Spotify was founded in Sweden around 2006 by Daniel Ek and Martin

Lorentzon, with the idea to make music available for everyone for “free” while

at the same time to make sure that artists also get paid for their music (unlike

with pirating, where artists would get nothing for their “stolen” music)

The streaming service launched on October 7, 2008 and the

company initially limited the sign-up for free services by making it

invite-only. In 2010 Spotify launched in UK and 2011 in USA.

In 2018 Spotify went public via NYSE with ticker symbol

$SPOT.

What is Spotify?

Spotify is global digital music streaming service. It gives users

instant access to its vast online library of music and podcasts, and soon to be

audiobooks (and who knows what else, Spotify is always trying new things).

Some say Spotify is just another streaming service company, but

I say it’s the ONLY true company for all type of creators

around the world who wish to express themselves via audio format.

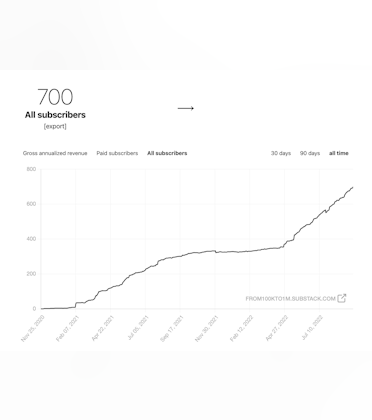

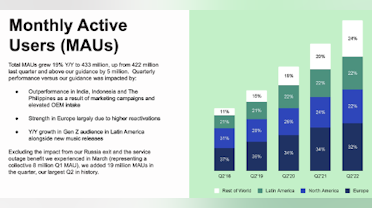

Currently there is about 433+ million MAUs

About 182+ million are paying subscribers.

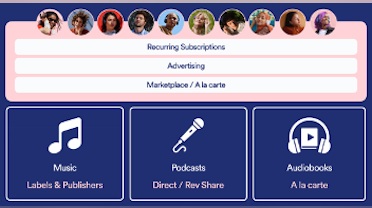

How does Spotify (currently) make money?

Spotify offers Premium and Ad-Supported Services. Both are separate

and yet depend on each other. Ad-Supported is used as funnel to attract new costumer

which later are to be converted into premium subscribers. There are many tiers

when it comes to Premium, Spotify tries to cater to everyone (individuals, students,

duo, and family) while also having different prices for second/third world countries

(all depends on the audio quality/ability of a country).

How Spotify "losses" money

This is also where the controversy comes with Spotify, because

large chunk of profits Spotify gives back to labels/artist, because Spotify does

not own music that it plays (remember about the piracy? This is how Spotify got

rid of it, sort of).

Because of this, Spotify’s gross margins have been high 20+ with

some improvement but not dramatically enough for markets to not worry about

Spotify’s future...

But that will change with new segments…

Quick look at financials

Given the current pessimistic global environment and Spotify

being growth company, I won’t be giving any kind of precise valuation methods

as this is not the way that I (

being a shareholder) started position in

$SPOT, but

I will run through my thought process.

I think currently Spotify is undervalued (vs what the future

holds) by how much exactly is it?

I can’t say, that is why I’ll DCA as it goes lower.

Before going into bullish thoughts, I want to say that I

understand that Spotify is not perfect and has to keep evolving/growing in

order to stay ahead of competition, but in the tech world who isn’t?!

Here are reasons why I’ comfortable buying $SPOT as it goes lower…

- Large TAM with profitable segments + new segment like audiobooks/podcasting

in different languages + population and number of smartphones and IoT devices

are increasing yearly.

- Spotify’s aggressive move into podcasting and perfecting Ad technology.

- Spotify superior product to other audio services:

- Spotify is still run by the original founder who is still obsessed with audio. Daniel Ek also owns 7% of the company and has the voting rights (given by other large shareholders).

- Although Spotify has to give large slice of the music profits to labels/artists, as Spotify gets bigger, they gain more power to negotiate in their favor if/when they need to.

- Other segment will distance Spotify from music/labels depends.

- As more new cars come on the road with modern displays (with app stores) there is a possibility of Spotify to dominate “car audio experience” even without the Car Thing, and take share from the radio.

- Spotify owns 8% of $TME and Tencent owns about the same about of $SPOT, I’m sure there is a bull case in there somewhere with that combo.

- Spotify has shown to be FCF positive, but chooses to spend all of that cash back into things like improving experience, podcasting, audiobooks, having cash for emergency/negotiations with labels and other things.

- Selling concert tickets, merchandise, and streaming live concerts via live feed or metaverse.

- Spotify’s willingness to keep trying new things and learn from (positive and negative) experience.

- Their AI & amount of data that users are willingly sharing, lets Spotify to constantly tune/improve its products.

- The possibilities with audio ARE really endless…