Trending Assets

Top investors this month

Trending Assets

Top investors this month

Sorry I’m late

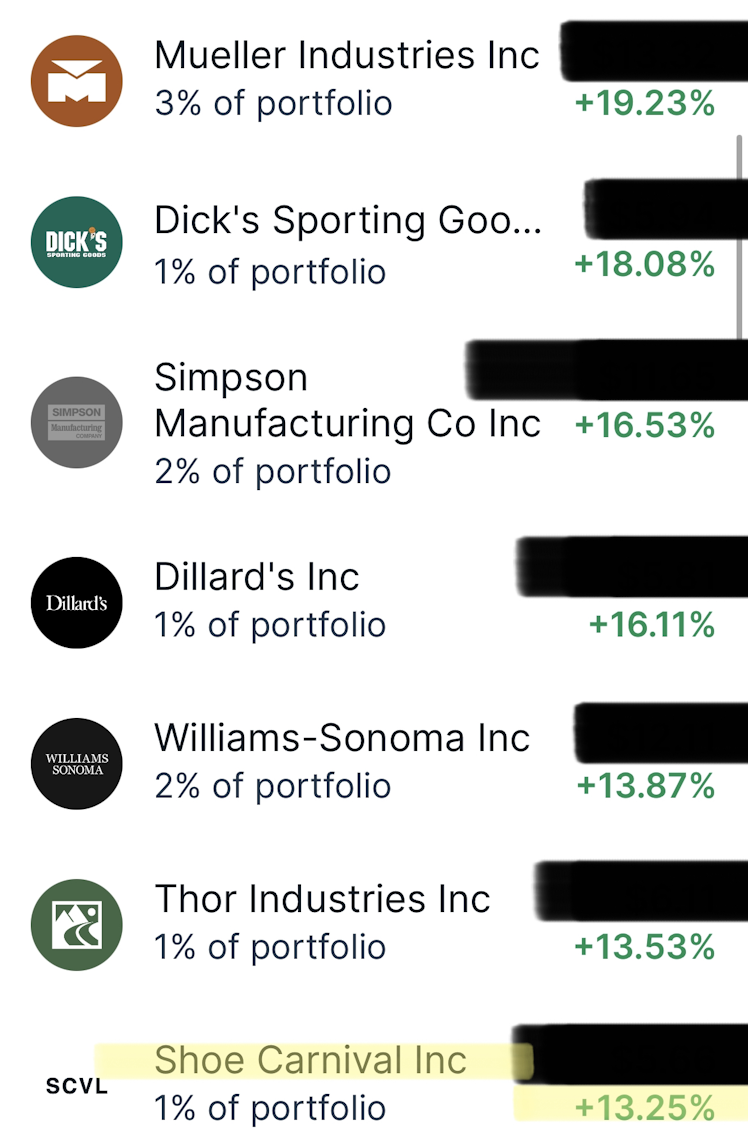

Sorry I couldn’t get a write up done for the Buy the Dip competition, better late than never, so that we have the article to check next July😉. These are some of the buys from my last 30 days or so. $SCVL was my candidate for the Buy the Dip entry; just couldn’t get the time to put my data together.

Not usually someone who buys small niche companies like Shoe Carnival, but at pre-pandemic prices and excellent execution, I love this stock at this price.

Some companies I own like Google, Microsoft, and Berkshire Hathaway, I intend to hold forever, unless there is some catastrophic shake up. Plenty of other companies, like Shoe Carnival, I buy with short term expectations for capital appreciation. This is not a long term buy, same with most of my retail, but a short term trade to take advantage of what I believe is an irrational price.

And I heard all the noise about mall shopping centers dying; as I was yielding a dividend near 10% and seeing capital appreciation of +140% on my $SPG buy the dip during the Covid crash (that’s why I ignore the noise).

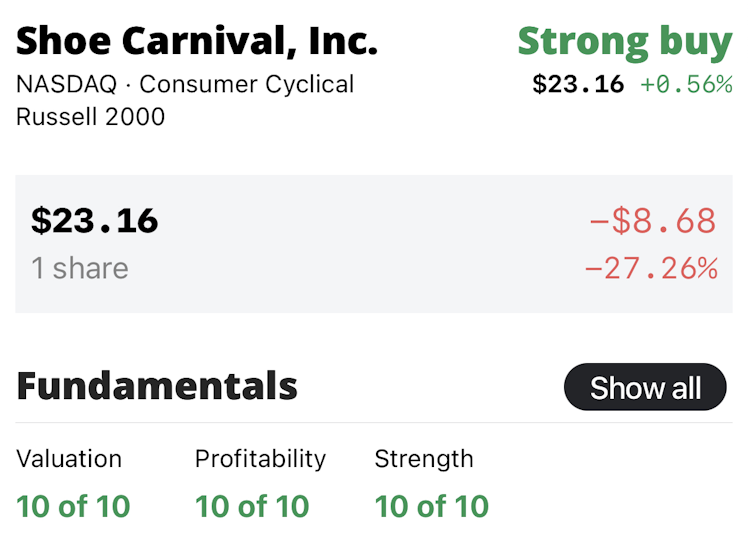

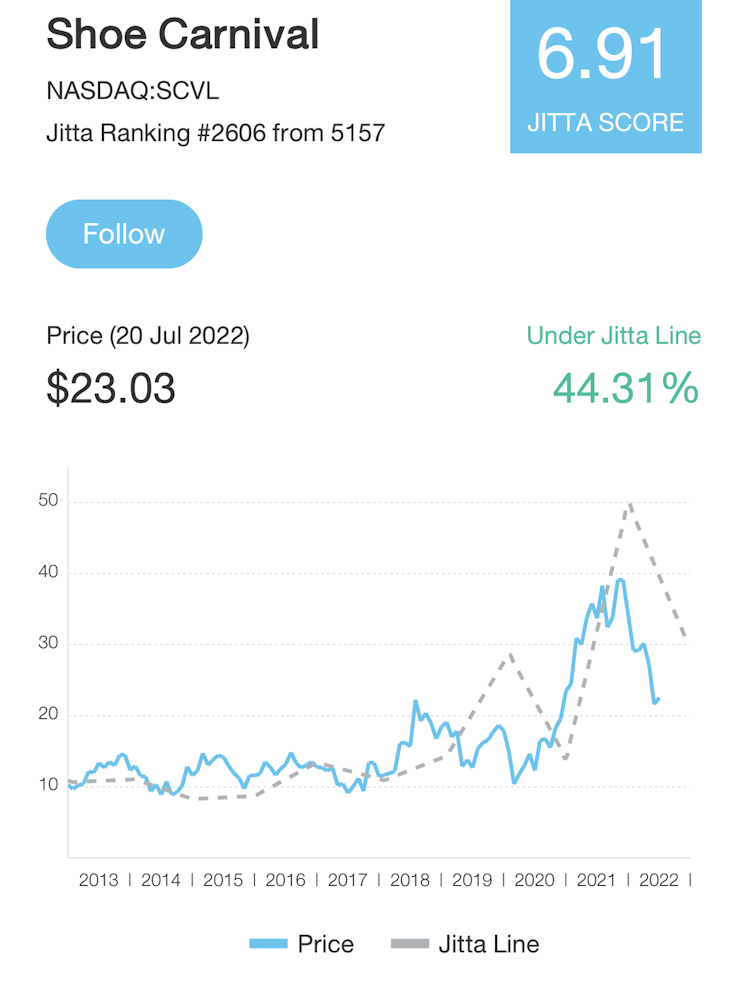

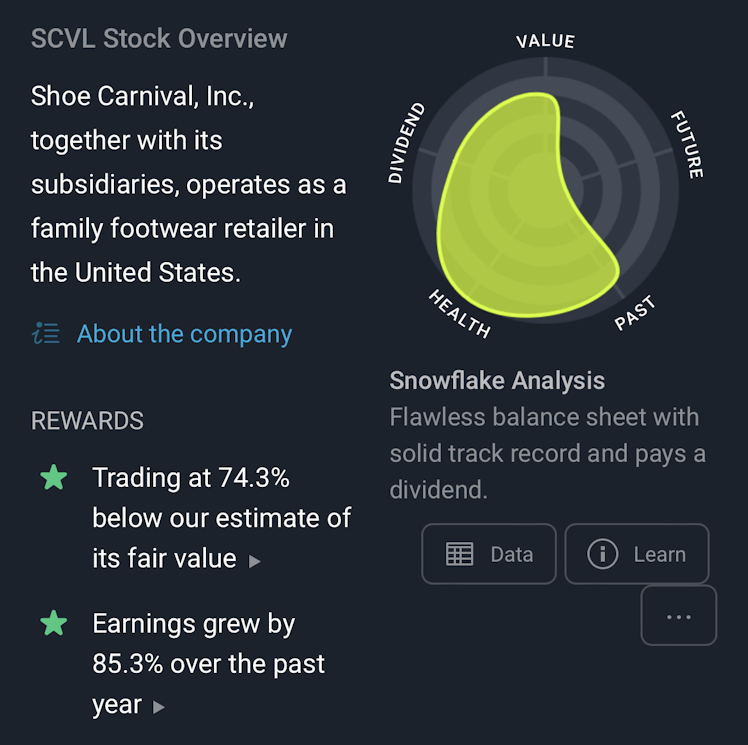

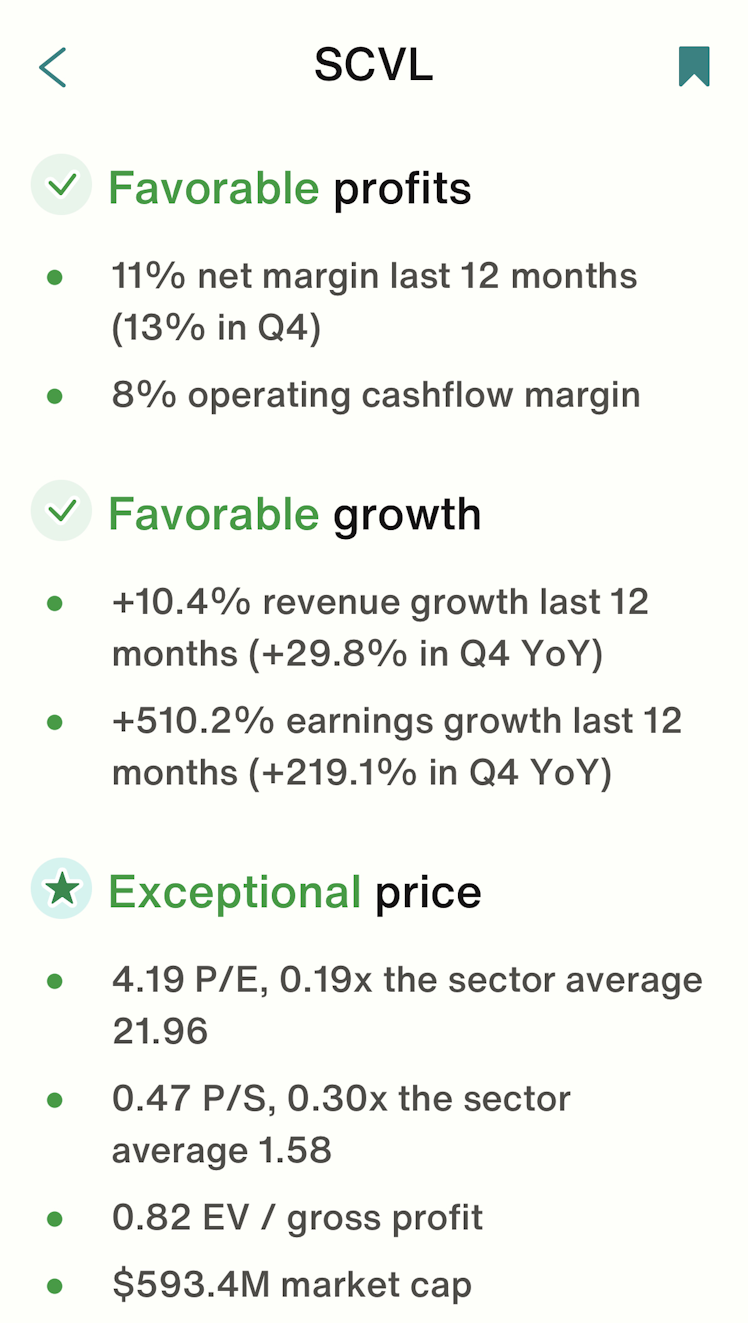

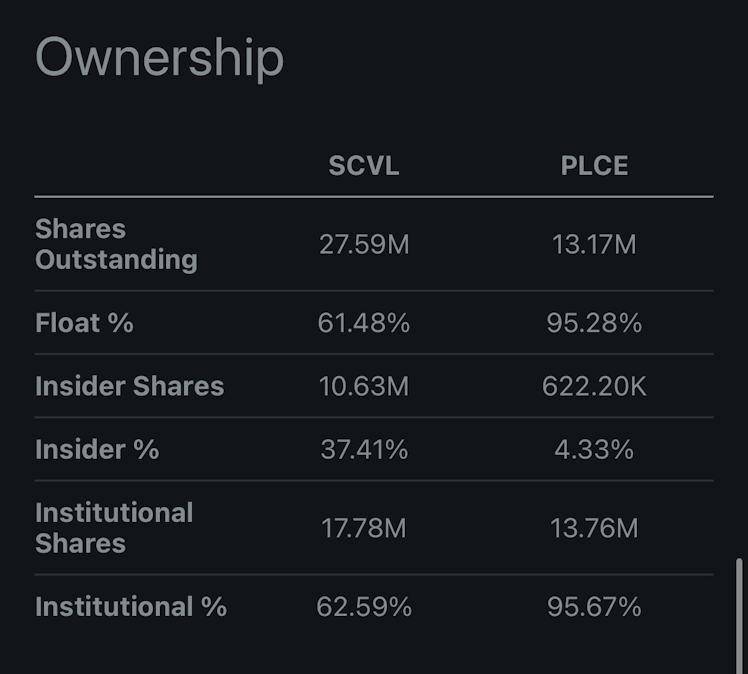

Since the competition is over, I’m not going to drop all the analysis. But valuation is insane. EV/EBIT <5, P/E <5, PEG <1, P/S <1. ROE 34%, ROA 14%, ROTC 18%. Growth looks great too but is skewed due to the drop during Covid and accelerated growth post-pandemic. Makes it tricky even when comparing 3 & 5 year CAGR. Margin of safety estimates I use range from 44%-74% below fair value. Those are some of the details driving my decision. Dividends have increased 9 consecutive years, with a small payout ratio of ~6%, and double digit 3 & 5 year CAGR. One last bonus? Only 2 Wall Street analysts cover the stock and insiders hold nearly 40% of shares.

In pictures:

Source: Kappa (the one share in this pic is just a virtual share added to track the stock on a watchlist within the app. Actual purchase was on July 14 @ $20.45/share)

Source: Jitta

Source: Simply Wall Street

Source: Bloom

Source: Seeking Alpha

These are some of the sources I use to look for cracks in my thesis, second & third opinions, etc.

Already have an account?