Trending Assets

Top investors this month

Trending Assets

Top investors this month

3/21 - 3/25 Watchlist

As a little background of myself I am an options trader that focuses on trades around market structure.

I won't be trading those sectors themselves but I'll be taking their top holdings and comparing them to how they perform against $SPY in the recent days.

*While all plays are nice for equity I'll be hand selecting my favorite ticker from each section. Feel free to ignore the big list at each section and skip straight to the charts.

Currently my favorite plays will be longs within the FINANCIAL SECTOR

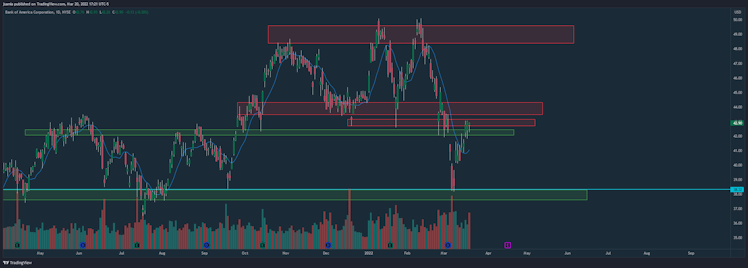

$BAC $WFC $JPM $MS $SCHW $BK are some great stocks to be looking at as we see strength coming in. I'll be picking up calls on demand zones while giving myself 2 weeks of time.

$BAC is holding breakout levels / demand zone very nicely. I'll likely be looking to add right on open assuming no gaps happen. I do believe with financials rotating in we can see financials climb pretty fast.

43c 04/01

45c 04/14

COMMUNCATION SERVICES

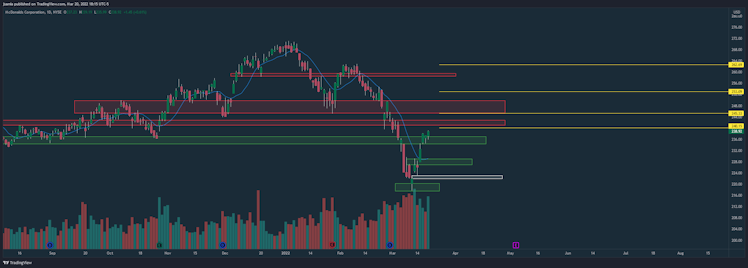

Personally my favorite is going to be $FB. Retail doesn't seem to understand that when a large cap runs, it RUNS. This can go on for much longer than expected. I expect small pullbacks but we just played $FB last week and had our cons go from $1.00 to $10.XX

However, do keep in mind we are testing supply zone right now. Although I expect a clean break and that we start making our way towards the gap fill.

220c 03/25

250c 04/14

$TWTR is seeing a breakout and some unusual volume imo. I took a stake in it for fun and as sentiment to Meta.

40c 03/25

$DIS $NFLX are coming along with sentiment to the rest of the market, but still just on watch. Not quite seeing the strength I want.

TECHNOLOGY

I can chart these upon request but honestly there are so many other's charts out there on these stocks. These are all going to be relatively strong right now with $QQQ pushing up.

$NVDA has NVDA day coming up, but I'd rather be playing the sentiment. $AMD is most notable here due to how close it is to breaking out.

CONSUMER DISCRETIONARY

$NKE has earnings and is seeing momentum on it. Would love to pick up calls right on Monday open and ride the IV til close. Otherwise you can choose to lotto calls and reduce your risk with spreads. Personally going to be swinging 2:1 CALL:PUT spreads.

$MCD is seeing buyers behind it once again and I'm ready to enter long. Going to be looking for retest of demand zone and entering when that happens. We do have a gap fill at the bottom but I don't believe we'll fill it. In the case that we do break demand zone I'll sit patiently and wait til we build a base.

250c 04/14

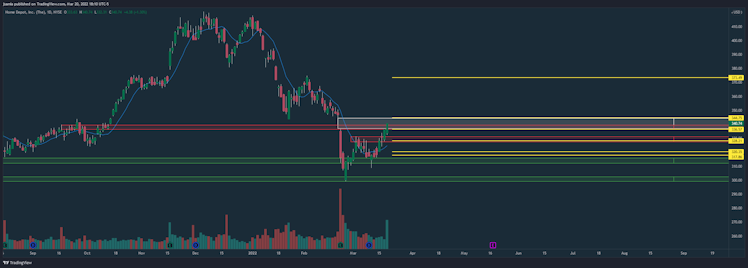

$HD still seeing strength is close to gap filling. I've actually been in this guy since the bottom, however feel free to daytrade this one. On successful retest of 336 it looks good for calls and ready to gap fill.

350c 03/25

Still working on my formatting, but hoping I was properly able to convey what I wanted!

Already have an account?