Trending Assets

Top investors this month

Trending Assets

Top investors this month

$CRM Q4’21 Results: Beat Rev & EPS, ups guidance. Long

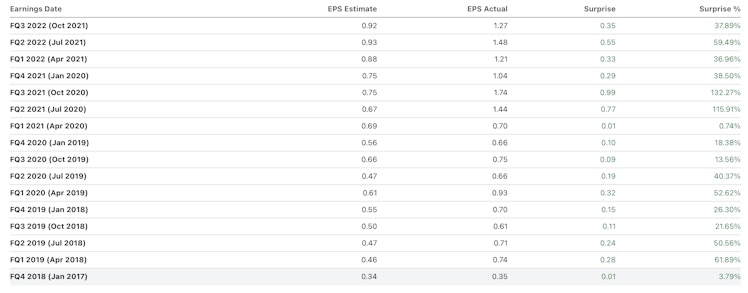

- Q4 Non-GAAP EPS $0.84, beat by $0.09.

- Revenue $7.32B, up 25.8% YoY, beat by $80M..

- FY23 Revenue Guidance: $32.0 Billion to $32.1 Billion vs. $31.80B consensus.

- Q1’23 Revenue Guidance: $7.37 Billion to $7.38 Billion, up 24% YoY vs. $7.27B consensus.

- Raises FY23 GAAP Operating Margin Guidance to Approximately 3.6% and

- Non-GAAP Operating Margin Guidance of Approximately 20%

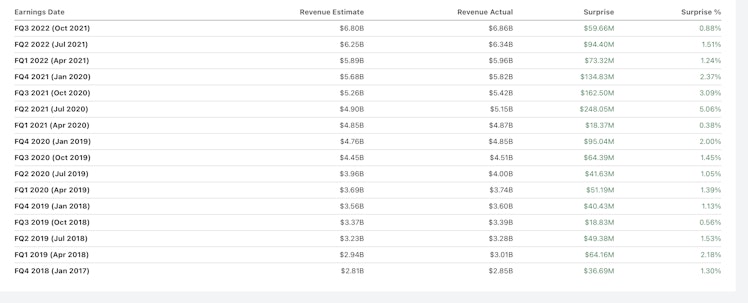

What a stellar record of revenue and EPS and beats for the last 17 quarters.

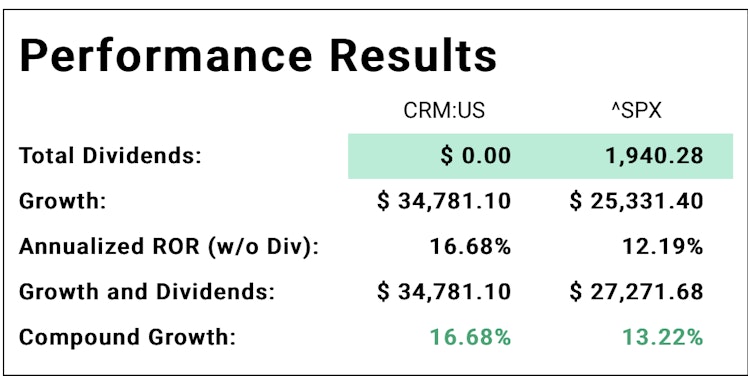

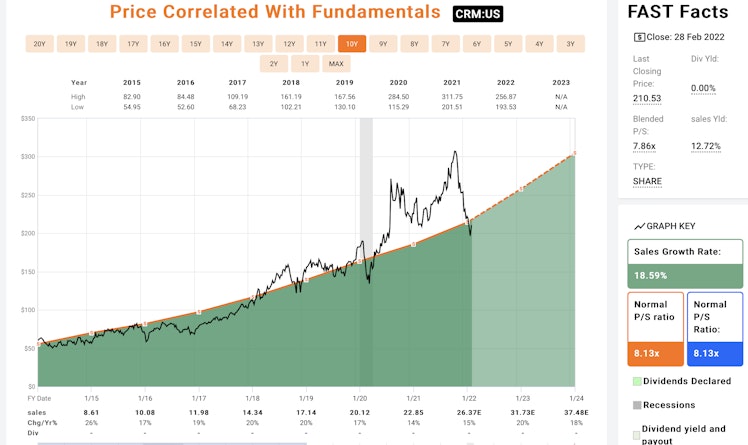

And moving forward if shares trade at normalized sales of 8x based on revenue estimates in 2024 (which the company has traditional beaten), shares will trade at ~$304 which is an average annual return of ~21%. Obviously these are just possible outcomes based off of historical multiples and earnings estimates. They will be wrong, but as an investor, I like the risk reward of owning this proven winner here.

I have my portfolio linked and all transactions shared here.

Curious if anyone is long, bullish, bearish, etc on $CRM and why?

Already have an account?