I have a theory that Commonstock is an amazing place for us to share what we’re working on, crowd-source the best resources smart investors here have found, and produce our own high-quality research.

So essentially, in this use-case, Commonstock can be a crowd-sourced central research hub with the added bonus of connected portfolios transparently showing skin in the game, performance, etc.

With that being said, I’d love it if you’d share any research you have found about

$DOCN so far.

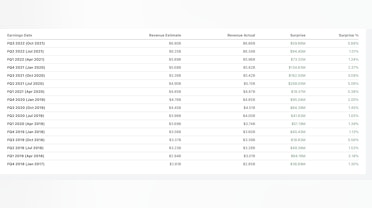

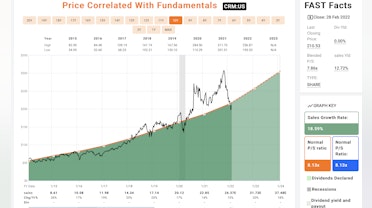

My starting point is Digital Ocean’s Q4 2021 earnings. They’re executing very well and growing more efficient with scale while still accelerating revenue growth. All great signs.

Market expected to grow from $70B to $140B in the next few years (IDC)

Revenue growth

2020: 25%

2021: 35%

Q4 2021: 37% (accelerated into EoY)

FCF Margin goal

2022: ~9%

2024: 20%+

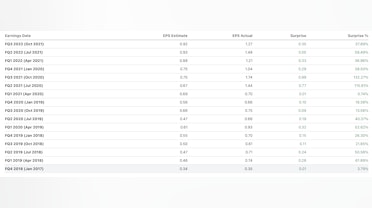

Rule of 40

From 7% to 41% this year.

Plan to exceed 50%

So that’s a quick review of recent execution + management’s current thinking on guidance.

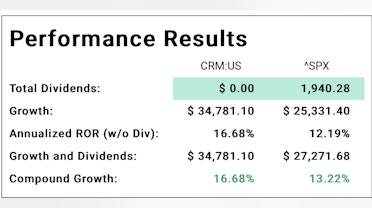

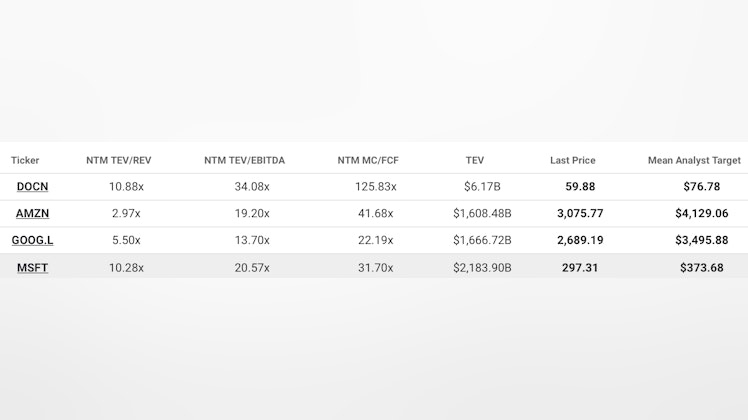

Now for a look at where we stand on next twelve months enterprise value to revenue. This is why I currently don’t own the stock. It’s currently at a much richer multiple than

$AMZN and

$GOOGL, and a bit higher than

$MSFT.

DOCN gross margin is significantly higher than AMZN, but lower than GOOGL and MSFT.

So in order to own DOCN here, one must be convinced that the growth potential far outweighs the growth + relatively limited risk from GOOGL and MSFT which are established businesses with a lot of optionality.

All of the above is why I want to do a deep dive on Digital Ocean even though I’m not currently a share holder.