Trending Assets

Top investors this month

Trending Assets

Top investors this month

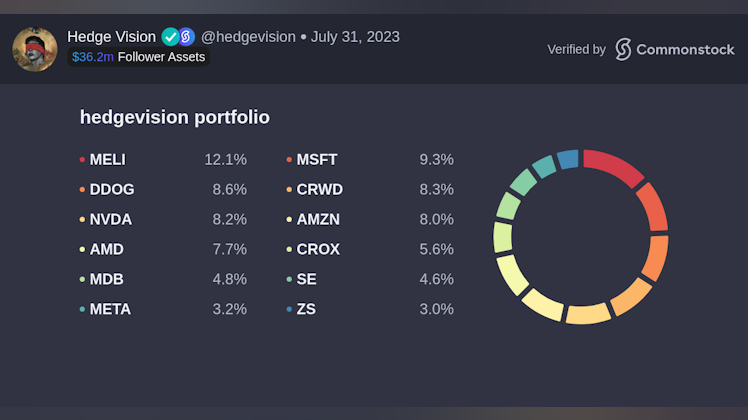

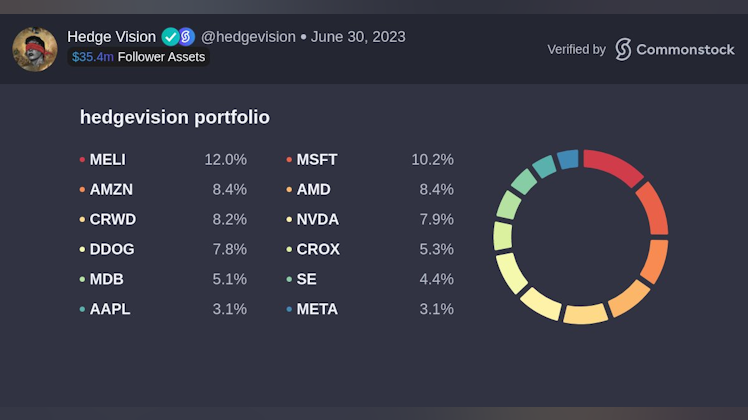

@hedgevision

Hedge Vision

$26.5M follower assets

160 following809 followers

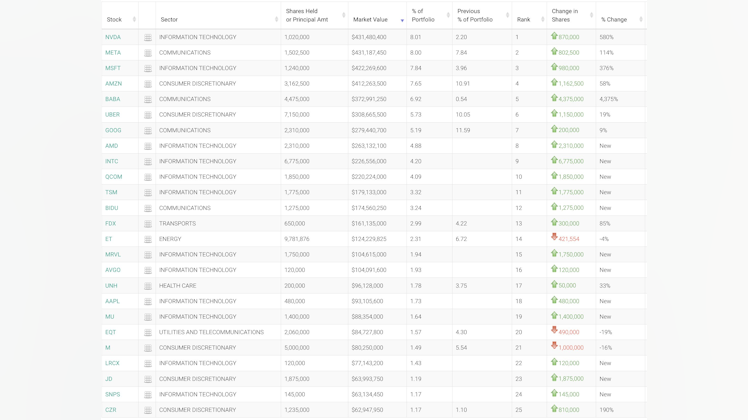

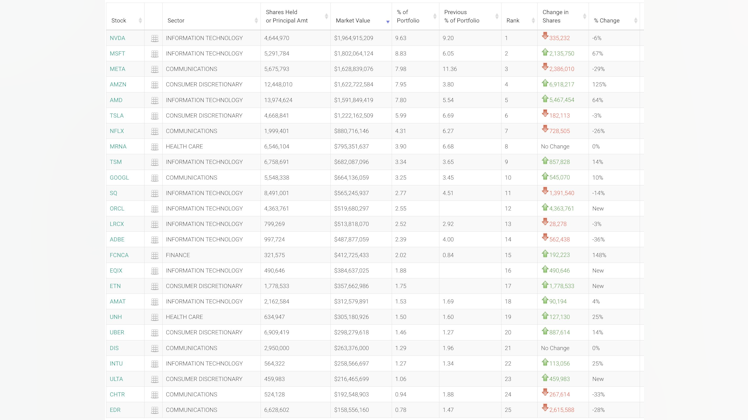

2023 Mid-Year Portfolio Review

hedgevision.substack.com

2023 Mid-Year Portfolio Review

The Hedge Vision portfolio has returned 48.5% this year

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?