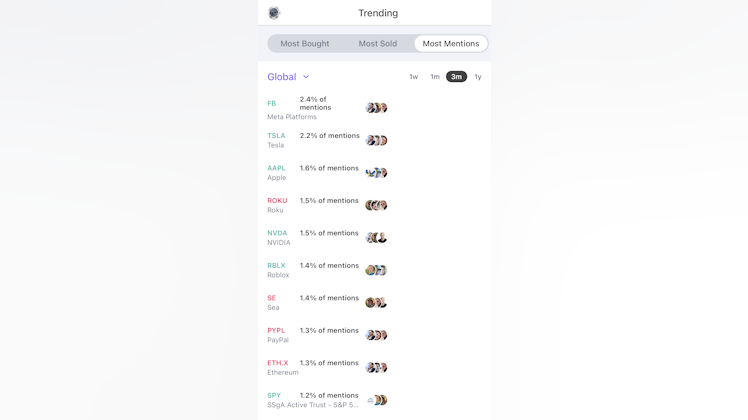

My favorite investment (not trade) for 2022 is Ether Capital (TSX: ETHC.NE) which has gotten a bad rap as the

$MSTR of

$ETH.X. It's much more.

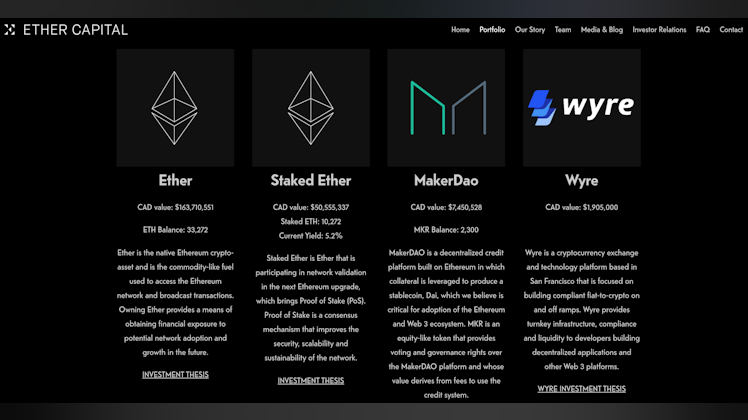

Ether Capital holds 43.5K ETH in a public investment vehicle, and stakes 10% of its holding. It also holds

$MKR.X and a small position in Wyre. Vs Microstrategy which has a legacy shrinking business, Ether Capital is a pure play holder and staker of Ethereum.

Best of all is the sum of the parts analysis:

43.5K ETH * $3,858 = $168M

2.3K MKR * $2,532 = $5.8M

(+) Wyre investment at cost of $1.9M

(=) $176M total holdings. Current Market cap is $163M and there will be a 5.2% staking yield akin to a dividend.

Most impressively, company has been public since 2018 and has persevered through crypto winter.

Investor presentation below: