11 Lessons from Terry Smith, the UK Buffett

Terry Smith is one of the UK's most legendary investors.

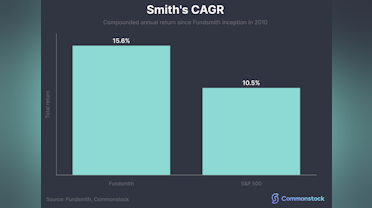

Since its inception in 2010, Fundsmith has earned a CAGR of 15.6% and grown to more than £23 billion in size.

Here are eleven takeaways from the man himself.

1/ Terry Smith's three-step process is to "Invest in good companies, don't overpay and do nothing".

He seeks to acquire the highest quality and durable business across the US (67% of assets) and Europe (29% of assets).

2/ "You can't play 'greater fool theory, in which you knowingly overpay, hoping that a greater fool will buy them off you at an even egregious valuation".

This is why Smith stresses you don't overpay.

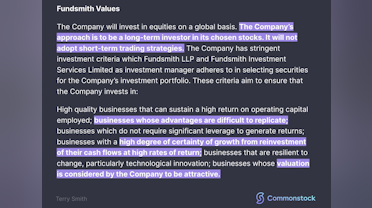

3/ Fundsmith's desired companies:

• High quality with sustainable ROCE

• Hard to replicate advantages

• No excess leverage

• High certainty of growth

• Reinvests cash flows at high returns

• Resilient to change

• Attractive valuation

4/ To ensure that Fundsmith abides by its strategy, Smith adopts a list of No's that contradict his low turnover approach.

No Trading

No Hedging

No Shorting

No Nonsense

No Up Front Fees

No Index Hugging

No Market Timing

No Debt or Derivatives

No Fees for Performance

5/ Be comfortable selling a company when the valuation gets too high, or the fundamentals change, no matter how much you like the stock.

Here's a look at what the Fundsmith portfolio holds today.

6/ Boring is better.

7/ Be picky and wait for the pitch. Life is too short to waste time on bad companies.

8/ Spending time to find the highest quality companies will save you time and money.

9/ Smith believes that quality companies will outperform in the long-term, despite market fluctuations.

10/ "Even if you manage to identify a truly cheap value stock and time the rotation into that stock correctly, this will not transform it into a good long-term investment".

In doing this, the investor has to continuously find new stocks, which Smith feels is a waste of time.

11/ Smith has always avoided banks, and feels that most retail investors should too. Here's why.

Smith: "The answer is that having an understanding of banks would make anyone more wary of investing in them".

Love this. Great lessons and we feel so aligned with his strategy (not entirely of course).