Trending Assets

Top investors this month

Trending Assets

Top investors this month

Humility in investing: The antidote to Dunning-Kruger

"Investment success can breed overconfidence and a resulting unrealistically low assessment of risk. Luckily, I have made a sufficient number of mistakes in my life that there is little danger that I will become over-confident. In my opinion, a good investor needs to strike the right balance between confidence and humility." ~ Ed Wachenheim

This quote perfectly describes my first 3 years in the stock market. Started in 2020 as many new investors, my naive investing approach of buying what’s growing it’s topline heavily more or less without a real investment case, understanding of the business or considering profitability was successful, at least until November 2021. In 2022 the market taught me that humility is the key to success in this game.

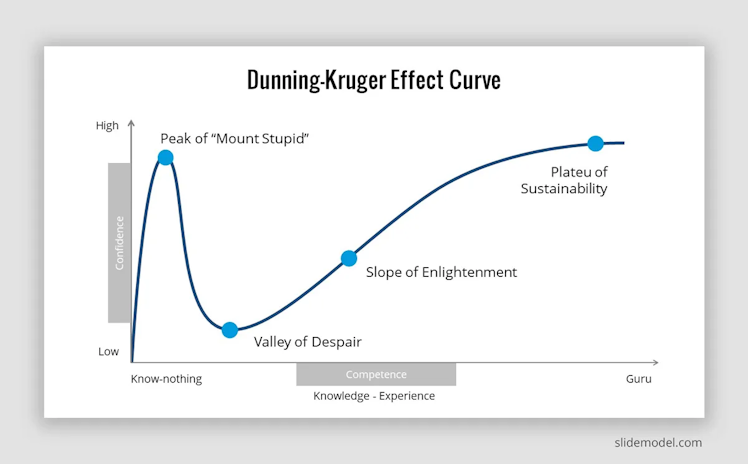

One way to describe the psychological impact of the post-covid bull market on new investors is the Dunning-Kruger effect, which describes the bias to overestimate your own capabilities or, in other words, to fail to spot your incompetence especially when combined with success despite low levels of competence.

Benefits of humility

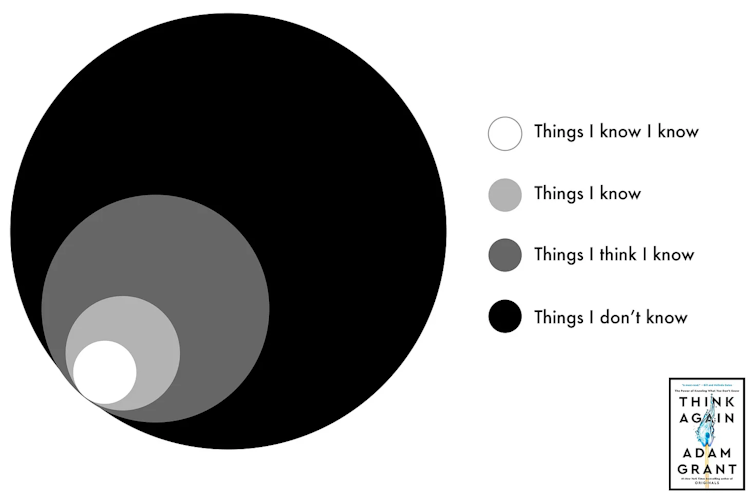

Someone who thinks he knows it all and has cracked the market knows barely nothing. Humility is the basis for avoiding mistakes, live-long improving and knowing what you do and don’t know. Commonly known as your circle of competence. A lower level of competence is likely to increase the likelihood of making mistakes, so sticking to it protects you from being overconfident in an area you know nothing about. On the other hand, it allows you to learn and ask questions because you are aware of your lack of knowledge.

In the long-term, you can learn about the things you don’t know yet. But what’s needed for that is an open mind, which only comes with humility. To be able to discuss, accept and examine contrary opinions leads to a better understanding of the underlying topic, indentifies and resolves biases and misconceptions in your own thinking and generally gives you a different perspective.

"The best way to improve your ability to think is to spend large chunks of time thinking. One way to force yourself to slow down and think is to write. Good writing requires good thinking. Writing gives poor thinking nowhere to hide. A lack of understanding becomes visible." ~ Shane Parrish

The quote is about writing, but the same could be said about discussion: Discussing gives poor thinking nowhere to hide. A lack of understanding becomes visible. Revealing these misconceptions also prevents investors from emotion based decision-making.

Knowing what you don’t know and an open mind leads to another important trait: risk awareness. The valuable part about is that you can take risks into account. E.g. you’re building a financial model for a company that’s outside of your circle of competence but you would like to expand it. Because of your risk awareness you use a higher discount rate than usual in this model and decide for an appropriate position size. Knowing that there are outcomes you can’t even predict is one part. The mentioned ability to review contrary opinions also leads to an awareness for most, in best case all, of the more predictable outcomes on which you could build up bear and bull cases for instance. You are better prepared for what could happen, rather than assuming that one outcome will happen.

What I’ve mentioned so far mostly refers to decision-making. But once you’ve decided, it’s time to learn and to draw conclusions from your experiences following that decision, no matter the outcome. You should look back and review your decisions from a fundamental, psychological, emotional, … perspective.

What’s the reason for the success? Did the fundamentals of the underlying business improved as I expected? How did I behave while owning the stock? Was I aware of the risks that could negatively affected my returns?

Same if you were wrong: Why was I wrong? Where were my misconceptions? What did I miss? Was I aware of the risk that led to my failure? Did I properly assess the risks? … and many many more. You may not be able to answer all the questions, which is fine. That’s a result of humility.

Current standing

I would say I’m more humble than I was 2 years ago which isn’t that surprising considering there’s no track record on which I could have built up more confidence last year. Luckily I could spot some naive misconseptions in my own thinking. The market forced me to. I never felt desperate, so it’s hard to say where I see myself on the Dunning-Kruger effect curve now, but at least I’m past the peak and confident that I’m not completely incompetent. I have written about my mistakes & learnings here.

As quoted in the beginning it’s the challenge to find balance between confidence and humility, which is the process I’m going through at the moment. E.g. I do know to avoid some stocks in areas like gambling, commodities, automotives, airlines, … because those are not only outside my circle of competence but also out of my comfort zone. I’m not saying that my competence in other areas is on a high level, but I’m interested in those and want to improve and slowly expand my circle while keeping things simple. There are no bonus points for complexity or courage to buy the things I don’t feel comfortable with.

The stock market surprises us every day, sometimes seems wild and is influenced by an seemingly unlimited number of factors that are impossible to understand or even anticipate in their entirety. We can’t be aware of every possible outcome of a decision. To acknowledge what we don’t know, can’t predict and probably never will and to take this into account in our decision-making to reflect uncertainity is one of the most important steps to become and stay successful in the long-term.

“If you wake up every morning hoping to find the next big thing, you will go to bed disappointed most of the time. Alternatively, if you aim to expand your circle of competence by a small amount, it is feasible to be successful every day.” ~ Robert Vinall

Stay humble, avoid overconfidence.

Cheers.

increasingodds.substack.com

Humility in investing: The antidote to Dunning-Kruger

Dunning-Kruger and benefits of humility

Already have an account?