Trending Assets

Top investors this month

Trending Assets

Top investors this month

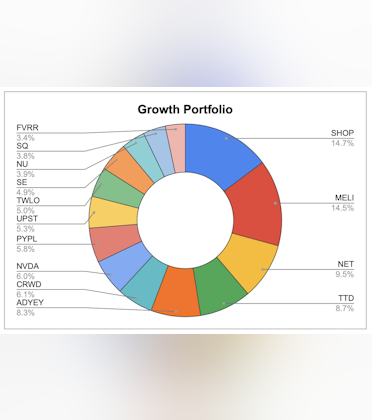

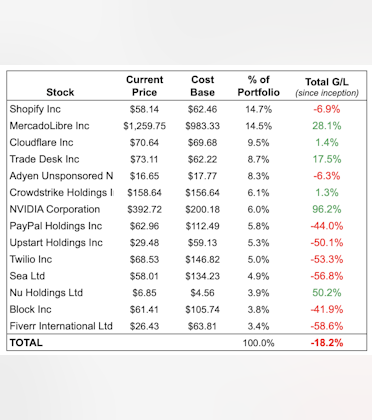

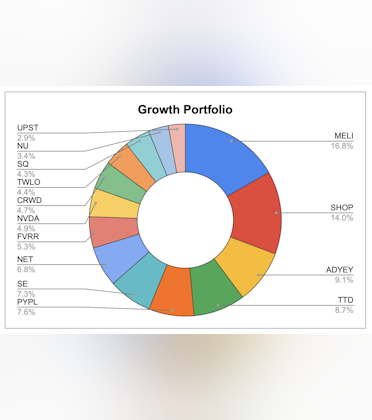

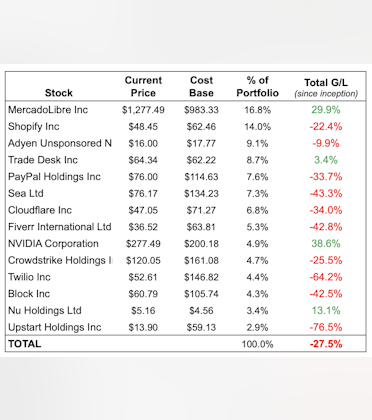

@beaver_cap

Beaver Capital

$16.6M follower assets

162 following1,229 followers

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?