Trending Assets

Top investors this month

Trending Assets

Top investors this month

An honest look into the past. 2022 recap.

I skip the part where I talk about how challenging 2022 was for investors in general, especially for those who started investing during covid like me, it was tough, everybody knows it.

So let's jump straight in how this year started for me personally:

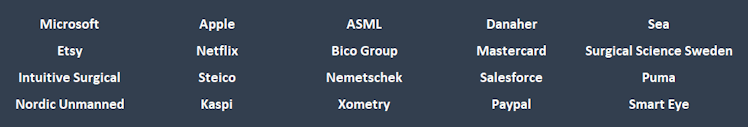

Here you see the stocks I owned on the 1st of January 2022. 20 stocks. In January I added $APPS to my portfolio, so 21 stocks. Micro to mega cap, cash burning to highly profitable, weak to strong moats and no track record to decades of shareholder value creation.

As I shared my portfolio update on the 2nd of January on Twitter I wrote:

''Through the year [2021] I learned a lot and i think i could elaborate the basic idea of my strategy. 2021 was a year to find out in which companies i want to invest and what kind of investor i want to be. [...] So in 2022 i try to develop the basic idea to a precise strategy.''

I was wrong. Looking back I had no idea of how my basic idea looks like. If I would have had an idea my turnover ratio would not have been so high. More on that later.

After the first months into 2022 I had to realize: well, stock don't always go up. Simply said. I never was an overconfident investor, but 2021 was an 'easy' year and as I write this I know there are people who be like 'told you so ' and that's totally fine, point for you. But nevertheless it seems like I had to make that experience of my stocks getting crushed by myself to really understand it. Saying 'I know that stocks can go down, it won't bother me' is easy. But the reality is that I had no clue about how I would react to it. That said: I knew nothing until I saw myself in that particular situation and made that experience by myself.

So after seeing my portfolio down 20% in the first 3 months I really started to think about my basic idea of investing. One reason I started sharing my thoughts on Twitter was that I commit myself and can look back at them. So here is what I did after Q1:

And I was done at the end of July. Coming back to turnover ratio: I decided to sell all stocks with a market cap >$ 10B next to additional company specific reasons for a sell for most of them and also sold two small caps: Smart Eye due to bad earnings in the meantime and Steico for less european real estate exposure. So 7 companies were left (white ones) and two joined my portfolio (green ones):

The absolute basic idea was and still is:

- High conviction plays instead of diversification resulting in a concentrated portfolio

- Looking for micro - mid caps so I am rather focused on my own research and process than relying on the 1000 opinions on each large cap out there

Obviously that's not a whole strategy but it's a fundamental starting point.

Since August I added $PUBM to my portfolio and had to sell Nordic Unmanned after loosing trust in their CEO. Also learned my lesson with position sizing resulting in decreasing my $AXON and $XMTR positions.

I definitely got a more detailed idea of my investment philosophy that I've developed throughout the year and could talk about other mistakes e.g. in position sizing or company specific learnings in more details but I want to keep this post simply focused on critizing my general thinking back the days.

For me the most important trait that every investor should stick to: stay humble.

The trait every investor should strictly avoid: become an overconfident idiot.

That's what I try to achieve with this post.

Cheers.

Already have an account?