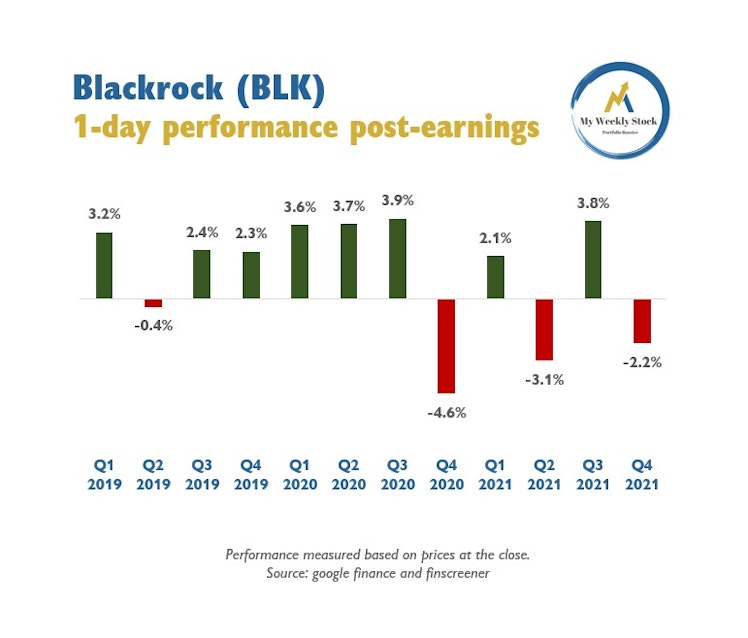

Blackrock $BLK - April 13th before the open

1-day performance in the past 12 quarters:

- Average returns = +1.2% 🟢

- Average price move = + / - 2.9%

- % of positive returns = 67% 🟢

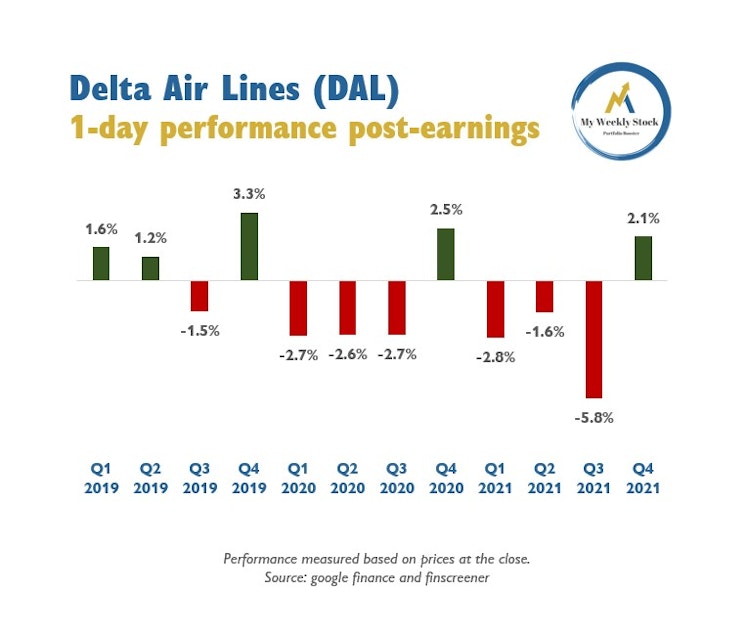

Delta Air Lines $DAL - Apr 13th before the open

1-day performance in the past 12 quarters:

- Average returns = -0.8% 🔴

- Average price move = + / - 2.5%

- % of positive returns = 42% 🔴

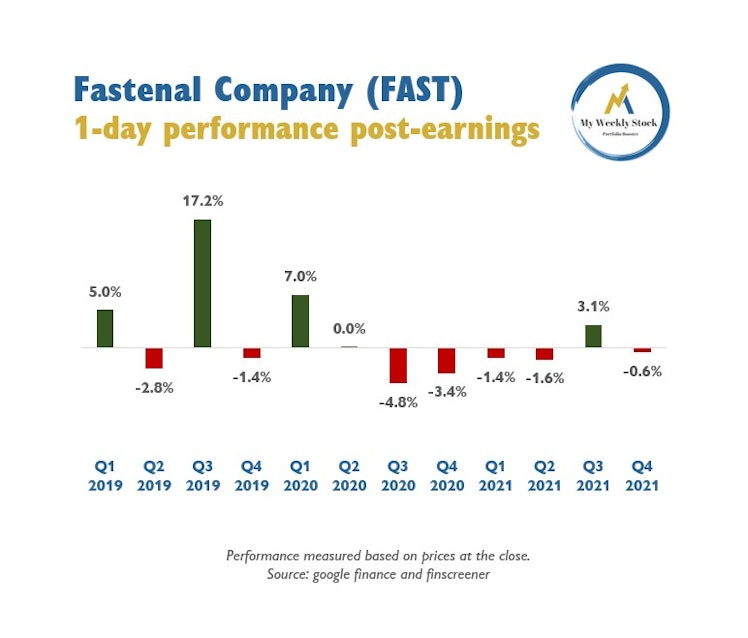

Fastenal $FAST - April 13th before the open

1-day performance in the past 12 quarters:

- Average returns = +1.4% 🟢

- Average price move = + / - 4.0%

- % of positive returns = 42% 🔴

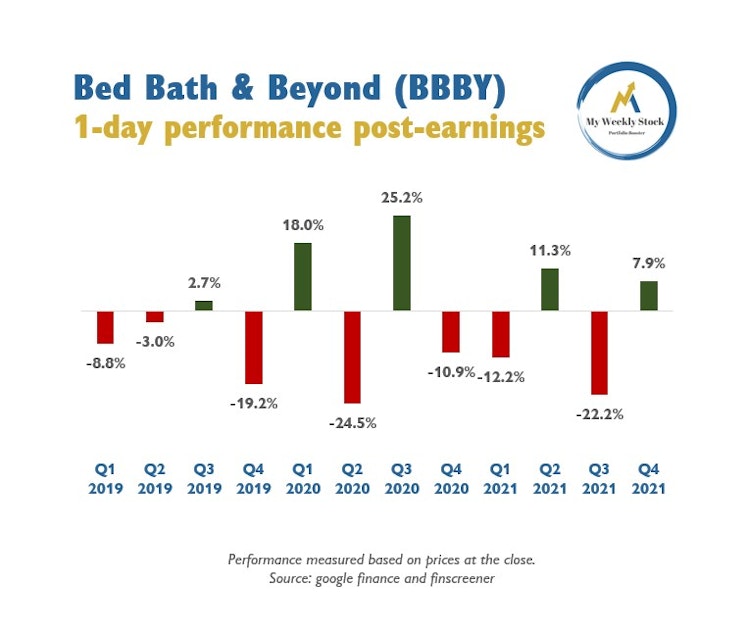

Bed Bath & Beyond $BBBY - Apr 13th before the open

1-day performance in the past 12 quarters:

- Average returns = -3.0%🔴

- Average price move = +/- 14%⚠️

- % of positive returns = 42%🔴

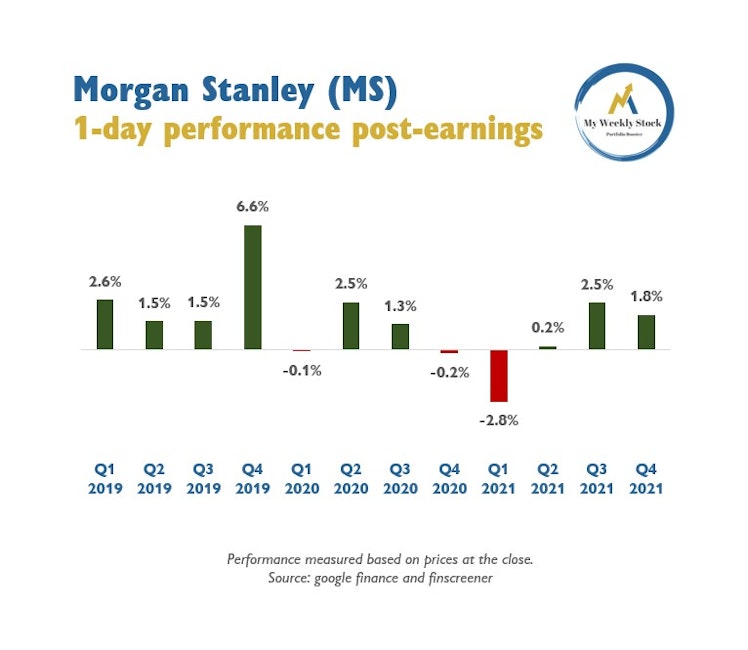

Morgan Stanley $MS - April 14th before the open

1-day performance in the past 12 quarters:

- Average returns = +1.5% 🟢

- Average price move = + / - 2.0%

- % of positive returns = 75% 🟢

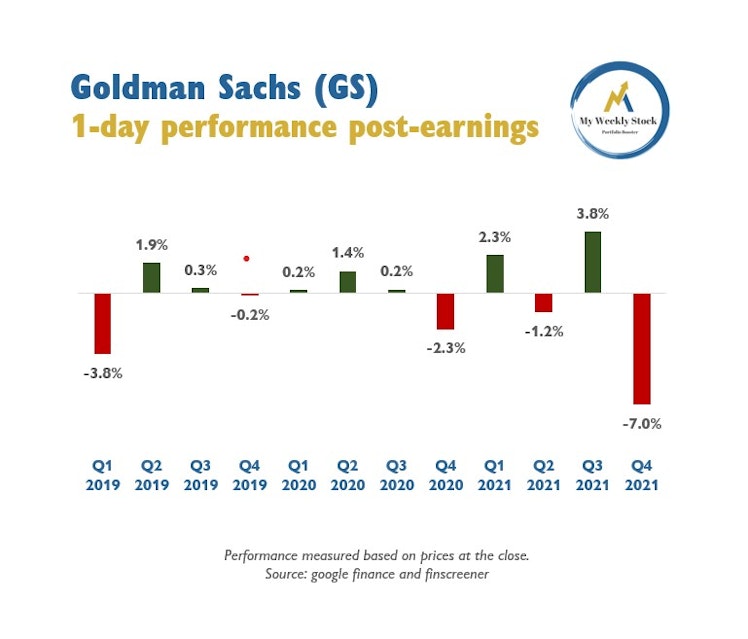

Goldman Sachs $GS - April 14th before the open

1-day performance in the past 12 quarters:

- Average returns = -0.4% 🔴

- Average price move = + / - 2.0%

- % of positive returns = 58% 🟢

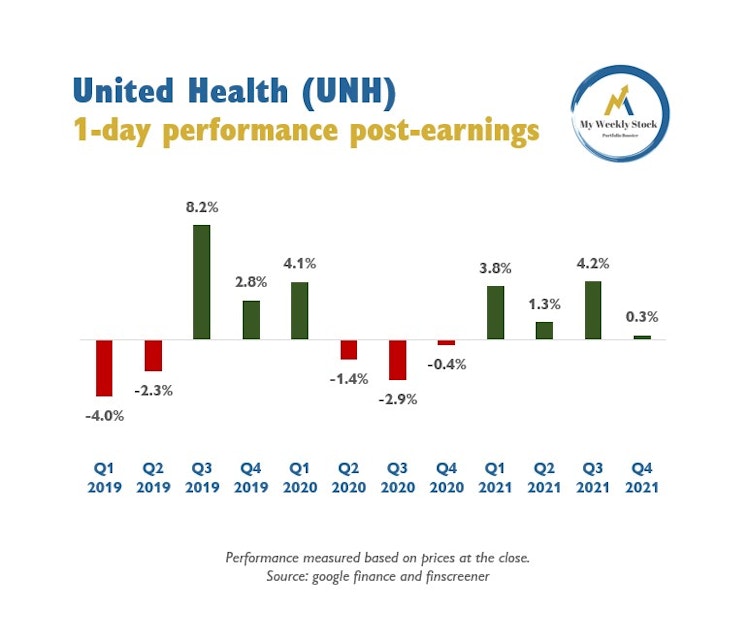

United Health $UNH - April 14th before the open

1-day performance in the past 12 quarters:

- Average returns = +1.1% 🟢

- Average price move = + / - 3.0%

- % of positive returns = 58% 🟢

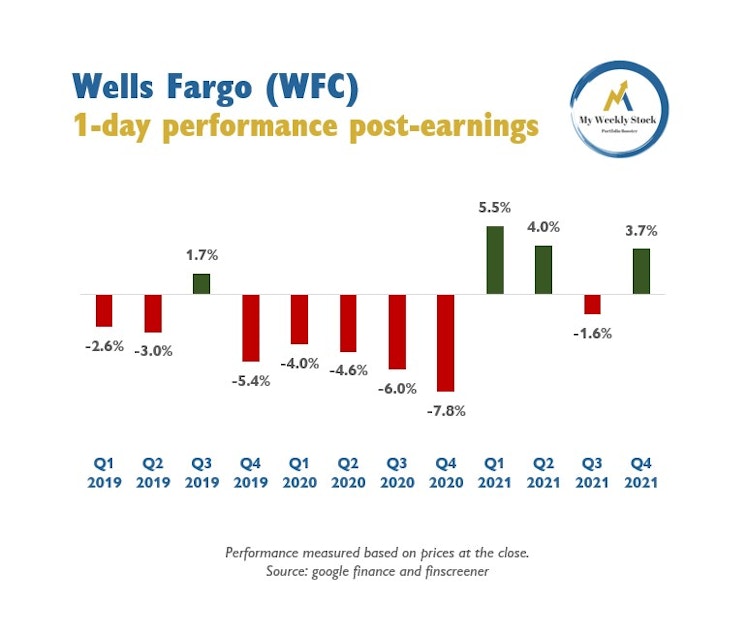

Wells Fargo $WFC - April 14th before the open

1-day performance in the past 12 quarters:

- Average returns = -1.7% 🔴

- Average price move = + / - 4%

- % of positive returns = 33% 🔴

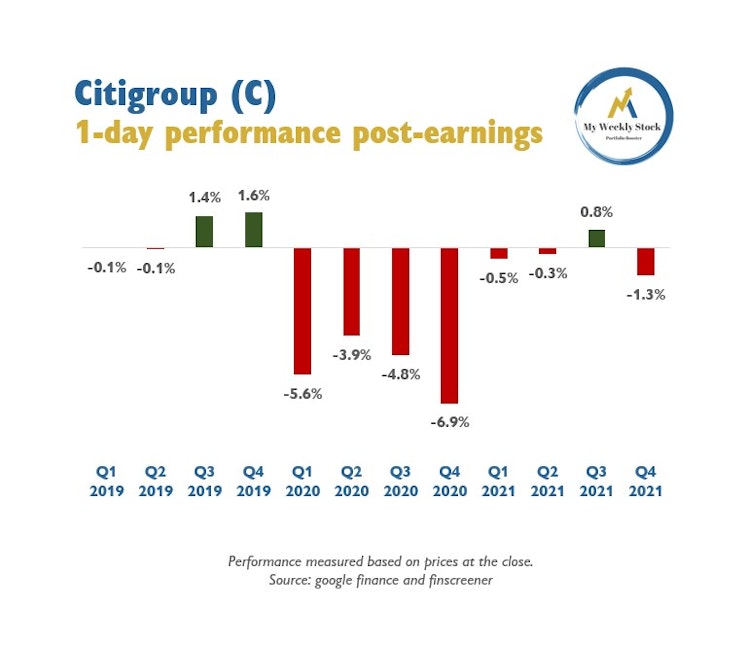

Citigroup $C - April 14th before the open

1-day performance in the past 12 quarters:

- Average returns = -1.6% 🔴

- Average price move = + / - 2.3%

- % of positive returns = 25% 🔴

Already have an account?