Hi all,

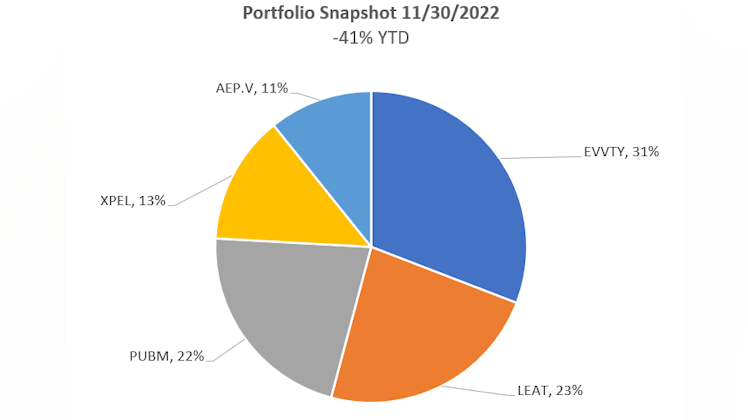

This year has not been easy for many growth equity investors, myself included. I've made many adjustments throughout the year to best position myself for this point in the cycle.

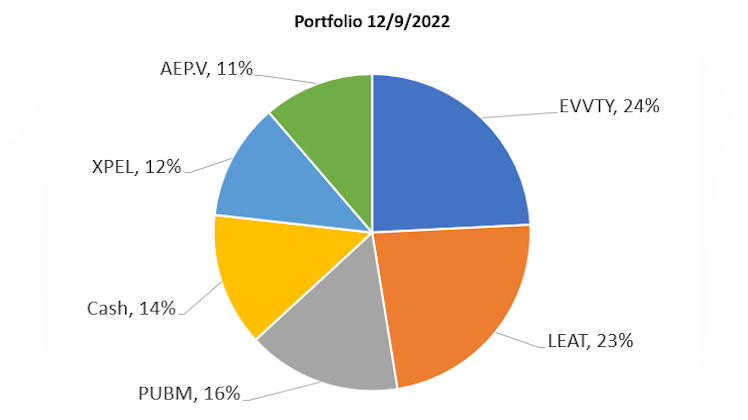

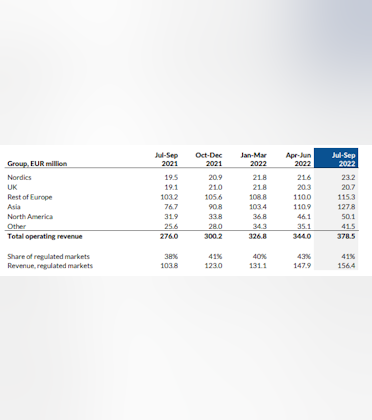

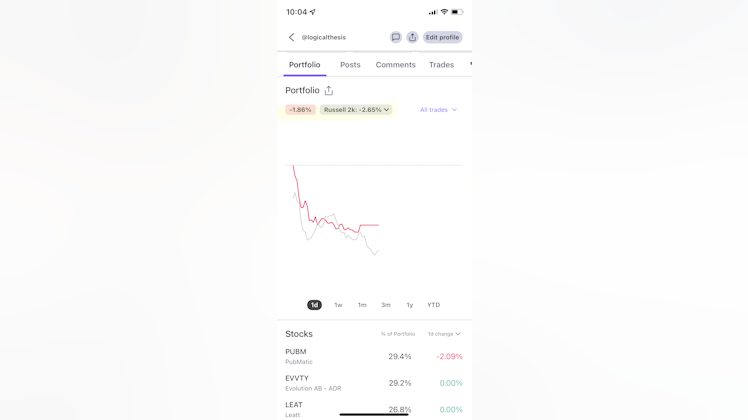

First, here is a screenshot of my current portfolio:

I consolidated my portfolio to my highest conviction names. People may find holding just five stocks a bit too risky, but on the contrary, it's easier to keep up with the businesses when there are fewer of them. The names in my portfolio are all growing double digits (upwards of 30%) and, most importantly, are profitable. This is key to what my strategy is now. Growth at a reasonable price (GARP) and profitable.

I have two buckets of stocks among these five:

• High growers with higher P/E:

$EVVTY $XPEL (~30% growth ~30 PE)

• slower growth with lower valuation:

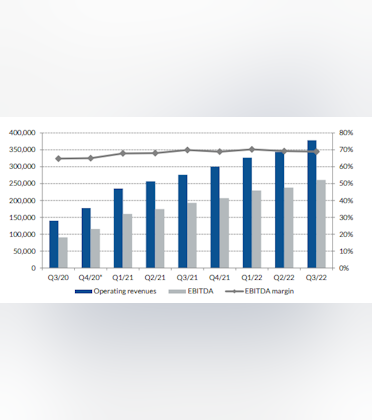

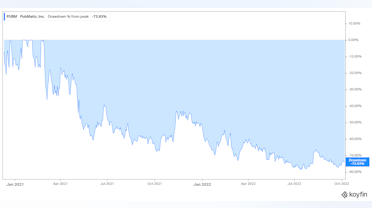

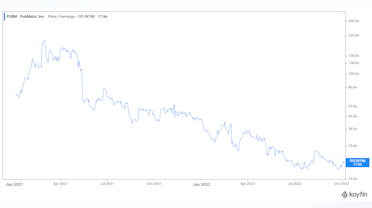

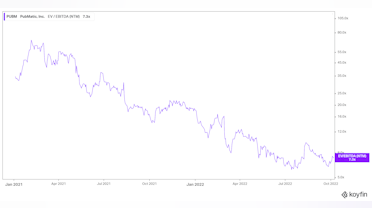

$PUBM (15% growth at 6X EV/EBITDA, 10X FCF),

$LEAT (8 PE and taking market share amid an industry slowdown),

$AEP.V (3X EBITDA and buying back shares until closer to fair value)

I used the downturn to swap what I consider riskier positions/lower conviction holds for the names above which feel easier to hold through an economic downturn (given confidence in the business model to generate cash flows). I invest in a taxable brokerage account which means:

- I was able to take advantage of realizing losses for future tax advantages

- I was able to take advantage of a bear market, where other equities I swapped to were also in drawdowns/undervalued

Here are a few of the lessons I learned and I hope they will help readers as they think about their future investments and protecting their downside.

Below are stocks/situations which resulted in majority of my 2022 losses. I ditched many names rather quickly as the economic cycle turned:

• cash burning biotechs like

$NAUT $SLGC - it's clear to me proteomics will be the future but how long until their technology is mass adopted and how much cash will they burn until then? I'm almost certain I will regret selling out of this sector, but I realized that although the general thesis of proteomics (next evolution of gene sequencing) will be the future of medicine, I'm not a biologist and cannot determine which company(s) will have superior technology. In this instance, it may be better to take a basket approach, but even then, it's a tough time to be burning cash and potentially having to raise cash. Both these names have sufficient cash to survive for years but I preferred to hold simpler to understand businesses. My second largest realized loss of the year was

$SLGC, holding it through nearly the entirety of its drawdown before selling.

• this brings me to another point: don't price anchor. It doesn't matter how much you are down so far, it matters what the stock will do moving forward. You don't need to make your money back the same way you lost it. In fact, it's likely it won't be made back the same way.

• another reason I lost big this year was buying the hype of SPACs.

$SLGC was a SPAC. So was

$ME (another major loss for me from a cash burning biotech, though I took most those losses in 2021). We have to remember that during SPACs, IPOs, spin-offs, the insiders who know the most about a company are selling you something. They know the ins and outs, the future outlook, and most importantly, the value of the business. During heightened valuations of the markets, I highly recommend to steer clear from IPOs in all forms. Wait for stock prices to reset. Don't let your emotions and FOMO trick you into big losses.

• another issue with

$ME was diworsification (Peter Lynch term). They realized their therapeutics programs burn cash rapidly so they needed self-funding methods. Their test kits were not generating enough $ and slowing down. They moved into primary care, which was the CEO's plan to have genetics-driven healthcare. This is yet another cash-burning outlet which will take years to grow (if it does). Dilution here is highly likely. I exited once I realized the cash burn rate increasing further.

• unprofitable businesses (especially retailers) like

$TUEM $BTTR caught me off guard. These may have worked better in a low rate environment and a high demand for goods environment like we saw during Covid. But without profitability, they're either forced to take on debt or dilute shareholders (and more so if the stock price is dwindling). If a company isn't profitable, you need to have a margin of safety on the balance sheet. These companies touted great growth (

$BTTR) and turnaround potential (

$TUEM), but I failed to respect risk. Because of this, I took my biggest loss on

$TUEM. I thought I was smarter than the market. The turnaround story made a lot of sense.

$BURL execs in place, activist hedge fund, incentives were aligned with shareholders. But I failed to consider the bear case. And the bear case was not reaching escape velocity, e.g. implosion. Investing is a game of probabilities, and our position size should be determined by the downside, not the upside. I can't stress this point enough. If a stock has a chance of going to 0, the likely bet size is $0. Take the downside into consideration. Make bets accordingly.

• my biggest learning yet, because it hurts my soul on a personal level is: don't give stock tips to family members and friends. No good deed goes unpunished. My genius and naivety led me to talk too much about

$TUEM in front of family members and friends. It seemed so obvious at 0.5x sales. What could go wrong? Oh, demand could fall off a cliff, their balance sheet could pose too much risk. Valuation tied to the income statement isn't enough, you must consider the balance sheet.

• which leads me to my final learning. What's cheap can always get cheaper. If you thought

$TUEM at 0.5X sales was cheap, wait til you can buy it at 0.05X sales. Great bargain, right?... Right??

All in all, it's best to buy profitable companies with a margin of safety on the balance sheet. Avoid speculative situations (assuming it will play out how you think it will without the track record). Avoid the 'too close to call' situations. Don't FOMO at peak valuations. You may make money, but it's equally likely you lose more money. Avoid mediocre business models. Diversifying in 20 mediocre businesses is not reducing risk.

I hope my memo provides valuable learnings and helps fellow investors protect their downside.

Be careful out there and happy hunting!