Trending Assets

Top investors this month

Trending Assets

Top investors this month

$VIRT : GET PAID TO HEDGE

Virtu at ~$18 is an asymmetric situation: get paid to hedge from a market crash.

In this article, I’ll explain my Virtu Financial thesis in a few charts.

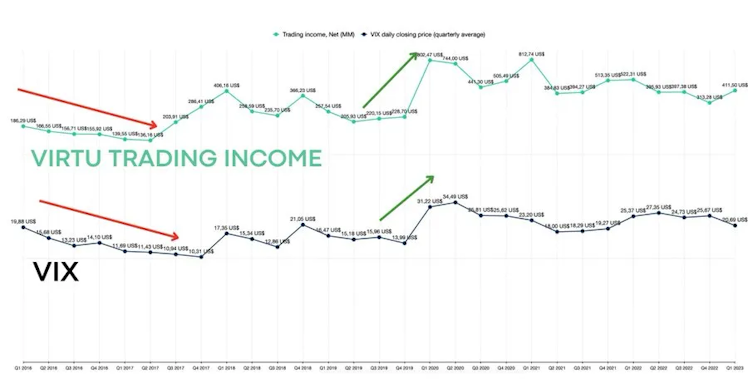

Virtu shines when panic spikes

Virtu is one of the rare companies that raise when the VIX (volatility index) spikes and the market crashes.

How is this possible?

Virtu, as a market maker, supports market liquidity by providing a bid and ask price for securities (mainly US Equity).

> It makes money from the spread it is able to capture from people buying and selling.

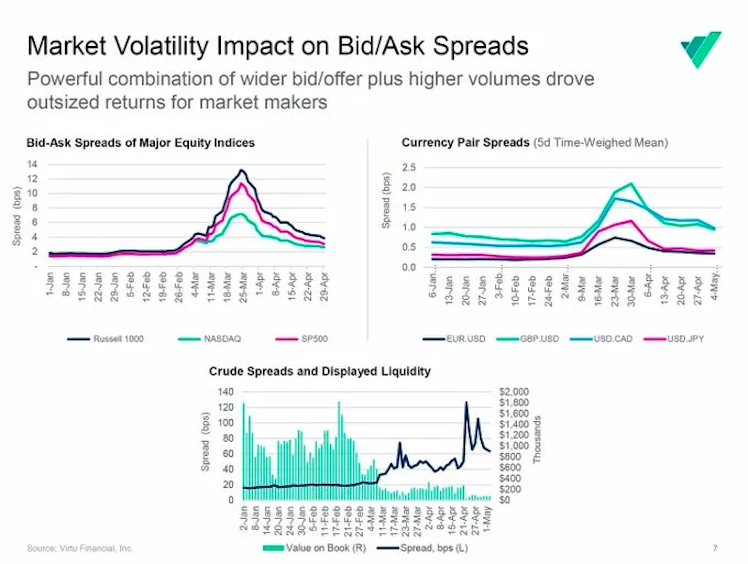

Virtu makes more money when:

- Volume is high;

- The bid-Ask spread is high.

Virtu’s dream situations are crashes like in 2020, which presented an appealing combination of high volatility and wide spreads.

As a market maker, Virtu’s role is to always provide a bid and an asking price to facilitate transactions. This means that Virtu doesn't care about the direction of markets: Virtu cares about investors keep trading.

We could synthesize Virtu’s Trading Income by the following conditions:

- High VIX = high income;

- Low VIX = low income.

Continues at: https://laorca.substack.com/p/virtu-get-paid-to-hedge

Already have an account?