Trending Assets

Top investors this month

Trending Assets

Top investors this month

Looking at the investment opportunities of companies in various industries from the CPI of the United States in April

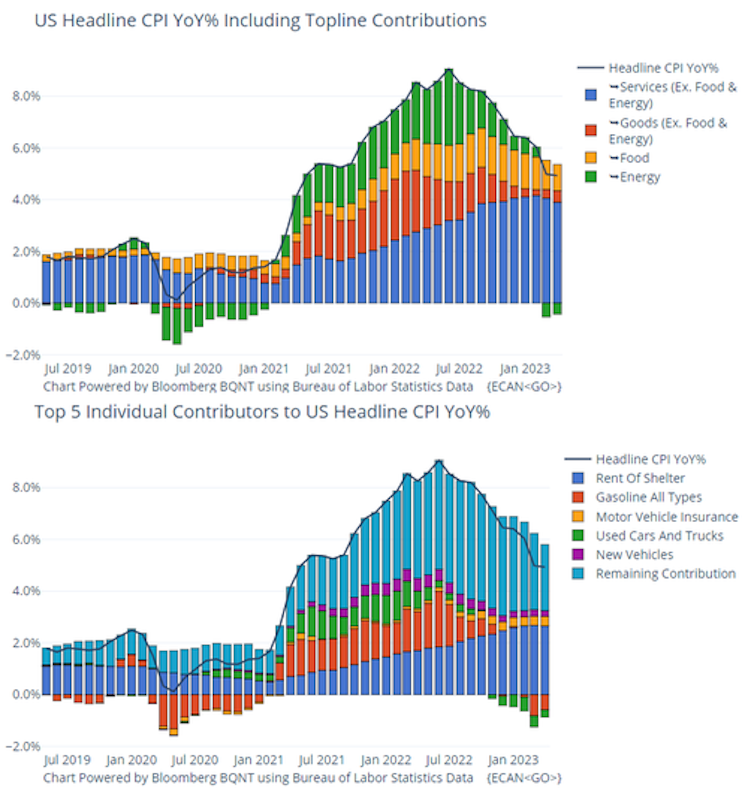

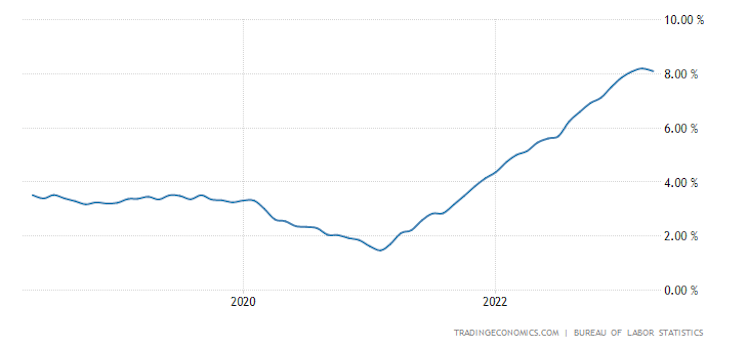

Last Wednesday,the CPI announced by the US Bureau of Labor Statistics rose by 4.9% year-on-year in April, which was the 10th consecutive decline since the high point in the second half of last year, and the smallest year-on-year increase since April 2021, which was lower than the expected 5% and the previous 5%, while the CPI rose by 0.4% month-on-month and the expected 0.4%.

However, although the overall CPI has declined, the range is not large, and the core CPI has only decreased slightly by 0.1% compared with last month, with almost no significant change. In fact, the core CPI has hovered around 5.5% for the fourth consecutive month, and the annualized value of the last three months is still as high as 5.1%, which is still at the 5% mark, indicating that it is quite sticky. At this rate, inflation is still a long way from the long-term target of 2%.

If we look at the CPI of subdivided items, different industries do show different characteristics.

Energy is the main driving force for the downward trend. The energy index has dropped by 5.1% year-on-year, while the energy sectorIt $XLE is also the largest plate in pullback/retracement this year. After all, last year's performance was too good, with the stock price reaching a new high and the profit reaching a new high. Since the beginning of this year, oil companies have increased dividends, hoping to keep shareholders' enthusiasm when oil prices fall. However, in terms of body, in the face of insufficient demand, there is little motivation for oil prices to continue to rise. So companies in the energy industry $XOM $CVX $COP $EOG $MPC Waiting is not a good target this year.

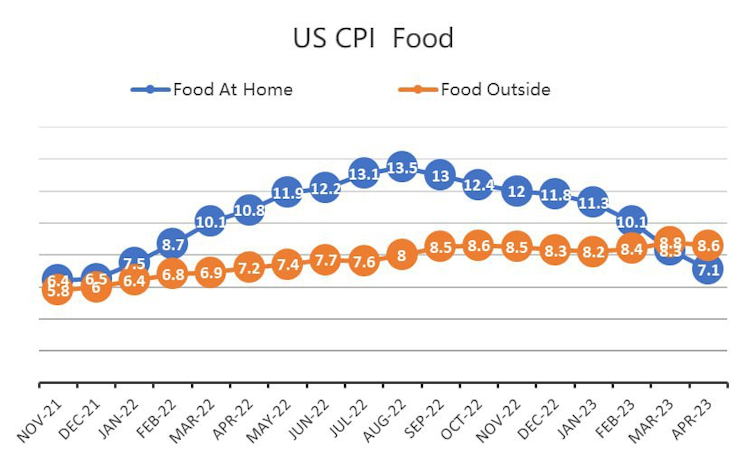

The overall food index rose by 7.7% year-on-year, which has been higher than the overall value, but it also showed a downward trend. To tell the truth, most foods are just needed, and the elasticity of quantity and price is not great, so there is not enough motivation to start quantity through price reduction after price increase.

And food includes "eating at home" and "eating out". Among them, the growth rate of the cost of eating out has been lower than that of eating at home. Therefore, in the era of food price increase, more and more people choose to eat out, which puts greater pressure on the general food industry. Before that, we were in $TSN It is also mentioned in the financial report analysis of, ", the prices of meat and vegetables in basic foods can't rise, especially beef with higher unit price, and the volume and price have fallen, which puts great pressure on these producers and distributors. And chain restaurants and related supply chain enterprises, such as$PEP $KO $MCD $SHAK And so on, they perform better.

Housing is still the most important factor driving up CPI. The rent of residential buildings has increased from 0.5% last month to 0.6% month-on-month, the equivalent rent of owners has remained flat at 0.5% month-on-month, and the index of staying away from home has dropped by 3.0% month-on-month in April. The market has been waiting for the rent to fall, but it has not fully appeared so far.

However, it is estimated that it will take another quarter to fully show the lag of rent, so the slowdown of rent inflation after June may be a greater consensus. In addition, owners' equivalent rents rose 8.1% year-on-year, setting a new record, adding some confusion to the downward trend.

United States Rent Infation

Trend of real estate sector $XLRE And REITs related to Mortgage are still under pressure for some time, such as the largest mREITs $NLY

In terms of entertainment services, the travel industry made some correction in April. In April, the hotel accommodation price dropped from 3.1% last month to-3. 4%, which looks more like a monthly fluctuation. Some microscopic evidences show that the demand for hotel orders this summer vacation is still good, which means that the hotel accommodation price may not be able to continue to drop sharply. This may be good $BKNG As well as $UBER Companies in this travel industry.

Interestingly, Airbnb's financial report just released this week lowered its forecast for the next quarter because it included recession forecast. I don't know if it will exceed expectations.

Among the remaining decline indices, air fares fell by 2.6%, with the largest decline, mainly due to the impact of falling oil prices, which $JETS Aviation sector, such as $LUV $ALL $UAL Have a certain influence. But $BA It is indeed an industrial sector, and the current 737max delivery is expected, which is not affected by the aviation industry.

The new car index decreased by 0.2% month-on-month, while the price of used cars reversed the previous decline, from 0.9% month-on-month to 4.4%, showing signs of bottom out, but it still declined year-on-year, among which the decline in oil prices contributed greatly. In this regard,$TSLA $RIVN Such new energy vehicle companies did not get much benefit, but made certain adjustments to the price of new cars when raw materials rose. Traditional car companies still face challenges $F $GM

The communication index fell 0.1% month-on-month, with little change. The basic health care index did not change in April, but fell 0.3% last month. The health service index rose 0.5% in April after falling 0.4% in March. The prescription drug index rose 0.3% in April. Healthcare is also a relatively inflation-resistant sector, with volatility correspondingly reduced after the end of the pandemic. In addition, the price growth rate of labor-intensive items such as garbage collection (0.6%), hospital services (0.5%), motor vehicle maintenance (0.5%), laundry and dry cleaning (0.5%) is still relatively high, indicating that the impact of high wages on service inflation still exists.

On the whole, core inflation is highly sticky, but after excluding rent, service inflation has weakened, which is a great comfort to the Fed, and it can consider suspending the rate hike in June-July. The slowdown in inflation is a positive signal, but it also depends on the speed at which core inflation slows down.

The non-farm data released last Friday remained strong, and the wage income of workers continued to rise, which helped the continuous expansion of household consumption. In addition, enterprises in most industries still have strong pricing power (except for some industries that are difficult to raise prices). Up to now, Q1 corporate financial report shows that although the price of upstream products has dropped, many companies can maintain a high profit margin, and enterprises have no motivation to cut prices for the time being. And most companies in the technology industry, such as $AAPL $MSFT $GOOG $NFLX $META They all performed well, and in the case of strong uncertainty in the consumer industry, they became a good choice for investors to balance their positions.

Already have an account?