Trending Assets

Top investors this month

Trending Assets

Top investors this month

@saesch

Saesch

26 following19 followers

The Investment Checklist: The Art of In-Depth Research

Hey folks, I've read Michael Shearn's book: The Investment Checklist: The Art of In-Depth Research and decided to write kind of a summary splitted into 3 parts.

I would say the book is mainly for investors who already got started but need a wrap up of all the thing they came across with some new insights. Further research on most topics is likely needed as the book gives more of an overview and explains the most important concepts of a topic but doesn’t dive too deep. So for really experienced investors it’s probably more of a overall refresh, for less experienced ones it provides some starting points for diving deeper.

Have a good start into the new week!

increasingodds.substack.com

Increasing Odds | Saesch | Substack

Sharing my investment journey on how I try to increase the odds of investing successfully and building long-term wealth. Click to read Increasing Odds, by Saesch, a Substack publication with hundreds of subscribers.

Thanks for the post/links. Looks interesting. Bookmarked to read tomorrow!

Humility in investing: The antidote to Dunning-Kruger

"Investment success can breed overconfidence and a resulting unrealistically low assessment of risk. Luckily, I have made a sufficient number of mistakes in my life that there is little danger that I will become over-confident. In my opinion, a good investor needs to strike the right balance between confidence and humility." ~ Ed Wachenheim

This quote perfectly describes my first 3 years in the stock market. Started in 2020 as many new investors, my naive investing approach of buying what’s growing it’s topline heavily more or less without a real investment case, understanding of the business or considering profitability was successful, at least until November 2021. In 2022 the market taught me that humility is the key to success in this game.

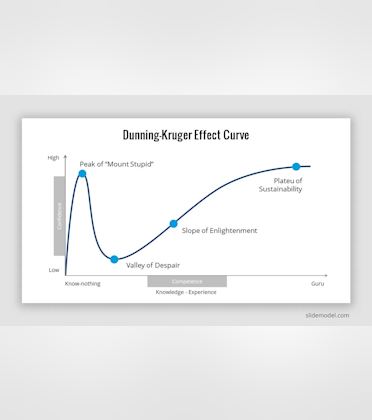

One way to describe the psychological impact of the post-covid bull market on new investors is the Dunning-Kruger effect, which describes the bias to overestimate your own capabilities or, in other words, to fail to spot your incompetence especially when combined with success despite low levels of competence.

Benefits of humility

Someone who thinks he knows it all and has cracked the market knows barely nothing. Humility is the basis for avoiding mistakes, live-long improving and knowing what you do and don’t know. Commonly known as your circle of competence. A lower level of competence is likely to increase the likelihood of making mistakes, so sticking to it protects you from being overconfident in an area you know nothing about. On the other hand, it allows you to learn and ask questions because you are aware of your lack of knowledge.

In the long-term, you can learn about the things you don’t know yet. But what’s needed for that is an open mind, which only comes with humility. To be able to discuss, accept and examine contrary opinions leads to a better understanding of the underlying topic, indentifies and resolves biases and misconceptions in your own thinking and generally gives you a different perspective.

"The best way to improve your ability to think is to spend large chunks of time thinking. One way to force yourself to slow down and think is to write. Good writing requires good thinking. Writing gives poor thinking nowhere to hide. A lack of understanding becomes visible." ~ Shane Parrish

The quote is about writing, but the same could be said about discussion: Discussing gives poor thinking nowhere to hide. A lack of understanding becomes visible. Revealing these misconceptions also prevents investors from emotion based decision-making.

Knowing what you don’t know and an open mind leads to another important trait: risk awareness. The valuable part about is that you can take risks into account. E.g. you’re building a financial model for a company that’s outside of your circle of competence but you would like to expand it. Because of your risk awareness you use a higher discount rate than usual in this model and decide for an appropriate position size. Knowing that there are outcomes you can’t even predict is one part. The mentioned ability to review contrary opinions also leads to an awareness for most, in best case all, of the more predictable outcomes on which you could build up bear and bull cases for instance. You are better prepared for what could happen, rather than assuming that one outcome will happen.

What I’ve mentioned so far mostly refers to decision-making. But once you’ve decided, it’s time to learn and to draw conclusions from your experiences following that decision, no matter the outcome. You should look back and review your decisions from a fundamental, psychological, emotional, … perspective.

What’s the reason for the success? Did the fundamentals of the underlying business improved as I expected? How did I behave while owning the stock? Was I aware of the risks that could negatively affected my returns?

Same if you were wrong: Why was I wrong? Where were my misconceptions? What did I miss? Was I aware of the risk that led to my failure? Did I properly assess the risks? … and many many more. You may not be able to answer all the questions, which is fine. That’s a result of humility.

Current standing

I would say I’m more humble than I was 2 years ago which isn’t that surprising considering there’s no track record on which I could have built up more confidence last year. Luckily I could spot some naive misconseptions in my own thinking. The market forced me to. I never felt desperate, so it’s hard to say where I see myself on the Dunning-Kruger effect curve now, but at least I’m past the peak and confident that I’m not completely incompetent. I have written about my mistakes & learnings here.

As quoted in the beginning it’s the challenge to find balance between confidence and humility, which is the process I’m going through at the moment. E.g. I do know to avoid some stocks in areas like gambling, commodities, automotives, airlines, … because those are not only outside my circle of competence but also out of my comfort zone. I’m not saying that my competence in other areas is on a high level, but I’m interested in those and want to improve and slowly expand my circle while keeping things simple. There are no bonus points for complexity or courage to buy the things I don’t feel comfortable with.

The stock market surprises us every day, sometimes seems wild and is influenced by an seemingly unlimited number of factors that are impossible to understand or even anticipate in their entirety. We can’t be aware of every possible outcome of a decision. To acknowledge what we don’t know, can’t predict and probably never will and to take this into account in our decision-making to reflect uncertainity is one of the most important steps to become and stay successful in the long-term.

“If you wake up every morning hoping to find the next big thing, you will go to bed disappointed most of the time. Alternatively, if you aim to expand your circle of competence by a small amount, it is feasible to be successful every day.” ~ Robert Vinall

Stay humble, avoid overconfidence.

Cheers.

increasingodds.substack.com

Humility in investing: The antidote to Dunning-Kruger

Dunning-Kruger and benefits of humility

Great post. The sign off is so simple and yet so vital to all. Stay humble, avoid overconfidence.

Global Outperformers

I would like to share this thread of Dede Eyesan (twitter.com/dede_eyesan) with the Commonstock community.

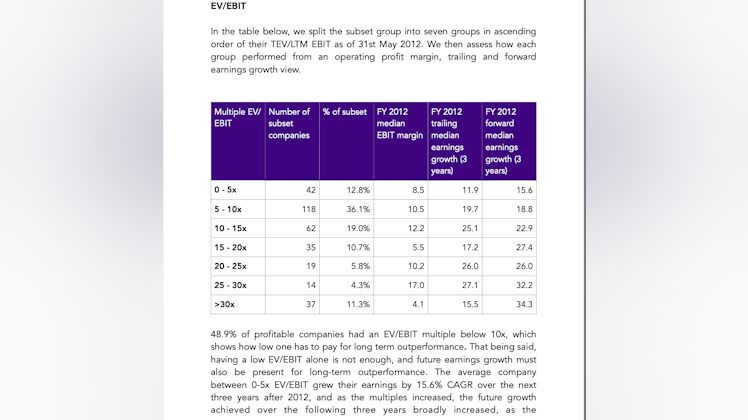

He and his team did some great work on studying companies that returned 1000% or more in 10 years:The study covered May 2012 – May 2022 and companies with a market capitalisation of at least $550 million. We screened out companies from countries with hyperinflation, like Venezuela and Zimbabwe. In total, 446 companies returned 1,000% between the ten-year period, from a sample size of 14,090 (3.16% of subset). The following four sections are:

•Factor analysis

•Geographical study

•Industry study and case studies

•Ten overall lessons on outperformers

E.g. here you see that 50% of these 446 companies had an EV/EBIT < 10 in May 2012.

Beside the thread he shared all the research in a 270-pager, free to download, link at the end of the thread. This is not an ad, just want to spread this quality research.

X (formerly Twitter)

Dede Eyesan (@dede_eyesan) on X

Last year, I published a book titled Global Outperformers, where I studied listed companies that returned more than 1,000% in 10 years.

There are four parts to our study, and I will share a thread below, sharing somethings our book explores about global equity investing.

1/68

Interesting find, thanks man!

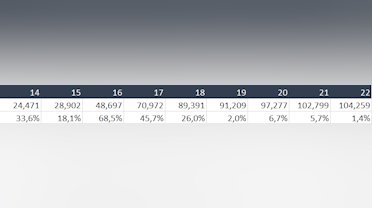

Quarterly Portfolio Update - 31/12/22

$SUS.ST (Surgical Science Sweden) $SDI.L (SDI Group) $NEM.DE (Nemetschek) $KSPI.L (Kaspi.kz) $BICO.ST (BICO Group) $APPS $PUBM $XMTR

New: $PUBM.

Increased $NEM.DE by 7%.

Sold $NUMND (Nordic Unmanned) at ~12 NOK.

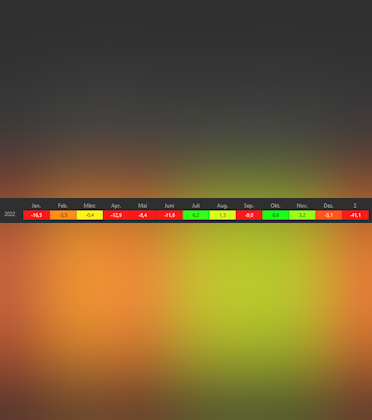

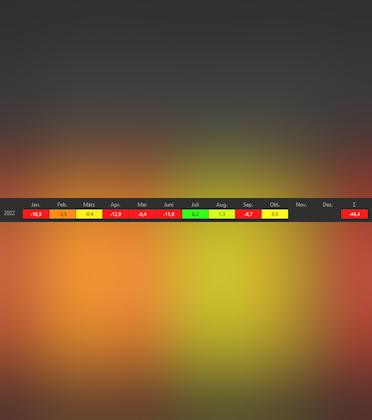

Performance for consistency and transparency, cash not included:

- Internal rate of return: -51,08%.

- True time-weighted rate of return: -41,1%.

IRR tracks the performance of actual money invested and distributed over time, so impacted by market timing. TWR eliminates the impact of the timing of cash flows and isolates the portion of a portfolio's return that is attributable solely to my stock picking skills.

Don't need to say that my performance is kinda devistating. I shared my thoughts about that in my 2022 recap: Part 1 & Part 2.

Cheers.

Mistakes & Learnings. 2022 recap II.

In part 1 I looked back on my general thoughts. In part 2 I want to share some thoughts on more specific mistakes, learnings and plans for 2023.

Position sizing:

I didn't think about position sizing that much in the past and I felt that with -16,5% performance in January this year. Beside some basic large caps which made up about 1/4 of my portfolio another 1/4 was filled with $SE $ETSY $NFLX and Bico Group (unprofitable swedish MedTech). As I bought $APPS in January it instantly made up 8% in a portfolio of 17 stocks.

Sure, afterwards it's easy to say I should have made things different, but if I look at these companies they provided some risks like high valuation ($SE & $APPS), easing covid tailwinds (basically all of them), heavy M&A (Bico & $APPS), unprofitability (Bico & $SE), weak moat ($NFLX), unexperienced management team (Bico), ... which I didn't pay that much attention.

So I believe here was my main mistake in 2022: Didn't acknowledge risk by position sizing while allocating for an (naive?) upside without considering downside. I don't want to set strict rules for that in 2023 but I will play around with position sizing in 2023 e.g. decreasing exposure to a riskier stock if it makes up XX% of my portfolio. Call it risk management. I have to find out what works for me so it probably won't work out as I want, we will see.

Stock picking:

As I'm down -40% for the year I have to comment on the stocks I picked. Did I pick the 'right' ones at an unattractive valuation or did I pick the 'wrong' ones beside their valuation anyways? Hard to say what's right or wrong respectively easy to say in hindsight and one year isn't the right timeframe to answer that anyways but I believe I did some basic mistakes:

- extrapolate past growth into the future

- don't care about valuation

- rely on analysts expectations

those are simpliefied. It wasn't that bad. I knew a company won't grow with 30% p.a. for 20 years, knew that high valuations shrink future returns and that analysts can and will be wrong but I guess I didn't take this 'knowledge' serious enough and was likely to ignore it more or less when valuing a company.

Noise and focus:

2022 was noisy. Everyone had opinions on everything. Wherever you looked someone knew what you have to change in your portfolio, which stock you need to sell because they will go bankrupt and which macro trade will outperform everything. At the start of '22 I saw myself wasting so much time on senseless predictions and discussions totally distracting me. Luckily I was able to get rid of the noise throughout the year by cleaning up my Twitter feed, avoiding market news and daily performance checks and focusing on impactful discussions and content out there. I'm confident to continue that in 2023.

Spend twice as much time knowing what you own versus new ideas. What you don’t own can’t hurt you. - Ian Cassel. In the past year I definitely spent more time looking for new ideas than keeping myself up to date and diving deeper into the companies I already own. As my portfolio is more concentrated now I want and need to change that. Hard to say but maybe I could have avoided some losses if I would have been more focused, who knows.

Risk tolerance:

At least something went great in 2022: I didn't overestimate my risk tolerance. I'm totally fine with that volatility, I'm fine with being red, I'm not in a bad mood, ...

Plans for 2023:

I definitely want to read more investing related books. What means more? Four Books are the goal, one every quarter. Sounds easy for many but I never had a reading habit so I need to start somewhere. I want to start with rereading 100 Baggers by Chris Mayer as I didn't take any notes as I read it last year followed up by:

- Common Stocks and Uncommon Profits by Phil Fisher

- The little book that still beats the market by Joel Greenblatt

- One up on Wall Street by Peter Lynch

so nothing too special, just some 'basic' stuff.

By reading more, combined with my experience so far and dozens of other sources like Fintwit, Commonstock, YT, ... I would like to define a more detailed framework on top of my basic idea. But that's something for the 2nd half of '23.

In the first half I definitely plan to spend some time with Excel. Create one big spreadsheet were I can find all the data of my stocks to really track the fundamental development and to compare them. It's not that difficult but will take some time to organize the data.

That said I hope everyone who celebrates had a great christmas time and I wish you all the best for the upcoming year.

Stay humble, avoid overconfidence.

Cheers.

An honest look into the past. 2022 recap.

I skip the part where I talk about how challenging 2022 was for investors in general, especially for those who started investing during covid like me, it was tough, everybody knows it.

So let's jump straight in how this year started for me personally:

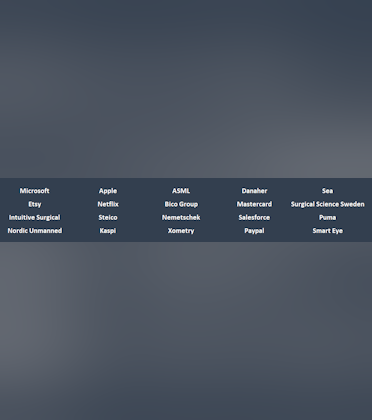

Here you see the stocks I owned on the 1st of January 2022. 20 stocks. In January I added $APPS to my portfolio, so 21 stocks. Micro to mega cap, cash burning to highly profitable, weak to strong moats and no track record to decades of shareholder value creation.

As I shared my portfolio update on the 2nd of January on Twitter I wrote:

''Through the year [2021] I learned a lot and i think i could elaborate the basic idea of my strategy. 2021 was a year to find out in which companies i want to invest and what kind of investor i want to be. [...] So in 2022 i try to develop the basic idea to a precise strategy.''

I was wrong. Looking back I had no idea of how my basic idea looks like. If I would have had an idea my turnover ratio would not have been so high. More on that later.

After the first months into 2022 I had to realize: well, stock don't always go up. Simply said. I never was an overconfident investor, but 2021 was an 'easy' year and as I write this I know there are people who be like 'told you so ' and that's totally fine, point for you. But nevertheless it seems like I had to make that experience of my stocks getting crushed by myself to really understand it. Saying 'I know that stocks can go down, it won't bother me' is easy. But the reality is that I had no clue about how I would react to it. That said: I knew nothing until I saw myself in that particular situation and made that experience by myself.

So after seeing my portfolio down 20% in the first 3 months I really started to think about my basic idea of investing. One reason I started sharing my thoughts on Twitter was that I commit myself and can look back at them. So here is what I did after Q1:

And I was done at the end of July. Coming back to turnover ratio: I decided to sell all stocks with a market cap >$ 10B next to additional company specific reasons for a sell for most of them and also sold two small caps: Smart Eye due to bad earnings in the meantime and Steico for less european real estate exposure. So 7 companies were left (white ones) and two joined my portfolio (green ones):

The absolute basic idea was and still is:

- High conviction plays instead of diversification resulting in a concentrated portfolio

- Looking for micro - mid caps so I am rather focused on my own research and process than relying on the 1000 opinions on each large cap out there

Obviously that's not a whole strategy but it's a fundamental starting point.

Since August I added $PUBM to my portfolio and had to sell Nordic Unmanned after loosing trust in their CEO. Also learned my lesson with position sizing resulting in decreasing my $AXON and $XMTR positions.

I definitely got a more detailed idea of my investment philosophy that I've developed throughout the year and could talk about other mistakes e.g. in position sizing or company specific learnings in more details but I want to keep this post simply focused on critizing my general thinking back the days.

For me the most important trait that every investor should stick to: stay humble.

The trait every investor should strictly avoid: become an overconfident idiot.

That's what I try to achieve with this post.

Cheers.

Love the transparency and honesty. wishing you every luck for next year.

How do you organize your watchlist?

How it started

I'm investing for two and a half years now. Whenever I came across an interesting company I straight went to Tradingview, typed in the ticker -> right click -> add to watchlist. That was it.

So I saw my watchlist growing and growing, no structure, no notes, nothing. Once in a while I was annoyed looking at dozens of tickers so I cleaned it up. Which basically meant I kick every ticker where I can't remember why I added it. And then the process of adding random tickers started again.

How it's going

Things recently changed as I came across Koyfin which watchlist tool I am using atm. Here I created the following lists:

I generally just add companies that seem interesting to me at the first look and check some basic boxes for me e.g. no commodities, no chinese stocks, ... stuff like that. So whenever I come across one that fits the basics I put it in the first one and add a quick note why it's interesting occasionally with a link to a wirite-up or other ressources. There it sits until I find time to do some basic research.

If I get more interested while researching it stays in that list, I just put it on top of it.

If I believe it's valuation is lifted up I put it in the 2nd one. E.g. $SLP . The basic idea here is that I probably got more time to do research because of its valuation so I can focus on the lower valued ones in the first list first. 2nd list doesn't mean I am less interested.

As the name says the 3rd list contains companies that are unprofitable but operate in an interesting field. E.g. $DM $SEMR $HIMS. Here it's the same idea: no rush to do research. Further I am less interested due to weaker financials/higher risk.

A company goes to the 4th list if I think it's better to pass for now and just keep watching. E.g. due to a new management team, high debt, restructuring processes, big M&A deal, any short-term headwinds or an ongoing law suit like at $MITK.

The 5th list contains companies that operate outside of my comfort zone. Here you'll find cybersecurity like $QLYS or professional services like DSW Capital or Keystone Law Group. Here it's the idea that I can come back to these if I really want to dig into a specific sector.

With that structure I hope to be more focused on the companies that fit my approach the best and less distracted from companies I probably wouldn't buy anyways. It stops me from adding random tickers because I can force myself to add some information. More focus, less noise.

So how do you keep track of interesting companies?

Investment Grade - completely vetted. Great companies. Waiting for valuation or capital to buy

Keeping an Eye On - the on deck for investment grade. Missing a few pieces before being promoted.

Speculation -for early biotech or mineral exploration

Competition-the main competition for companies I hold.

My portfolio as of 30/09/22 - End of Q3

$AXON $SDI.L (SDI Group) $SUS.ST (Surgical Science Sweden) $NEM.DE (Nemetschek) $KSPI.L (Kaspi.kz) $APPS $XMTR $NUMND (Nordic Unmanned) $BICO.ST (BICO Group)

Increased my position in $NEMTF by about 10% at 50,60€.

Decreased my position in $XMTR by about 50% at 58,10$ after it more than doubled from its lows in May.

Performance update for consistency reasons, cash not included (true time-weighted rate of return):

After 9 months into the bear market im used to this volatility. Nevertheless the month was devistating, especially for Nordic Unmanned due to shitty earnings.

Sept Idea Competition: SDI Group $SDI.L

Story time

SDI Group is a UK-based serial acquirer comprising manufacturing businesses in the scientific/technology sector focused on digital imaging and sensors & control systems growing organically and inorganically through a buy-and-build M&A strategy. Formed in 2007 by private equity SDI's focus was to gain market share in a fragmented industry by consolidation. But beside two acquisitions in 2009 (which are nowadays known as 'Atik') the management failed to execute its strategy. But stay with me, things changed.

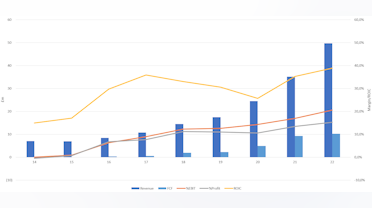

Strategy execution started as CEO Mike Creedon and Chairman Ken Ford took over control. Creedon became CEO in 2011, Ken Ford became Chairman in 2013, both joined the board in 2010. Through their knowledge in finance, M&A and strategic planning they managed to transform a slightly profitable business into one with EBIT margin >20% and profit margin >15%, grew revenues 27,7% p.a. since their first acquisition in 2014 by acquiring 14 more companies and growing organically (organic growth '18: 11%, '19: 5%, '20: 3,7%, '21: 19%, '22: 21,6%) while increasing gross margin from 57% to 64%, next to delivering ROIC >25% and FCF/share growth of 50% p.a. since 2016.

A flood of numbers. Lets sum it up:

- Steady organic and inorganic growth

- Increasing margins

- High ROIC

What's more:

- Experienced management with track record

- Successful buy-and-build M&A strategy

- Low leverage: 0,25x EBITDA

- Trading at LTM EV/EBIT 17,5, P/E 23, FCF yield 5,75%

- FY23e growth of 27%

- No independent analyst coverage

- Market cap: 173£m

Daily Business

SDI's subsidiaries design and manufacture imaging, sensing and control applications used in several markets like life sciences or niches as art conservation through its business segments Digital Imaging (DI) and Sensors & Controls (S&C). 40% of sales come from the Uk, 20% China, 15% Europe, 10% US. Due to low EU exposure the Brexit had no significant impact.

Strategy

SDI's buy-and-build strategy is build on a decentralized business model and lean headquarter. Acquired companies remain their independency, brand, culture and their management teams keep control about the daily business. ''Never change a winning team.''

''The owners may want to change processes or personnel, but we haven’t experienced that with SDI Group. Since 2015, they have supported us where we needed support, and have let us do our thing as we have been doing for 30 years now.'' - Kenneth Petrie, founder of Sentek (acquired in 2015).

The acquisition criteria are simple:

- Circle of competence: scientific/technical applications

- Profitable and cash generative track record

- Strong local management

- Fair price: 4-6x EBIT

- Strong exporter within their niche

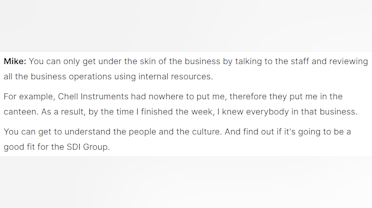

Mike Creedon and his team do the whole due diligence process, obviously by checking the numbers, but also by meeting the staff of a target. There are no third-party advisors involved beside lawyers. Lovely anecdote:

Acquisitions are financed through a mix of cash from operations, bank debt and share issues. Dilution is something to watch here. Here you see shares outstanding & dilution.

For some it may be kind of a red flag. But the other option would be to use higher leverage and despite this dilution FCF/share grew 51% p.a. and profits/share grew 35% p.a. since 2016 (can't compare to 2014 due to unprofitability/really low margins).

Post acquisition SDI provides financial support, develops a medium/long-term strategy and implements financial KPI's which are monitored monthly. Probably one of the biggest advantages of becoming part of a group like SDI is the sharing of knowledge within the group. Best practices, insights, ideas - just a small improvement on a process could lead to increased margins or higher growth for an acquired company.

Here you see the acquisitions since 2014. According to Mike Creedon the recent acquisitions have been priced at 4-6x EBIT. If you adjust the PBT multiples to something like forward adj. EBIT management sticks to their EBIT multiple range. The price paid is net of cash including earn-outs. SDI used about 42,5£m for 16 acquisitions. (edited/updated on 05/02/23)

Short-term tailwinds:

- Tough economic times may force business owners to sell

- Positive Fx impact due to weak £

Long-term tailwinds:

- Underlying markets are steady growing

- Higher M&A activity due to retirements of ''Baby-Boomer'' generation

- M&A experience and track record of management decreases general risk of M&A activity

Things to watch

- New CFO (M&A is a people-driven business, it's about relationships)

- Pressure on margins due to inflation

- Political noise in UK

Would appreciate any kind of feedback and feel free to ask questions.

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?