Trending Assets

Top investors this month

Trending Assets

Top investors this month

$HOOD: Your panic, my gains

Robinhood at ~$10 offers an asymmetric situation with relatively little downside and potential explosive upside.

In this article, I’ll explain my HOOD -2.92%↓ ’s thesis in a few charts.

Volatility is a broker’s food

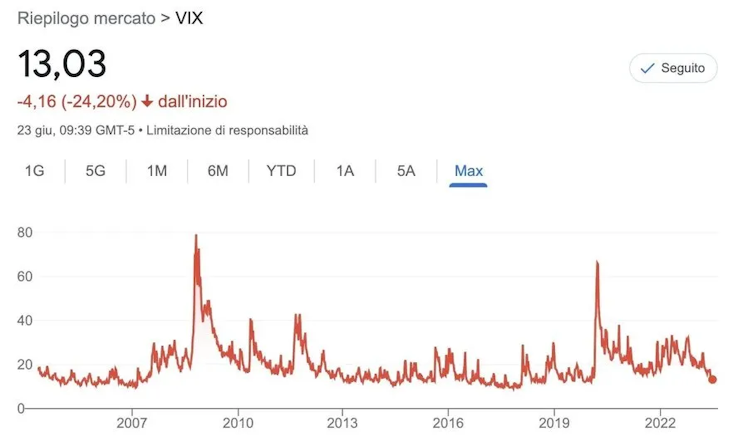

Brokers like Robinhood make money when people trade substantially due to high volatility. Brokers don't care if the market goes up or down, they care if it moves.

Therefore volatility is a broker's food:

- High Volatility = much trading activity = $$$;

- Low volatility = low trading = ☠️.

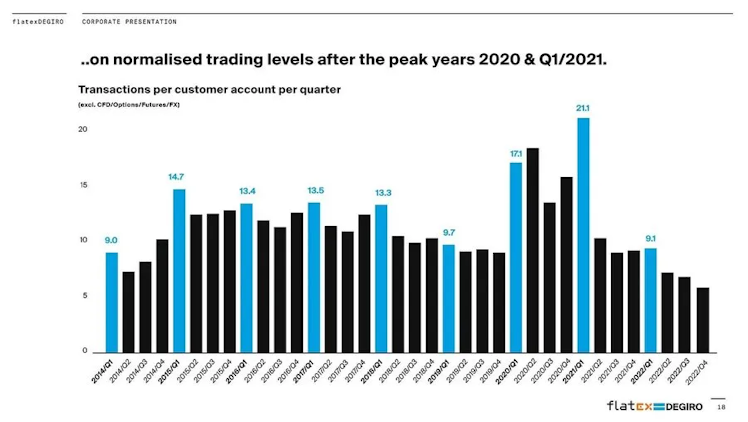

We can see this dynamic from FlatexDEGIRO, the closest alternative to Robinhood in Europe.

> When VIX explodes -> Revenues explode -> Stock explodes.

For instance, FlatexDEGIRO's Revenue grew +150% in 2020 thanks to the spike in volatility combined with low-interest rates.

> Since brokers benefit from volatility, investing in a broker means being "long volatility".

Currently, VIX is at nearly record low levels, which is a very adverse environment for brokers like Robinhood.

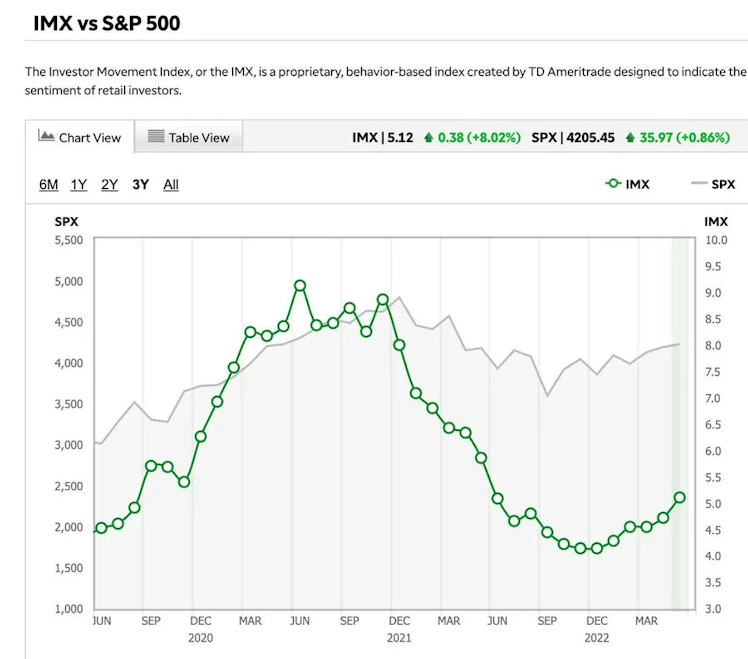

Meanwhile, retail investors are back. After an abrupt 2022 retail investors are returning confident on the market. This is a positive catalyst for Robinhood, which is focused on retail trading.

Meanwhile, retail investors are back. After an abrupt 2022 retail investors are returning confident on the market. This is a positive catalyst for Robinhood, which is focused on retail trading.

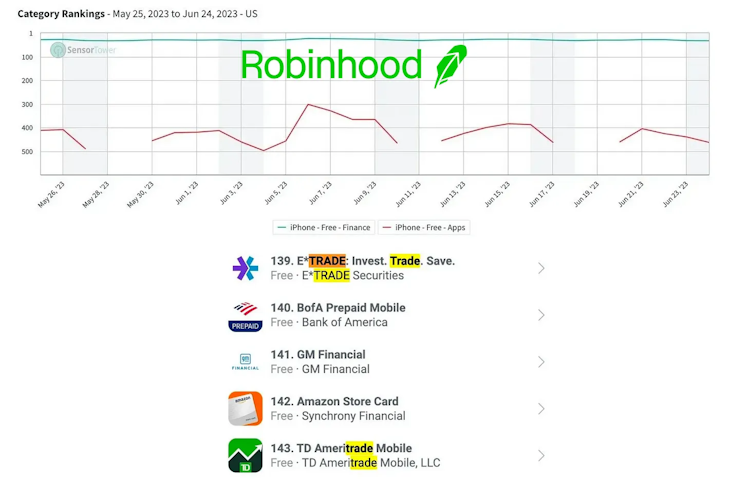

Despite the hate after the GameStop saga, Robinhood remains the most loved "neobroker", standing at #33 position on the App Store/Finance. Competitors such as E*trade and TD Ameritrade lag well behind at the #139 and #143 positions respectively.

Continues at: https://laorca.substack.com/p/hood-your-panic-my-gain

Already have an account?