Trending Assets

Top investors this month

Trending Assets

Top investors this month

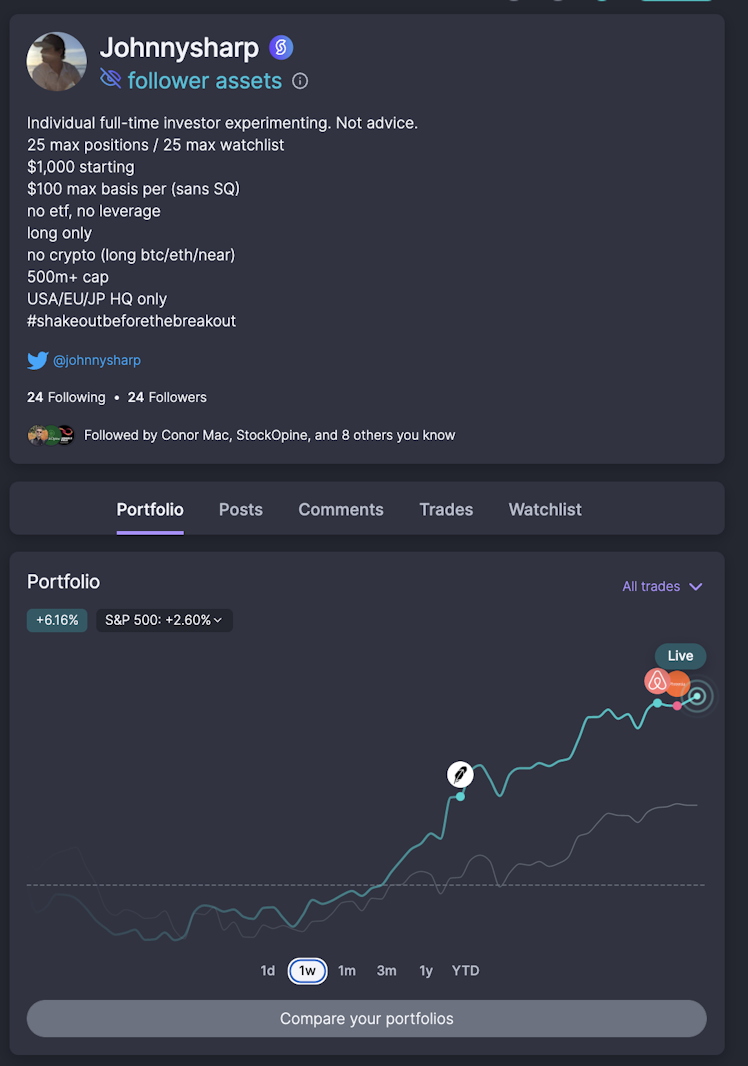

@johnnysharp

Johnnysharp

24 following27 followers

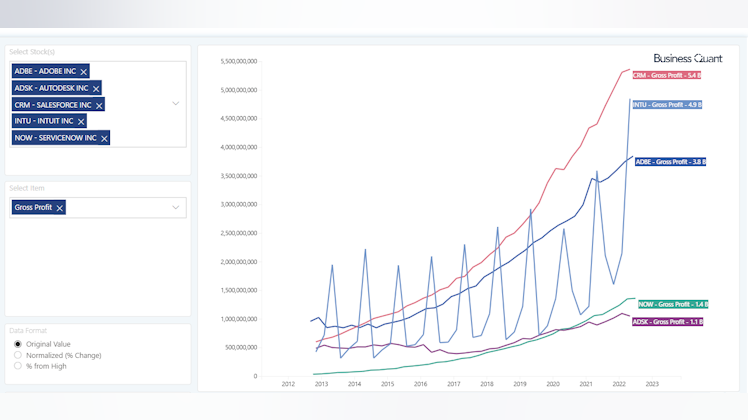

Useful free fundamentals charting resource - Business Quant

+ 6 comments

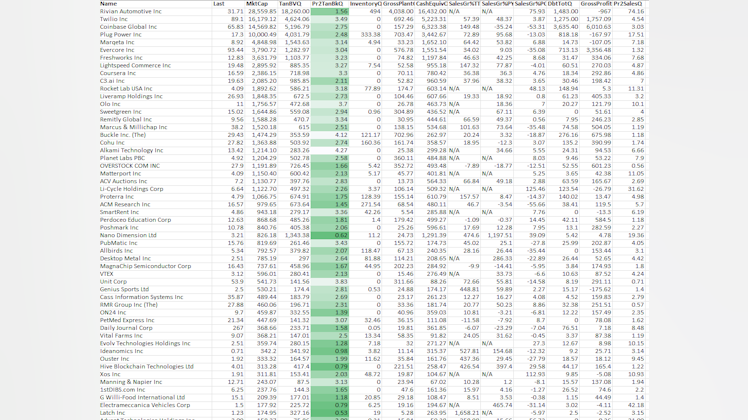

Another look at co's trading near/below Cash - more SPACs this time

+ 10 comments

Custom Screen - Companies trading near or below cash value - looking for gems

+ 7 comments

Reloading $KIND

X (formerly Twitter)

Rihard Jarc (@RihardJarc) on X

The 9% stake that activist investor Elliott Management has taken in $PINS probably means a bigger push toward a sale of the company.

23% of the market cap is Net Cash on yesterday's close. I think if the buyout were to happen the price would have to be much higher.

Long.

+ 3 comments

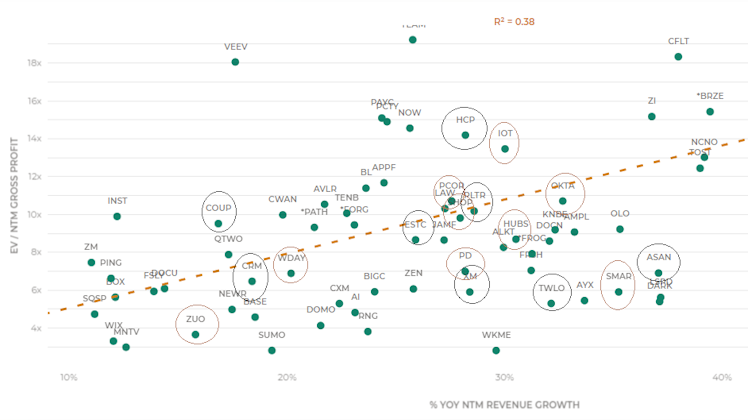

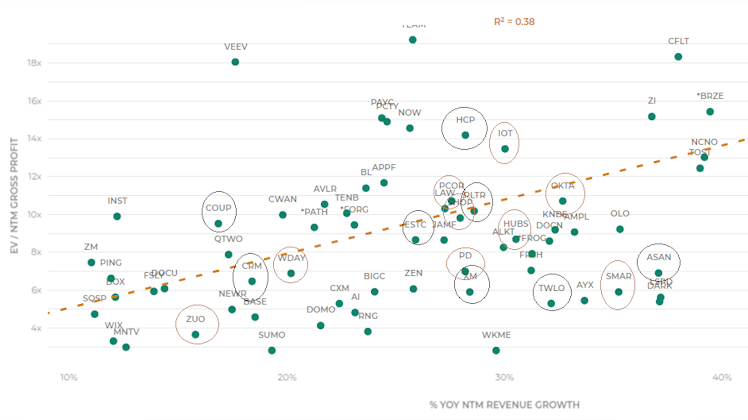

NTM Gross vs Rev Growth

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?