Trending Assets

Top investors this month

Trending Assets

Top investors this month

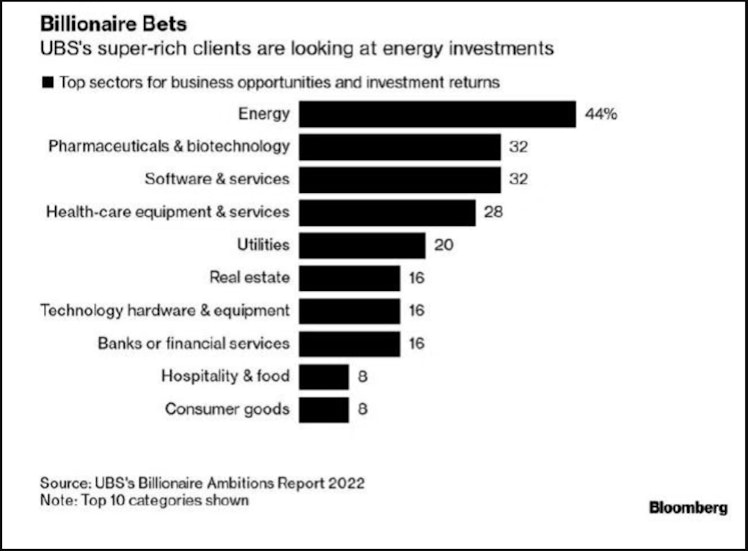

@kostofff posted a note on where the super-rich deploys their cash within the markets. Click here for the post.

Here are the results from this particular source

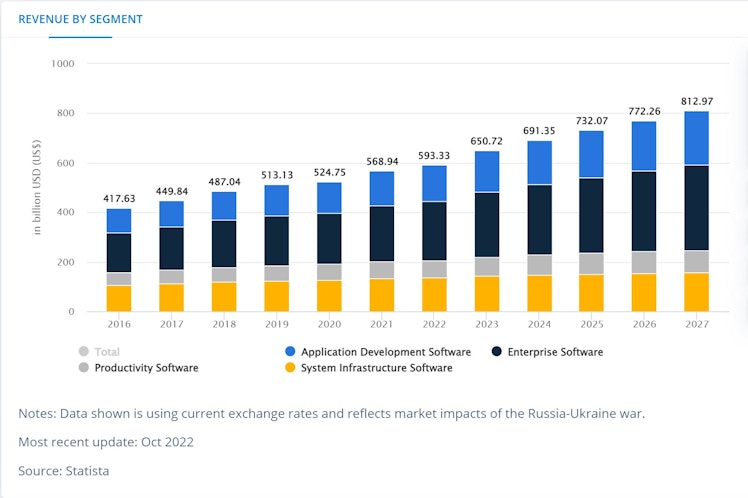

Over the years, software and SaaS have become a higher percentage of indices and, as a result, occupy a higher percentage of portfolios.

Software is indeed eating the world, and I would go as far as to argue it has become a staple of economic output if looked at in its entirety. It is mission-critical in many circumstances, and maintaining software infrastructures has paved the way for new software classes.

Software is inherently deflationary, allowing organisations to allocate the jobs of whole departments to a single piece of software. It allows young companies to compete with larger organisations because they can be more efficient and lean.

The progress and advancement of software are not slowing down by any means, and if broken down into smaller constituent groups, we can see segments that enable organisations to become even more deflationary are poised to grow quickly. Alongside modest growth for Application development software.

Either way, it supports a strong argument for why other investors should consider Software alongside the super-rich.

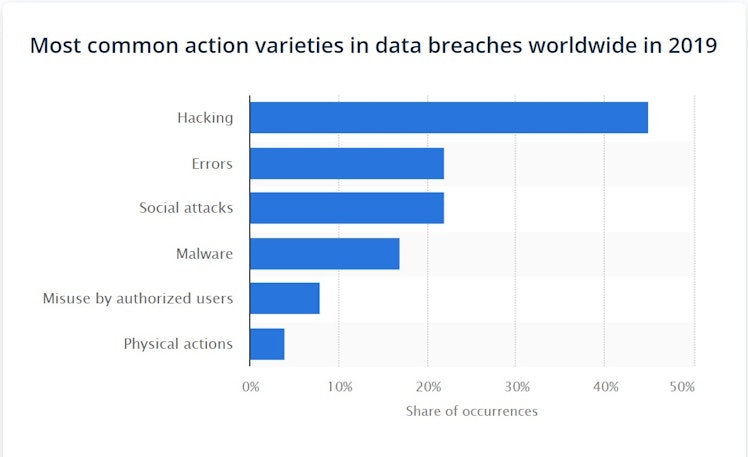

As software becomes more fundamental to everyday life, whether consumer-facing or behind-the-scenes, it also brings with it opportunities and consequences that ironically require more software to solve.

A function of increasingly relying on computing and software is the susceptibility to digital attacks resulting in the industry we know as 'Cyber Security. As you would expect, the proliferation of companies offering Cyber Security solutions has increased alongside the number of ways our digital infrastructure can be breached.

Source - Statista

This has given rise to innovative solutions and the adoption of new technologies, such as AI/ML, that are required to keep this digital infrastructure functioning.

Crowdstrike $CRWD adopts Machine Learning to deploy endpoint security that relays with an AI-powered threat graph called 'Falcon'. Simply put, the protection it provides constantly evolves by detecting attacks across its clients and other sources and updating all devices in real time.

Companies like ZScaler $ZS are born out of necessity. This company has taken a 'Zero Trust' approach, said another way, rather than playing catch up with the ever-sophisticated ways hackers are infiltrating our infrastructure, it assumes trust in nothing and assigns it afterwards.

Cyber Security is a fickle industry, so much so that if you go to University and obtain a degree in the subject, by the time you graduate, a lot of what you learned may be redundant.

But that same speed of change can apply to other software; therefore, we need a way to assess and track companies operating within the software industry. How do we pick big winners or avoid companies that are at risk of being disrupted by the very thing that fueled their rise; Software?

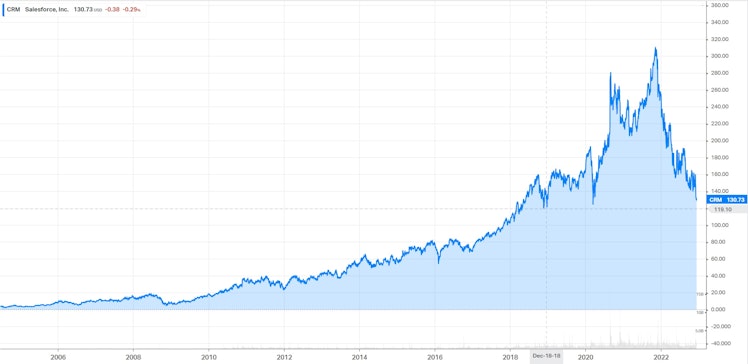

Some companies like Salesforce $CRM have stood the test of time and rewarded shareholders by outperforming their constituent index.

Source - Koyfin

It's good and well, showing a chart of one of the most successful SaaS companies, but we need to think a little deeper.

There are myriad ways to assess and view companies, but here are a few that I personally employ to track software companies, encompassing a qualitative and quantitative perspective.

(1) Constant Innovation - R&D spend

In the world of software, I cannot stress the importance of continuously spending on R&D. As intimated earlier in the post, the market moves quickly, and software allows for lean start-ups, meaning other companies can deploy the same tactics afforded to current leaders against themselves.

A young company can come with agility and quickly acquire low-hanging fruit; before you know it, the disrupter has been disrupted. A company must deploy cash towards new products and ideas to stay ahead and continue pioneering the curve.

A stock I own and is an all-time favourite of mine is The Trade Desk $TTD. They maintained a steady increase in R&D spending, settling at about 20% of revenue as of recently.

According to this source, the median for SaaS companies in 2020 is 23%. However, I would argue it depends on the company's stage. Is it in hypergrowth, or is it maturing? You must also consider how efficient their R&D spend is. Generally, between 15% & 30% is the sweet spot I look for. Anything below or above prompts me to investigate further.

(2) Customer requirements come first.

When spending on R&D, it has to be spent on areas that benefit the company, its customers, and its growth ambitions. Aligning with the company's core competencies and strategies.

I see many companies, not just in software, spending for the wrong reasons, such as pandering to Wall Street, guessing what customers want, or drifting too far afield from their core strategy and offering.

I talk about this in great depth in a post from last week, which you can access by clicking here or for the longer and more in-depth version, you can access my Substack, which is free, by clicking here.

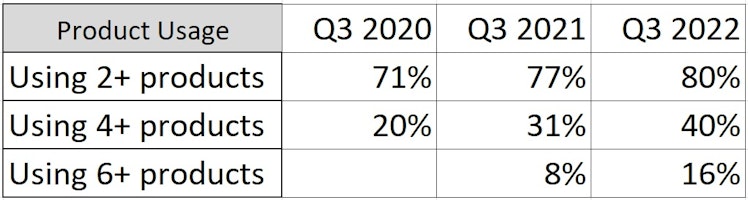

Sticking to software, I look for companies that listen to customers' wants and then quickly produce those products. A prime example of this is Datadog $DDOG. We can quantify this by looking at the number of customers using more than one product. Luckily, Datadog makes it easy for investors and discloses this information every quarter.

After listening to their customers and introducing 6+ core products in Q3 2021, it doubled a year later to 16%. That's a 100% increase.

Even customers using 4+ products in Q3 2020 jumped by 100% two years later in Q3 2022.

(3) Management - Predicting the future and sticking to the vision

I hinted in the previous section about pandering to Wall Street. The same goes for pandering to investors. If the software industry is as fast-moving as I have mentioned, then you need to understand that management is best placed to know what direction it's going and what has to be done to maintain leadership and growth.

One way to know is the introduction of products that are quickly adopted by new and current customers, as we have already touched upon.

Another qualitative factor is management's ability to predict the future regarding industry direction. For brevity, I will talk about the CEO of The Trade Desk $TTD Jeff Green.

Looking at earning calls from 2018, you will see Jeff makes many remarks about where the industry will go. Most analysts scoff at his predictions and push back during Q&A. Fast forward to 2020,2021 and 2022 and guess what? Jeff nails them time after time.

If you want to discern between a company taking advantage of a trend and a company paving the future, then analyse management's ability to predict the direction of their industry.

The CEO of Sales Force $CRM Marc Benioff also had a knack for making audacious predictions that came true.

Conclusion

- The best years of Software and SaaS lie ahead.

- Software should take up some part of your portfolio.

- Be aware that the Software industry moves quickly; therefore, have a framework in place to assess company growth.

- Track R&D expenditure

- Ask yourself; Are they listening and catering to their customer’s needs?

- Don’t just look at cell B7; Also look to management for predictive qualities and forecasts that are proven right, time after time.

buyingyourtime.substack.com

6 Breakdowns in the Disruptive Innovation Process

Understanding Innovative processes

Already have an account?