I am so grateful and appreciative of all of you ❤️. I received the unfortunate news that I lost my job yesterday.

Hey everyone,

2022 has been a heck of a year. There are so many people that have it so much harder than I do. I fully realize that.

But it’s also okay to acknowledge when things are tough.

February of this year was one of the best and worst months of my life.

I got a new job that paid well, had some incredible teammates, and allowed me to help more people learn about investing.

Sadly, my dad also passed away from aggressive cancer that was discovered only a couple of months earlier.

I left the active duty Air Force in 2018 because my wife and I decided that we wanted to prioritize time with family. At the time, we were stationed in Washington State and both of our families lived in Florida.

So we worked hard, made some sacrifices, took some risks, and ended up living in Florida. Closer to both of our families than we had been since 2011. We also got to spend more time with our families in the first few months of living in Florida than we had in the previous 7 years combined.

In 2021, my parents moved to within 5 minutes of where we live now because my mom retired from 30+ years of teaching and my dad had a history of health issues that we felt made it best for them to be close to us.

Then in December, we got the horrible news of his cancer.

This has been an exhausting ride for me professionally since leaving active duty in 2018. I lost my job at the beginning of the pandemic and was fortunate to stay gainfully employed until I got the news yesterday.

I share all of that to say there have been times when I’ve second-guessed the risks I took leaving the military and joining startups. But at the same time, those risks led us to where we are today as a family… and allowed me to spend more time with my dad in the few months before he passed than I did since I started college in 2007.

So what’s next and what does this sappy story mean for my newsletter?

Through these ups and downs, a few things are very clear to me.

- I know I want to prioritize time with family

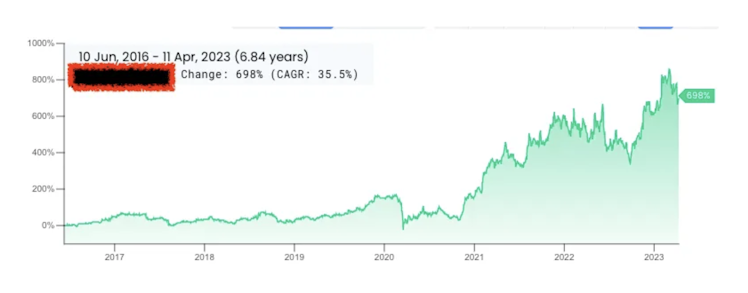

- I absolutely love investing. Our investing gave us the safety net to take all of those risks and get to where we are today

- I believe in myself and I’m ready to bet on myself. If I don’t I’ll always wonder what would have happened if I did.

Here is how my newsletter is changing

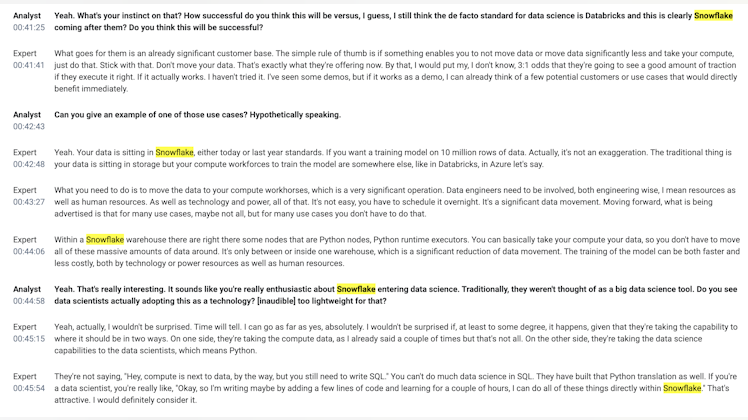

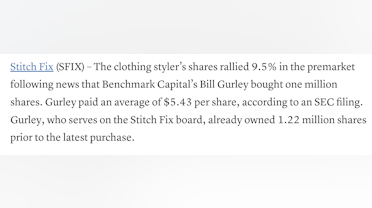

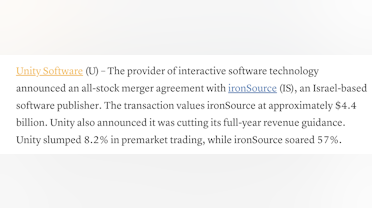

- Free subscribers will still get an email every Saturday. That will include a recap of the most important news from the tech industry each week (heavy focus on software/SaaS companies).

- Paid subscribers will get

- Two deep dive research reports sent on the first and third Tuesday each month

- Full access to my real-money portfolio

- Alerts of ALL portfolio changes two days before I make them

The cost for paid memberships is currently $24/month or $199/year. On Monday, July 18th, the price is increasing to $29/month or $248/year.

If you are currently a member or sign up before Monday, July 18th your price will be locked in at the lower cost for as long as you keep your subscription.

See you all Saturday for our next free tech roundup email.

Our first paid deep dive will be out on Tuesday, July 19th. I’ll be putting my own money into the company two days after the report comes out.

Wishing you all the very best,

Austin