Trending Assets

Top investors this month

Trending Assets

Top investors this month

$TW Who said bonds are boring?

Tradeweb is a compounding beast eating market share in an inevitable trend in financial markets.

The current price of ~$73 does not reflect the strength of the fundamentals, which thrive amid volatile markets, creating an asymmetric opportunity.

In this article, I’ll explain my Tradeweb thesis in a few charts.

STOP phone calls

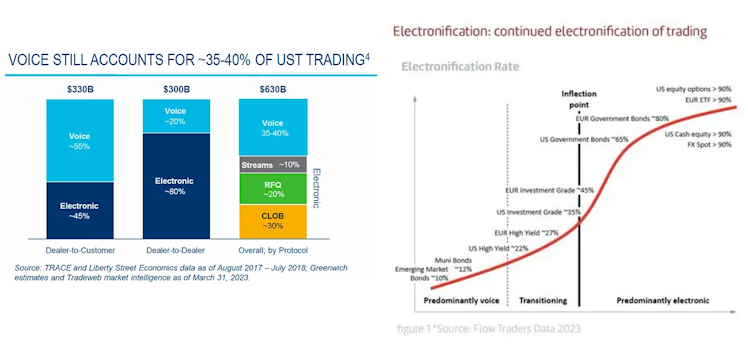

> 35-40% of the US Treasury trading happens on voice calls.

Many fund managers still make calls to brokers rather than a few clicks on a platform like retails do on Robinhood (I’ve seen it!). This is clearly inefficient.

Tradeweb offers a leading electronic platform to facilitate institutional bond trading.

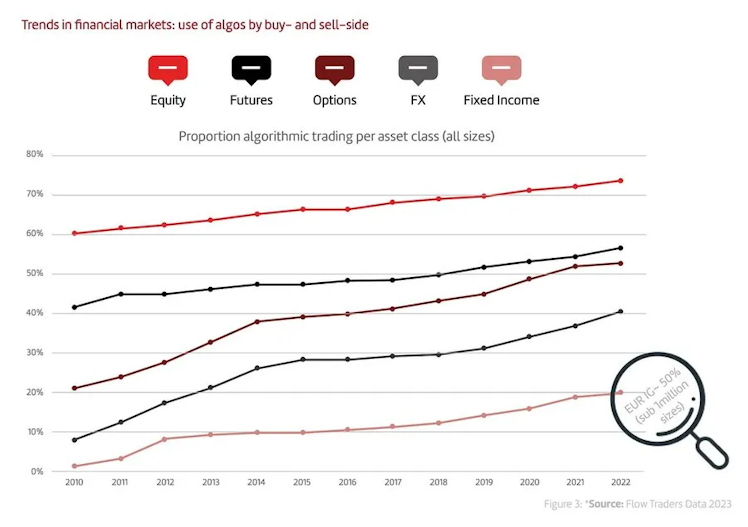

The Fixed Income Market ("bonds") is catching up with electrification:

> ~75% of Equity trading is done electronically vs ~60% in Fixed Income.

This is an immense opportunity for leading Fixed Income platforms like Tradeweb.

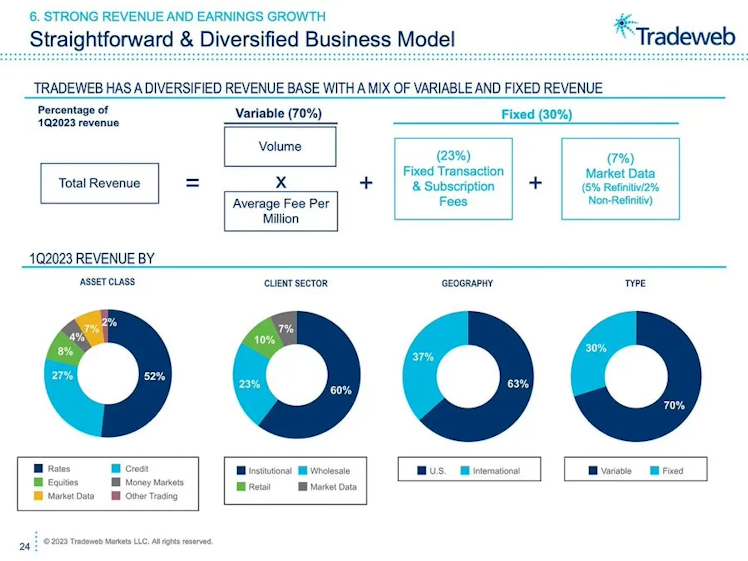

High growth - high margins. What else?

Tradingweb as a trading platform, derives 70% of its revenues as a % "bite" of the transacted volume.

As a consequence, Tradeweb makes more money when investors trade more or increase the size of their bond portfolios.

> Revenues grow at ~0% marginal cost. TW has no trading risk. It needs to keep users.

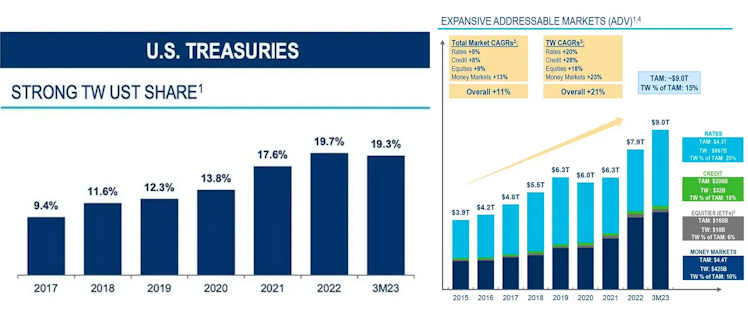

Tradeweb is taking market share in the US Treasury trading market:

> 20% of US Treasury trading is facilitated by Tradeweb

Already have an account?