Amplitude and the moneyball-ification of Product // $AMPL

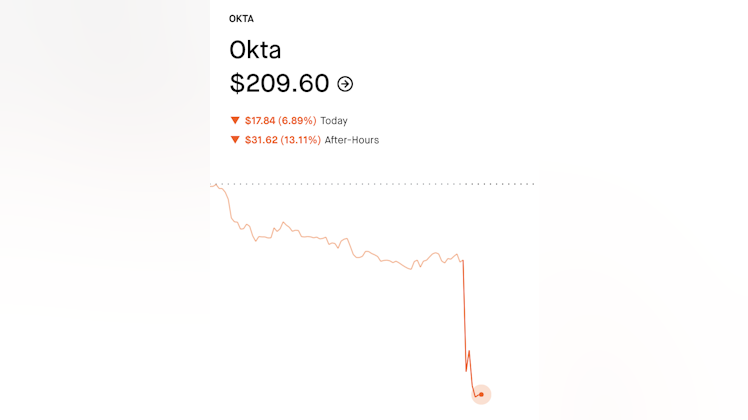

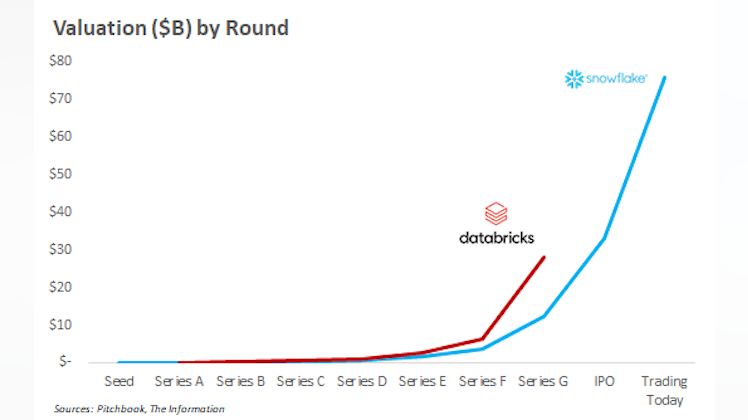

Amplitude hasn't gotten as much excitement as the larger data/analytics companies like Snowflake and Palantir, but I think it's got all the secular tailwinds you'd like to see in a high-growth stock. It just went public under 2 weeks ago and is one I am slowly building a position in.

I wrote a longer deep dive on the stock here, but I'll summarize below.

Background

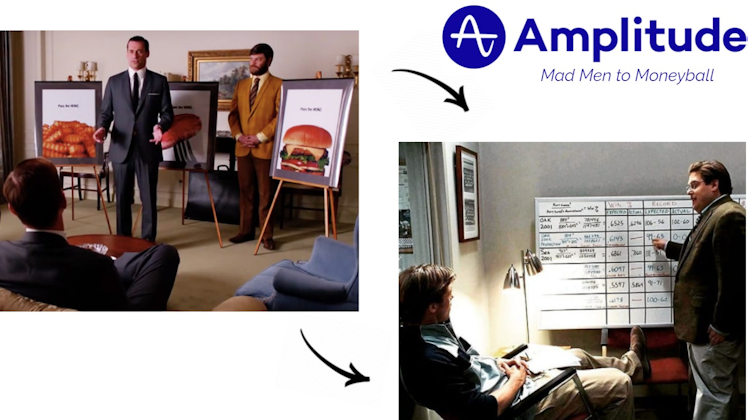

Amplitude is a product analytics company that enables product teams to better understand user behavior and iterate on their product experience. As mobile and SaaS exploded, you had an explosion of "product data" that teams were attempting to wrangle with. Companies like Facebook and Netflix built large scale systems to not only process this data, but also identify pain points and improve on them. Amplitude is democratizing the $37B product analytics market and helps answer questions like:

- Which behaviors cause low retention rates?

- What predicts conversion to the top subscription tier?

- Where in the purchase journey do users experience friction?

- Which features increase new customer retention?

I like the stock

The reason I am particularly excited is that they have built a strong wedge product (Amplitude Analytics) and have launched two new products this year alone. I think we're going to see Amplitude continue to keep product velocity high (with help from M&A) and drive significant expansions into existing accounts.

While they have competition from notable companies like Mixpanel, Heap, and Pendo, they seem to be farther along in transitioning from mid-market to enterprise. As such, I think they'll have a significantly easier time adding these product expansions to the largest customers.

Why Now

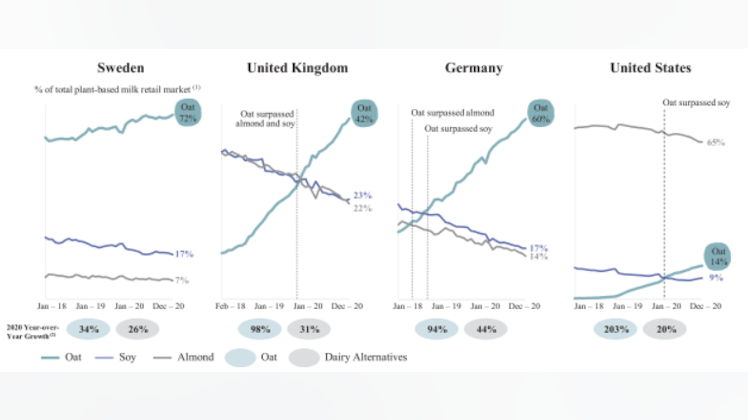

- Rise of bottoms-up sales: As end users became decision-makers of software (ie Slack, Figma, etc), it has become more important to understand how people use your product. We are no longer in a world of only top-down selling to executives, which means being user-centric is more important.

- Rise of product-led growth: As digital products became recurring, you no longer cared just about customer acquisition and top of funnel analytics. Today, product is always "selling" and expansion revenue has become a significant lever for large businesses.

- Democratization of data science and analytics: Lastly, there are more data consumers within organizations today than ever before. It's not just analysts or data scientists, but rather entire product organizations who want to be empowered with the right data.

Financials

The quick financial highlights are:

- Revenue growth is 66% YoY (note: covid creates atypical comp).

- Gross margins are 71%

- Number of customers have grown 51% YoY

- Net retention rate is steady at 119%

- 65% US revenue (35% rest of world)

Forward guidance is:

- Expected revenue growth of 65% YoY for Q3 ($43-44m)

- Expected revenue growth of 57% YoY for full fiscal year of 2021 ($160-162m)

- Expected revenue growth of 40%+ or more for 2022 ($224m+)

I think it's still early days for Amplitude and am excited to follow the stock and hear the journey progress.

nandu.substack.com

Amplitude: Mad Men to Moneyball

A deep dive into the leader in product analytics

This is awesome, @askates let’s get Spencer on here to comment!!

Product led growth is a new secret weapon I’ve started looking for everywhere. Cc @zach and his blog about it: https://notoriousplg.substack.com/