As the market continues to go down, there are more and more long-term opportunities opening up for buy-and-hold investors.

Hands down, one of our favorite opportunities right now is INMD stock. $INMD reports earnings tomorrow, so we will most likely write about it very soon. It is currently one of our biggest positions.

However, our newest buy ratings are on the following stocks:

$MEDP, $NVR, and $DPZ. These are not our core holdings, though. We only have relatively small positions here in MEDP and NVR, for now, and no position in DPZ yet.

Note: This is not professional financial advice.

Most of these Buy ratings are in downtrends, meaning that the chances for more short-term downside are high. The ratings are not based on technical analysis. Again, they are meant for long-term investors.

Here they are, these are free articles to read:

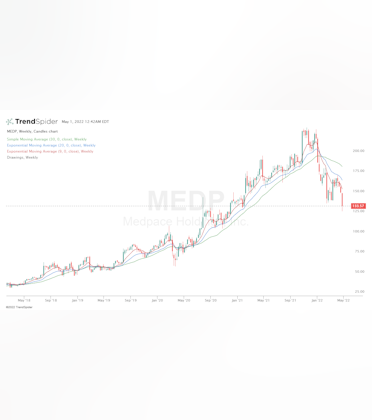

- **Medpace Stock: 43% Pullback; Time to Buy? (MEDP)

**

Medpace Holdings is a contract research organization (CRO). It essentially helps biotech/medical companies do clinical trials for new drugs, etc. It earns revenue from contracts. It is reasonably valued after a large pullback, very profitable, and growing consistently.

- Why NVR is a Top Homebuilder Stock

NVR, Inc. (NVR) constructs and sells real estate properties, such as single-family detached homes, townhomes, and condos. It also offers Mortgage Banking for its homebuyers.

We like the stock because it has a superb track record (highly profitable, growing) and is relatively undervalued compared to its past valuations.

Historically, buying big drops has worked on this stock. Check the chart above.

- Domino’s Pizza Stock: Focus on the Long Term (DPZ)

Pizza chain Domino’s has seen some inflation headwinds recently and will continue seeing them for the rest of the year. Also, the chart doesn’t look too pretty as it’s breaking down from a long-term uptrend.

However, DPZ has navigated through hard times before and can eventually bounce back. The company is still highly profitable and growing. This is definitely one for the patient investor.

Thanks for checking this out! If there are any stocks/topics you’d like us to cover, hit us up!