I’m rereading one of Peter Lynch’s books and forgot that he mentioned one of the strategies I’ve implemented over the last decade in my own investing philosophy.

He talks about finding the best performing businesses in an underperforming sector or industry. I used this strategy successfully with oil stocks on one occasion, and banks on another occasion. I just look for the worst performing sector of the prior 12 months, and go find the best 4-5 businesses in the space, easy as it gets. It fits right into my value based, out of favor stock selection method and has never let me down. If anything, I sell too early and miss out on half of the gains I could’ve earned.

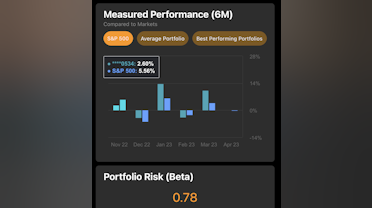

Now that I track my data a little better, I can share the results of utilizing this strategy during 2022/2023. I actually did this in 3 separate industries last year.

When inventories were high and everyone feared recession, I bought some retail businesses I believed were undervalued.

When the housing market was getting beat down, I bought my favorite housing stocks.

When the chip shortage was underway and semiconductor stocks were getting beat up, I did the same there; but I basically had my own semiconductor fund in that sector with 12-13 stocks, where I’d usually pick 3-5 of the best businesses in a sector.

Many of these buys are short-term plays and I sell relatively quickly. As I’m studying my own performance and habits from 2022-2023, I realized I should stop selling so fast and not be so happy with a 30% gain in a short time period. I will sell a “not forever” position at 20-40% usually because I don’t want to be greedy. If I can take a 30% gain in 2-5 months, I’m happy with that. However, these results shocked me today, looking into my purchases and seeing the ratio of winners to losers and the gains I’d be sitting on if I wasn’t so quick to take a profit.

Initially I looked at all my buy orders, and figured the % gain from the cheapest buy point, if stocks were held through today, August 8, 2023. That article with all my buys will be coming soon.

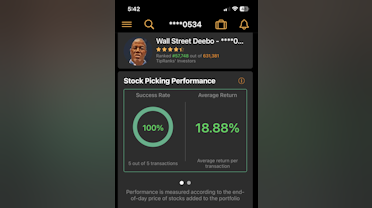

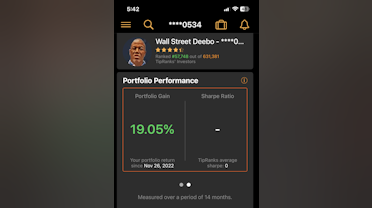

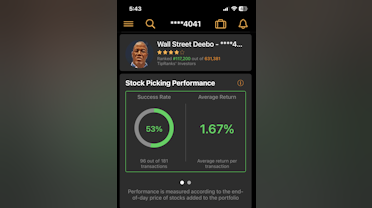

Next, I decided to start with the stocks I had recommended on CommonStock in 2022 and see what the returns would be from the day each article was written, if all purchases had been held through August 8, 2023. If we’d bought the stocks I recommended on the day the article was written, how would we be doing today. Am I worth following and are my stock selections criteria sound and profitable?

I learned a valuable lesson during this exercise, one that I already know, just don’t always apply. Although I know many of these buys are shorter term positions, I need to hold onto them longer than what I am, not to be greedy, but not to be so quick to sell either.

A couple articles written in 2022 offered up retail & housing stocks I liked. Here are the results:

We’ll start with retail stocks that I recommended on 8-8-22. Inventories were growing, recession fears were rampant, and retailers were being punished. Gains or losses represent buy and hold from 8-8-22 through 8-8-23.

Nothing out of this world, but nice gains in all but one position for 12 months time.

Next the housing stocks I liked on 4-4-22 and consequently ended up buying all of. If bought on 4-4-22 and held through 8-8-23, these are the gains we’d be sitting on.

Again, no 100-200% gainers, but clearly this little portfolio would’ve beat the market handily.

Semiconductors I never wrote an article on, not sure why. However, I found all kinds of companies I liked in this sector. These are the returns I’d be sitting on had I not sold anything since my decision to buy. Dates of purchase range from April through September of 2022.

The few losers here were such small losses, they’re relatively insignificant. With 20-70% gains everywhere and a whopping 234% from

$NVDA alone, I’d say this group did exceptionally well.

This was an interesting exercise for me, just to show where I’d be with solely a buy and hold strategy, instead of taking profits so quickly. Many of these stocks could’ve been sold for a higher return if sold closer to their 52 week highs, but I wanted to compare returns if held through the present to keep the parameters identical for the other lists. We know it’s a fairy tale to think we could’ve sold at the top anyway.

Two other groups of stocks I calculated returns for came from screens I presented in separate articles in 2022 on CommonStock.

One was a John Neff screen using his 2:1 total return : p/e ratio in which earnings growth + dividends = at least 2x the P/E ratio. If one had bought the resulting stocks the day the article was written, May 14, 2022 and held through August 2023, here’s how their returns would shape up.

Nothing is absolutely mind blowing but I like to see all the 20-50% gains with so little loss. On a side note, I bought

$LU and sold within a few weeks for >20% gain. These numbers represent buy and hold, so even the negative returns listed could’ve been profitable had we sold while the stock was up.

Another is a screen I created using the Value Line top 100 growth stocks of the last 10 years as the starting pool and screening for quality from there. I like screening like this because I start with very high quality companies to begin with, reducing the stocks further ensures I only deal with the cream of the crop. This article was written on May 17, 2022, gains are assuming positions were held through August 8, 2023.

These results are a little mind blowing. Not only is there not one single losing position, but of 21 stocks, only 4 had single digit returns, the rest returned 13-84%, while 2 of them,

$NFLX &

$NVDA are sitting on 134% & 152% gains.

Besides learning that I need to hold all positions a little longer and not be so quick to take a 30% gain, I also learned that Value Line’s information is of the highest quality and is a great source to use as a starting point for discovering wonderful companies at fair prices.

These are some of the reasons my investing philosophy is difficult to explain. I use lots of data, study lots of guru’s philosophies, and have different strategies I use, gleaned from books I’ve read about the greatest investors. I typically use the strategies and philosophies of Warren Buffet, Peter Lynch, Ben Graham, John Neff, David Dreman, Joel Greenblatt, and Philip Fisher primarily; and I never stop reading, always looking for new tools to add to the tool belt.

This article demonstrates the success of one of my strategies, touted by Peter Lynch, the power of John Neff’s 2:1 total return standard, and the quality of Value Line as a source of information.

Next I will show the returns based on a buy and hold strategy, from the actual date when I got my lowest price point on each position. In that article, I will list every position I bought in 2022 and demonstrate the gains if I’d held the stocks through August 2023.

Another nugget I tend to use of Peter Lynch’s philosophy is that great companies can be found anywhere. I’ve never held 1,400 stocks, obviously, but I buy a wider assortment of stocks than anyone I’ve met. I don’t diversify for the sake of diversity. I just buy wonderful companies at fair prices and don’t give a damn what sector they’re in. I couldn’t care less about sector weighting. If they’re performance and valuation matches what I’m looking for, I’m game.

You’ll see the crazy amount and variety of positions I actually held throughout 2022 in the next article.

Glad to be back, missed y’all🤙