Trending Assets

Top investors this month

Trending Assets

Top investors this month

@moneyballinvest

Moneyball Investing

$14.2M follower assets

14 following276 followers

Is Anyone Else Buying Netflix or am I Being Too Optimistic?

The Motley Fool

Netflix Is Growing Up. Does That Make It a Buy? | The Motley Fool

Netflix is finally employing ads and cracking down on password sharing . Will this work?

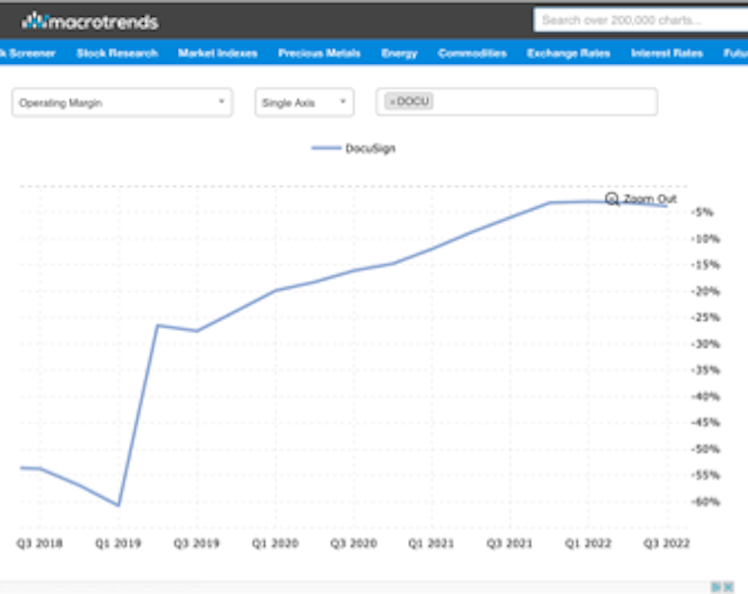

$DOCU Is DocuSign a Zombie Company?

The Motley Fool

Time May Be Up for This Pandemic Stock | The Motley Fool

DocuSign was a stock market darling during the pandemic, but competition is heating up.

Add a comment…

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?