Trending Assets

Top investors this month

Trending Assets

Top investors this month

My July Returns Are In!... And They're... Good?

I'm still getting annihilated in both of my portfolios but less annihilated than a month ago!

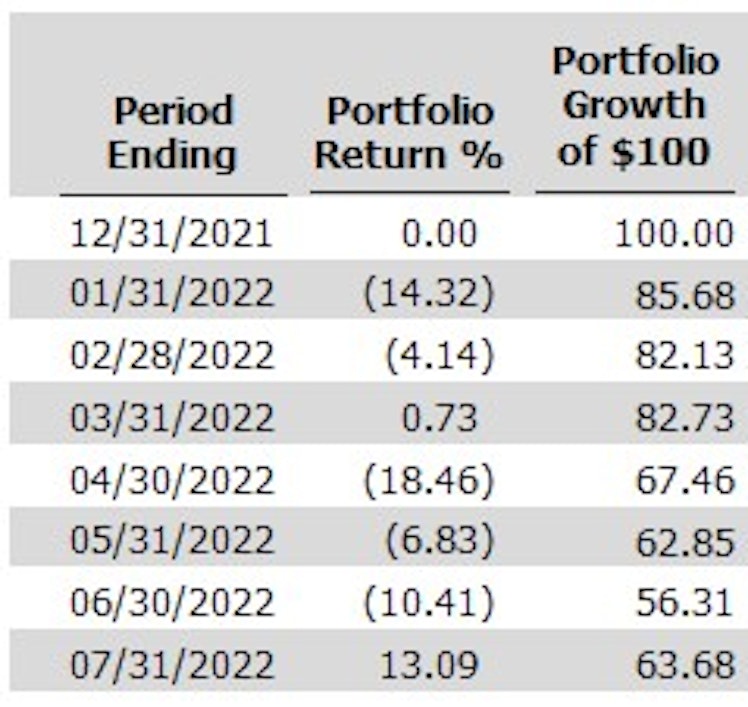

Retirement Portfolio

In June, I opened zero new positions. I added to $MKL twice, $TYL twice, $MCD twice, $WM twice, and $IIPR. Relatively quiet month. I also added to $NVDA, $BIPC, $AMT, $MPW, $O, $IIPR, $NLCP, and $TSM via DRIP. I exited zero positions.

My retirement portfolio was up 13.09% in July. However, I'm still down 35.84% YTD and my month-by-month YTD is as bad as growth investor's portfolio returns could look.

Shoutout to my best performing retirement positions in 2022 so far:

And a look at my best retirement performing positions in July:

My top 10 positions continue to make up ~33% of my portfolio. $MELI's great July brings to back to the top spot followed by $AAPL, $AMZN, $F, $GOOGL, $SHOP, little known and rarely mentioned $NVEE, $COST, my baby $SWAV, and $SIVB.

Looking forward to August, I'm still considering opening a new position in either $TTD, $TWLO $SONO, $NET, $NTDOY, and after this recent fall, $ROKU.

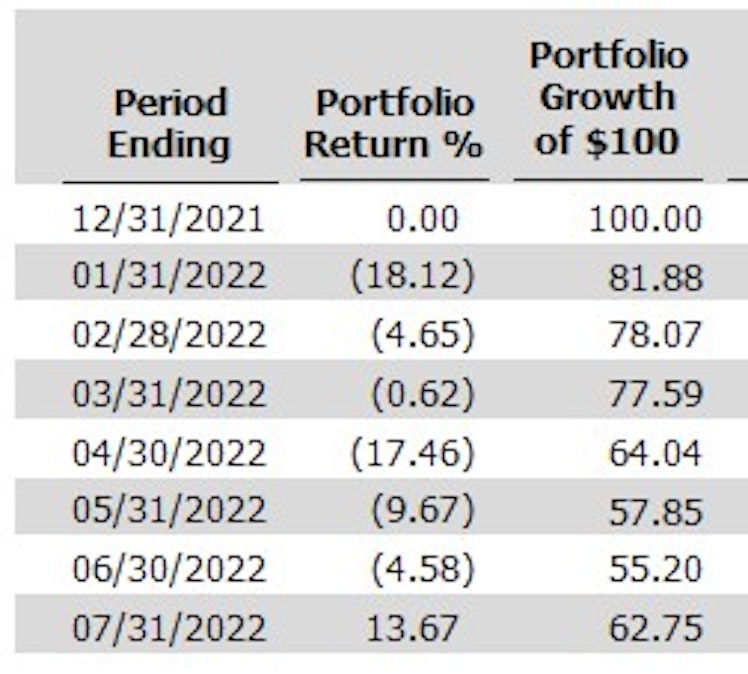

Taxable Portfolio

In June, I only added to $ATZAF. No positions in this brokerage pay a dividend so there was no DRIP and I did not exit any positions.

Similar to my retirement portfolio, my taxable was up 13.67% in July but is still down 36.60% YTD and the month-by-month is also still abysmal.

Shoutout to my best performing taxable positions in 2022 so far:

- $TMDX with a 110.75% return YTD

- $MSP with a 39.49% return YTD - RIP as is had such a great return because it was acquired.

- $SILK with a 8.10% return YD

And a look at my best performing taxable positions in July:

My top 10 positions continue to make up ~90% of my portfolio as I only have 14 positions in this brokerage. The top 10 remains basically the same with $SNOW, $TMDX, $ATZAF, $SILK, $DT, $LMND, $NCNO, $CPNG, $BIGC, and $OM. Those other 4 positions must be truly awful performers (indeed they are).

Looking forward, I'm undecided which position to add my monthly DCA to. Leaning towards $DT or buying the dip on $OM.

Alternative Investments

I've begun putting some money into Fundrise, Landa, and StartEngine. It's too little to even bother with showing returns and a lot of the stuff is illiquid but I wanted to at least catalog what I'm investing in.

Fundrise

I haven't really dove into yet. I've just been dumping money into it since April and letting them allocate into their Flagship Real Estate Fund. I'll look at their other portfolio options when I get some extra time.

Landa

I've been putting a very small amount of money into Landa each month since April just to play around. I've bought shares in 5 properties and seen some miniscule dividends. It's an interesting foray into real estate and I will probably continue adding to it. The current list of properties I have shares in are:

- 1394 Oakview (GA)

- 4474 Highwood (GA)

- 729 Winter (GA)

- 8662 Ashley (GA)

- 24 Ditmars (NY)

StartEngine

This is probably my favorite of the 3 and also the most risky by far. StartEngine allows angel investing in non-public companies. The odds of investments going to zero must be incredibly high while the odds of them ever making it to a publicly traded company incredibly low. That's why StartEngine will remain a very small portion of my portfolio.

I currently am invested in:

- 3i Tech - "3i Tech Works builds engagement solutions to increase customer loyalty and drive revenue for small and medium-sized businesses. Our integrated platform aims to even the playing field for brick-and-mortar retailers and restaurants by providing them the best digital tools to connect and engage with mobile customers."

- Future Cardia - "We are Future Cardia (Oracle Health, Inc.) - Bringing you a tiny insertable cardiac monitor for a long-term heart failure monitoring solution to disrupt the $5B market and to set the stage for Connected Implants. Our approach is a simple 2-minute office procedure that brings simplicity, accuracy, high compliance for long-term monitoring, and existing insurance coverage."

I having approved but not yet finalized investments in:

- SapientX - "We have created a voice assistant powered by AI (artificial intelligence) that can interact with users as if it were their best friend. Today, we are working with companies that make cars, appliances, smart home devices and vending machines to voice-enable a new generation of products."

- POPS! Diabetes Care - "We have developed and commercialized a revolutionary AI self-care platform for diabetes management. Our mission is for people to take ownership of their diabetes through simple technology, and we have people in all 50 states and Australia using Pops."

- Kari Gran - "Kari Gran Skincare is a pioneer in the rapidly-growing clean beauty business, headed by passionate female founders disrupting the category with differentiated products targeting an underserved market; women 40+ experiencing dry skin due to menopause. We know the stresses and challenges that come with dry skin, but more importantly, we also know the solution."

I also have an approved but not yet finalized investment in a signed edition Banksy artwork, Laugh Now.

StartEngine

Banksy Laugh Now | StartEngine

Buy shares in important works of art

Already have an account?