Axie Infinity: Not missing this opportunity

When I got into crypto, I didn’t trust it at all; that healthy skepticism has protected me from catastrophic losses as that industry has went to shit recently. I spread my speculative investments over close to a dozen wallets and exchanges, between $100-$300 on each platform. I did this not only to test the platform, software, customer service, ease of use & adoption, ease with which money flows; but also to protect myself from any bankruptcies. Voyager went bankrupt, Luna went to zero. This is why I feel so comfortable holding $COIN, I have a lot of experience in the space and they’re unique & safe for a number of reasons.

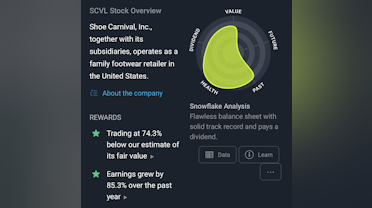

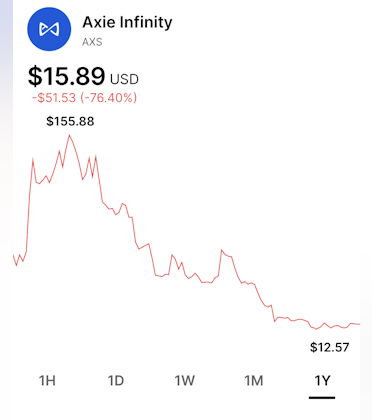

But this post is about an individual crypto coin and the opportunity I believe it presents. Of all the crypto out there, I have complete faith in 2; those that follow me know I’ve raved about Crypto.com’s $CRO.X & $AXS.X; nothing has changed, except they’re even cheaper now. The game, Axie Infinity, still has millions of dollars transacting across their platform and they’re one of the few crypto projects generating revenues like that, not just a pipe dream of some future revenues. I understand I am not entitled to those earnings, but if I’m going to invest in crypto projects, I need to see legitimate business behind my investment. This was a coin that got as high as $155 during the highs of the past year and is under $20 now. Because crypto investors have no idea what they’re doing, they have little idea of fundamental analysis; see Dogecoin and Shiba Inu, so coins like Axie (the baby), get thrown out with the bath water. I didn’t feel it was overvalued at $120; relative to all the worthless crypto’s trading for hundreds of dollars. But now it’s trading around $15 and I can’t pass up adding more to my holdings. There’s no science or fundamental analysis behind valuation of crypto yet, but I like my chances with this crypto. Their leaders in the biggest space in blockchain, generate more revenue than probably any project that’s not an exchange, or Ethereum, and has a very attractive yield. I won’t ever have more than 5% of my portfolio in crypto, but this is one I am happily adding to.

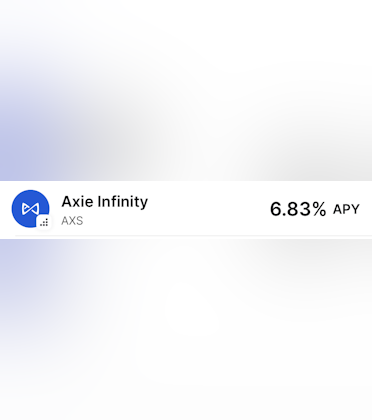

Plenty of projects have crashed and burned and that is a real possibility with Nexo, my high yield wallet holding Axie at 36% APY. So I have most of my Axie with Gemini, a much more transparent American exchange, that pays a more realistic 6.83% APY.

I will happily add at $15 while yielding almost 7%, to one of the two crypto projects I truly believe in.

Don’t ask me how Nexo yields 36%, but it’s been going strong for months. I’m from the hood, I don’t ask questions, I just have a realistic understanding of the speculative nature of the investment and limit my position accordingly.

Source: Gemini

Source: Gemini

Source: Nexo

Crypto.com

Crypto.com | Securely Buy, Sell & Trade Bitcoin, Ethereum and 250+ Altcoins

Over 80 million users buy, sell, and trade Bitcoin, Ethereum, NFTs and more on Crypto.com. Join the World's leading crypto trading platform.

Axie is dead. Players don’t enjoy the game and the Ronin blockchain was hacked