Trending Assets

Top investors this month

Trending Assets

Top investors this month

Alpha is real.

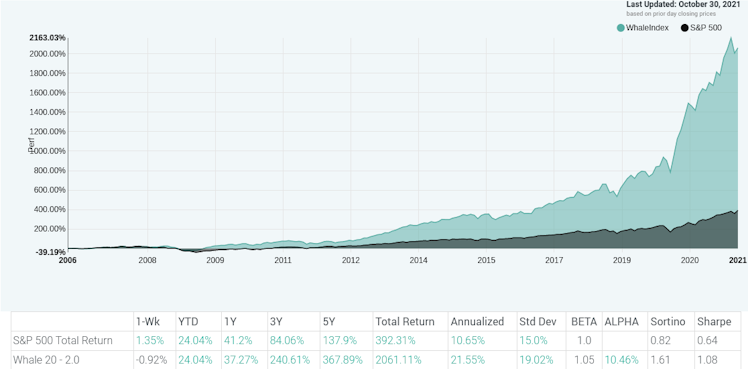

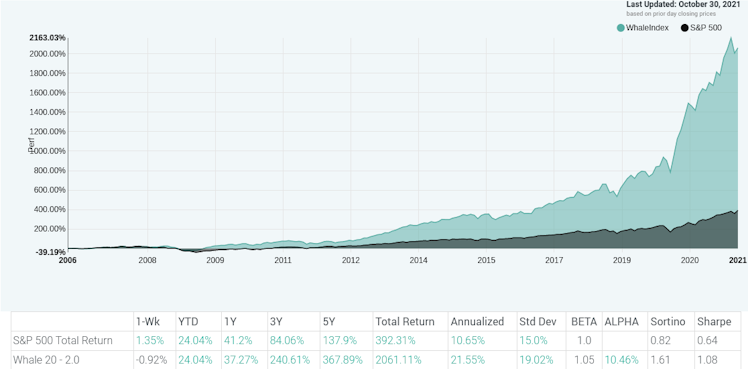

Whalewisdom tracks 13F's which are hedge fund quarterly filings that disclose long positions, but exclude leverage, options or shorts.

Notice the one year, five year, and ten year performance in this chart. If you just bought S&P 500 or NASDAQ index funds, you would have made 4x your money over 15 years.

But the top 20 hedge funds made 21x their money over the same period.

Already have an account?