Life with a dog is always better.

A few weeks back, I posted about

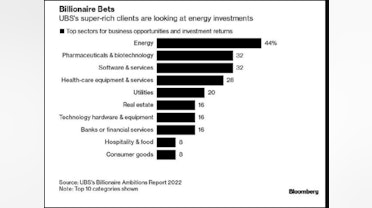

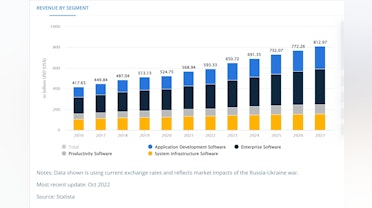

why you should be invested in software. It was based on the premise that software and hardware are modern companies' digital infrastructure, meaning more software must be produced to manage, monitor, analyse and secure these digital infrastructures.

Continuing the theme, I want to explore managing, monitoring, and observing an ever-evolving digital infrastructure with all its software and cloud deployment advancements.

But before doing so, we must educate ourselves on cloud computing and application development. I'll utilise sources and pictograms to distil information into a high-level, easy-to-understand summarisation.

DevOps

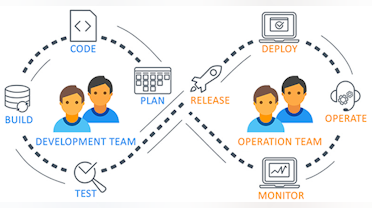

Before cloud computing, inefficient and unproductive practices made software production and implementation slow, rigid, and cumbersome. This was primarily due to a dysfunctional and non-optimized relationship between Development and Operational (IT) teams. Operational teams responsible for deploying and managing the software on their IT Systems required more interaction with the development teams responsible for producing, testing, and refining the code/software.

As technology improved, primarily cloud infrastructure and the ability to self-serve, also known as IaaS (Infrastructure-as-a-Service), so did the relationships of teams inside a business. In this case, Developer and Operational times could align closer to quicken and simplify developing, deploying, and refining software/code; thus, DevOps was born. This is a simplified version of history, but it delivers a high-level understanding.

Looked at holistically, DevOps is a combination of practices, philosophies and tools that combine Development and IT operations to shorten the software development life cycle and increase code quality through continuous delivery.

With the proliferation of cloud and hybrid computing, we witness applications and databases connected differently. It’s not just the connection but how software is designed, delivered, and refined.

With the proliferation of cloud and hybrid computing, we witness applications and databases connected differently. It’s not just the connection but how software is designed, delivered, and refined.

App deployment evolution

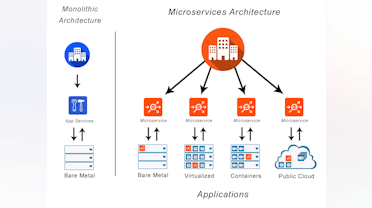

Cloud computing services leveraged virtualization technologies giving clients complete control over sandboxed networks. This abstracted the complexity of provisioning and managing infrastructure in the data centre.

The evolution of these technologies, paradigms, and practices continues today. We now have containerisation and micro-services.

Microservices is an evolution of the approach towards how software is architected. Rather than one monolithic application, the code is compartmentalised into smaller, independent repositories.

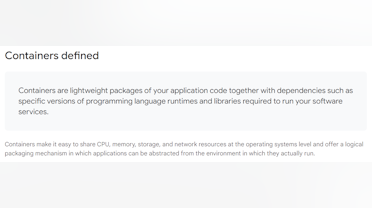

What about containers? They are pretty much as the name suggests. Here's an excerpt from

Google CloudMonitoring and Observing

We’ve quickly run through the changing environment for digital infrastructure. The cloud is becoming more sophisticated and specialized, giving rise to new ways in which software and app developers can create, manage, test, and deploy code.

This also affects IT operations and teams. They must monitor and manage an increasingly complex ecosystem covering many responsibilities. Managing digital infrastructure can be just as complex and time-consuming as managing physical infrastructure.

Many tools are available for the job; however, navigating different software solutions for different applications is counterproductive and time-consuming.

Enter Datadog

$DDOG - A cloud-scale monitoring and security platform that unifies metrics, traces, logs, and more for centralised visibility and faster troubleshooting on dynamic architectures.

Here is a more comprehensive description taken from their website.

Besides making it easy to manage and monitor the health of the digital infrastructure, they also enable DevOps teams to be more productive. One of the primary value propositions of Datadog is the simplicity of viewing the health of your organisation’s digital infrastructure through a single pane of glass.

What does this single pane of glass view look like? If I was a customer, what would I see? Here’s a snapshot of what a Datadog

$DDOG dashboard would look like.

When the dog was a pup

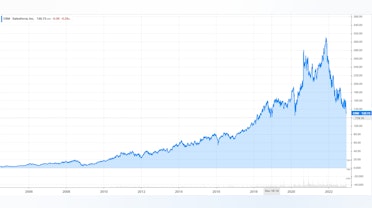

Datadog has climbed the ranks of Gartner magic quadrants to become a leader in its core competencies.

How did it manage such a feat with so much software and competition?

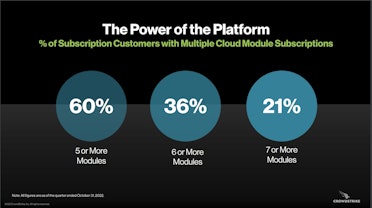

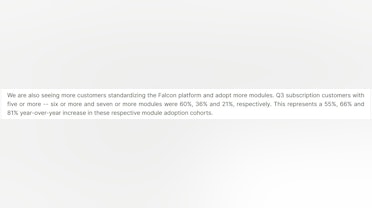

The first mover advantage is where it began, but it maintained its lead by adding more modules and functionality that were natural extensions of its core offering. They did not stray too far from their core competency, a vital strategy to remain a disrupter and a pioneer within your industry.

Here’s an excerpt from

‘Software Stack investing’, a respected and excellent resource I use for understanding companies like Datadog. The author,

@stackinvesting, briefly outlines how Datadog established a leadership position.

“The answer can be found by going back to Datadog’s first big industry achievement in 2018. That was consolidating the “3 Pillars of Observability” into one solution. This is a reference to the fact that monitoring the health of a software application could be accomplished by observing application logs, infrastructure metrics and code execution traces. Prior to Datadog, each of these functions was often addressed by a separate tool. Going back 10 years ago to 2012, an engineering team (DevOps was still a nascent concept) might use Splunk to examine log data, New Relic for traces and some open source project like Graphite for metrics. And Nagios could alert the team if something went out of threshold.”

Remember, a Unique Selling Point (USP) differs from a Value Proposition (VP). In this case, the USP brings together three aspects of observability traditionally done by individual vendors. But, the value proposition is a cleaner and more detailed view of the company’s digital assets and health, meaning time is saved, resulting in increased productivity.

Here’s another excerpt from Software Stack Investing’s website

“Datadog removed this swivelling and context switching. All the indicators above were consolidated into one toolset, providing DevOps teams with a single view of the health of their applications, logs and infrastructure. Not only was the interface common, but the data set was shared. This removed confusion where two different tools provided incongruent interpretations of the same problem. This consolidation was the magic of Datadog and explains the rapid rise in its popularity, in spite of Splunk, New Relic and others having the jump on them.”

No more going between applications and manually stringing together errors and alerts from one application to another or receiving an alert and wasting time trying to figure out how and why that alert rose.

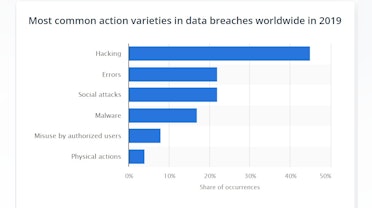

Securing the pack

Modern software and digital infrastructure have become vast, and observability is even more complex. With that complexity, better security functions are necessitated.

Datadog has ventured into Security and Operations, collectively known as DevSecOps. It’s introduced new offerings that are natural extensions of its core products covering Development and Operations. This makes sense; why wouldn’t you want security tailored around these primary functions?

They offer application security, SIEM (Security Information and Event Management) and cloud infrastructure deployment.

A dedicated security team will have Cybersecurity software in place, which is why Datadog hasn’t delved into Endpoint security or other cybersecurity products, as it would be straying too far from their core competency, resulting in a misalignment of strategy.

Instead, they listen to their customers and focus on the developers' needs. A developer’s remit is on the production environment, which is why Datadog offers tools to implement security at this stage. Similarly, it offers IT Operations security functionality that bolts onto what they are already managing. This allows for harmony between the developers, operators, and security teams in terms of having congruent and functioning communication regarding keeping a digital infrastructure running and secure.

Bringing it all together

How do they keep introducing so much functionality and new modules whilst sticking to their core mission of being simple and straightforward, saving time and money?

The answer is AI and automation.

An AI focus underpins all their offerings and functionality. In this case, a tool that intelligently amalgamates functionality acts as an assistant aptly called “Watchdog AI”.

It’s not only about increasing functionality that stems from its core offerings. It’s also about being cognizant of the environment for hiring developers, as they are in short supply. Automation is a crucial pathway to improving what’s already available and adding to the productivity gains already delivered through their products.

They can use baseline interpretations of the company’s data, and anything that deviates from that norm can be alerted towards the relevant team.

Datadog intends to fuse its offerings, making them congruent with its core strategy whilst providing timely assessment and notifications to the relevant teams.

A lot of standard workflows and processes can be automated; as a result, they introduced ‘Workflow Automation’. The workflow is a set of sequences activated from a ‘trigger’. So it could be a trigger arising from observability. If it frequently requires a predetermined response or action, it is suitable for automation rather than allocating time and resources.

Datadog is being recognised for its efforts, as evidenced in the latest Forrester Wave chart for AI within IT operations.

Staying ahead of the pack

Remember, Datadog was all about removing frustration and making the life of DevOps teams easier whilst breaking down silos and making data viewable from one pane of glass.

There are other commercial options; however, less time is wasted on not switching between disparate apps and tools whilst having everything on a single customisable pane of glass, saving time and resources and benefitting productivity.

The difference between ideating and successfully releasing products desired by your customers requires agility and iteration. When perfected, it’s a flywheel that can’t be underestimated; it helps to maintain a leadership position and pioneer the curve. The history of innovation below supports this.

DevOps continues to evolve, and as much as Datadog innovates and releases new functions extending its core offerings it recognises that obtaining these new products through acquisitions is a way to save time & resources.

I would argue that the pace of innovation in this space, coupled with niche offerings that address particular problems, warrants acquiring these products rather than organic development. Datadog has acquired technologies that bolt onto what it already offers, and it’s been doing so for many years.

Recent acquisitions include:

- Cloudcraft - Acquired on Nov 3rd 2022.

It is a cloud infrastructure monitoring tool that allows you to map and visualise your cloud assets and configurations.

It simplifies the complex mesh of interconnected resources and services, giving a high-level model of your digital infrastructure. This helps with costs, configurations, and how everything interacts.

- Seekret - Acquired on 4th Aug 2022

It extends Datadog’s unified platform to deliver deeper API observability, governance and automation across the entire API lifecycle.

With so many APIs, it can be challenging for engineering teams to understand the interdependencies, health, availability, and security of APIs and how they affect the experience of application users.

- Hdiv security - Acquired on 5th May 2022

Hdiv is a security-testing software provider that will enable Datadogs cloud security platform to take a more comprehensive approach to application security.

It monitors application behaviour to detect vulnerabilities during runtime, enabling developers to assess, track, and monitor risk from running applications.

- Sqreen - Acquired on 11th Feb 2022

Extending its functionality within application security monitoring, Sqreen helps to protect organisations’ production environment, further integrating the work of security, development, and operational teams.

Shifting from traditional monolithic architectures to microservices is complex, opening the door to code-level risk and vulnerabilities. Sqreen actively detects attacks on applications and traces them from network requests down to the line of code.

- CoScreen - Acquired on 10th Feb 2022

Simplifying how distributed engineering teams can collaborate to investigate, debug, and resolve issues in real time.

It’s a step beyond the constraints of asynchronous chat threads by being able to multi-user edit within a shared window.

Concluding Remarks

The cloud growth runway has many years ahead of it. With the increasing adoption of the cloud, we require tools to monitor, observe, and protect this digital infrastructure.

It’s not just about IT but also how we develop and deploy code. The better tools that DevOps have, the more productive they can be, which benefits the company.

You can deploy different solutions and stitch them together, which can be inefficient and time-consuming. A single solution that can amalgamate the different requirements into a single pane of glass solves the problem and makes teams more productive, benefiting the company from a product and financial standpoint.

The continued strength lies in adding more functions and features that naturally extend from its core capabilities meaning existing and new customers will adopt them and won’t be seen as disjointed.

Datadog fits this bill perfectly. Its ability to continually introduce new products that stay ahead of the growth in cloud technology and the evolution of DevOps will secure its leadership position for many years.