Trending Assets

Top investors this month

Trending Assets

Top investors this month

@arny_trezzi

Arnaldo Trezzi

$14.7M follower assets

40 following154 followers

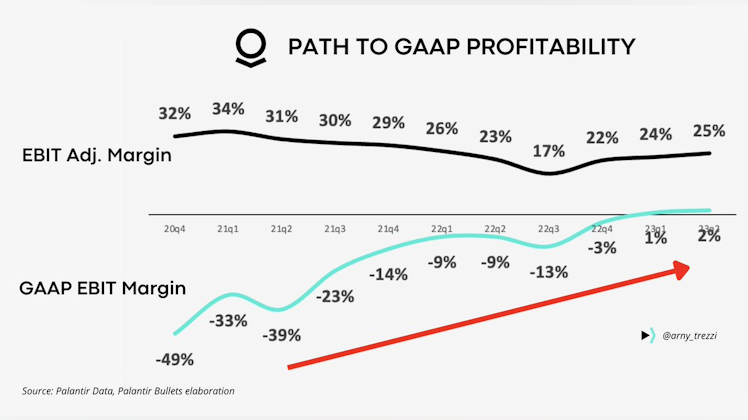

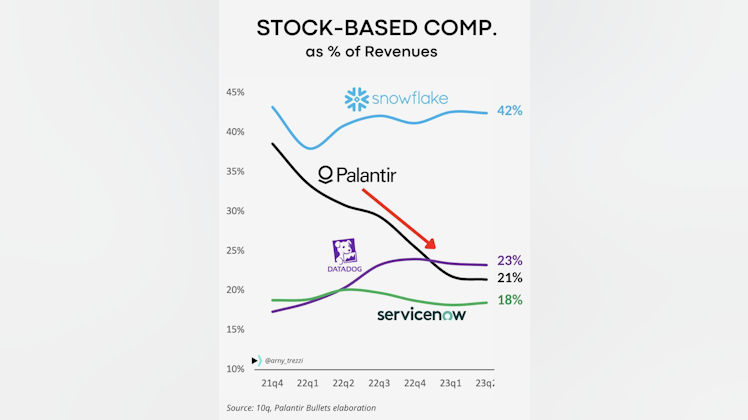

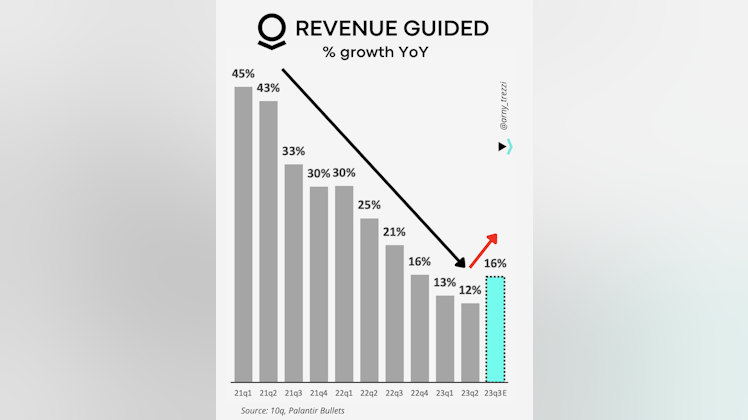

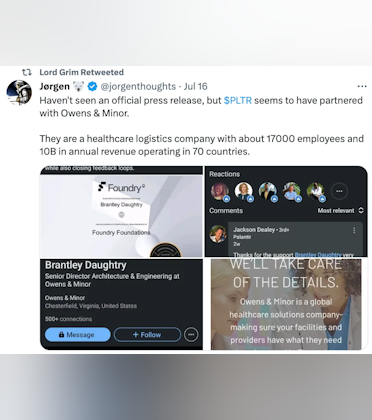

💫 WE ARE FAMOUS | $PLTR Bullets #36

www.palantirbullets.com

💫 WE ARE FAMOUS | Palantir Bullets #36

This week's Palantir developments and the crowned “Tweet of the Week”

They said NO | $PLTR Bullets #34

www.palantirbullets.com

❌ They said "NO" | Palantir Bullets #34

This week's Palantir developments and the crowned “Tweet of the Week”

+ 2 comments

$PLTR Bullets #33 | "COMPETITION IS COMING"

www.palantirbullets.com

⚡️ COMPETITION IS COMING | Palantir Bullets #33

This week's Palantir developments and the crowned “Tweet of the Week”

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?