Introduction

Crocs is an American shoemaker, known for its iconic foam clogs, that sells its portfolio of casual shoes through DTC and wholesale. The clogs showed up to the general public around the 2010s, drawing some skepticism about the unique and exotic design. However, the product survived public scrutiny and ten years later pushed for a second popularity run. This time the world was very different, post-pandemic world is trending to casual, social media awareness is favorable to new marketing strategies, e-commerce can fuel DTC sales and teenagers are running away from classic trends to new products. The result was clogs exploded in sales and popularity, and

$CROX became very profitable.

Business of clogs and other casual shoes

Clogs are comfortable, relatively affordable (for a recognizable product) easy to clean and to use.

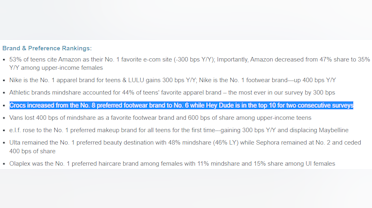

$CROX found a great opportunity to promote its products among teenagers and Z generation, who may become long term consumers.

Some clogs are also becoming popular among professionals, like medical and nurse staffs, for example:

Perhaps the most important development is the “fashion related” and famous influencers collabs. This kind of marketing campaign increase awareness and value perception for the products directly to target consumers. Even “unusual” collabs, like KFC and General Mills do the job of drawing interest.

Jibbliz are accessories to be attached to clogs holes. Each Crocs pair have 26 holes that can be decorated with personalized “pin like” charms with pop culture references, animals, cartoons and licensed figures. The personalization trend is for real, and for sure adds value for the clogs and revenue for

$CROX.

And it's not all about clogs.

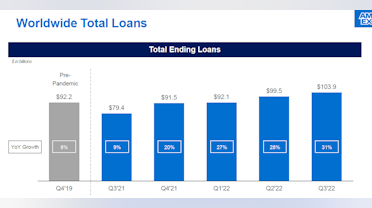

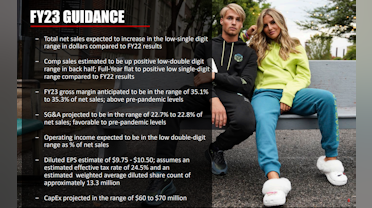

$CROX also sells other kind of casual shoes. This year Heydude`s acquisition increased the company relevance in casual shoes. Heydude´s was growing fast, has good margins, great digital penetration and good brand awareness too. There are also many synergies opportunities, like improving Heydude´s distribution channels, sourcing footprints and marketing expertise Acquisition multiples were less than 15x EV/EBITDA, and considering future revenue's growth projections, can be a real bargain.

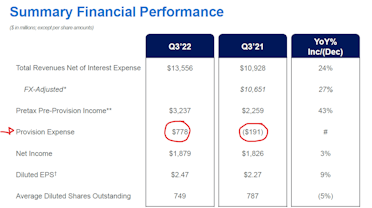

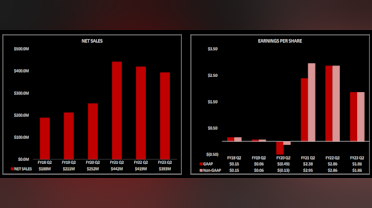

Financial overview

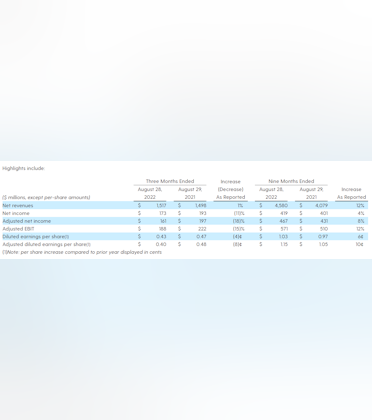

From a business standpoint, the shoes are very profitable, manufactured in China and Vietnam using simple materials and sold with great margins for a good value for consumers.

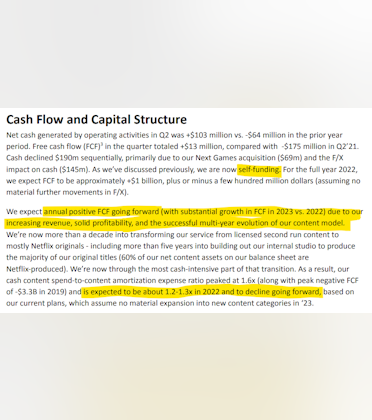

$CROX gross margins are around 50% - 60%, right now impacted by freight costs and disruption of supply chains, but with a good chance of recovery since those effects diminish.

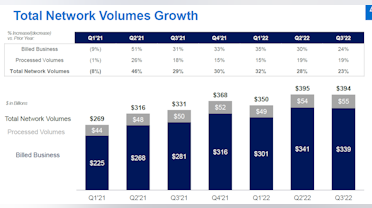

Revenues are also growing in a very fast pace. Company sales growth was around 45% in 1Q22 and above 20% considering only crocs brand. This number is very strong, specially considering a very difficult comp environment, since last year's stimulus and current inflation. Other famous brands, like

$GPS,

$ANF, are going through a tough time of margins reductions and increased inventories. The fact that

$CROX maintained good margins in these conditions is a very strong indicator of the brand and business model strength.

SG&A analysis is kind of difficult to establish right now, because of Heydude´s acquisition one time expenses and acquisition related costs. The adjusted SG&A is around 27% and can be benefits from future operational leverage.

Heydude´s acquisition was worth $2.5 billions, that originated a 3x debt/EBITDA financial leverage.

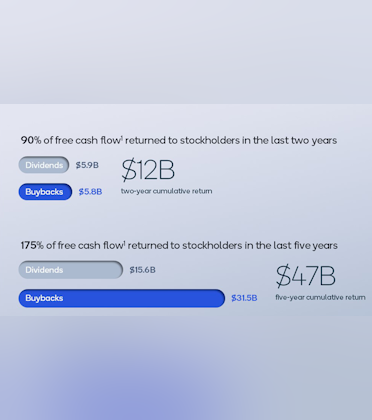

$CROX free cashflow in 2021 was more than $500 million. Adding Heydude´s results and organic growth, the company expects to reduce leverage to 2x ratio in one year, when they could resume share buybacks.

Company Risks

The huge point of attention is the brand awareness and value. The clog product is unique and susceptible to trend volatility. The fact that clogs survived initial strangeness from the consumers and rose stronger recently is very encouraging, but it's always possible that trends change over time and the desirable shoes became not so popular in the future.

Counterfeits and similar products are always a threat, but brand promotion intends to minimize these effects.

Other ordinary apparel retailer's risks are present too, like inflation, reduction in consumers spending, increase in costs and freight. But

$CROX recent financial performance in these conditions is very encouraging too.

Valuation consideration

$CROX stock price have taken a heavy hit from the market. However, the company's fundaments remain strong (strong revenue growth, stable adjusted margins, long term tailwinds unaltered), the financial results were not affected by the current harsh environment and the near future looks even better with improving scenario and Heydude´s integration roll out. For the long term,

$CROX expects a steady revenue growth of 17-20% to achieve $6 billions plus in 2026.

tradingview.com

Considering the 2022 outlook of $3.5 billions total revenue and 26% to 27% of operational margin, we can think of close to $1 billion operational result. The current market cap is around $3.3 billion and financial debt (without lease obligations) is roughly $2.7 billions.

Without thinking in great detail,

$CROX is negotiating close to 6 times EV/EBITDA projected for 2022, with strong revenue growth and a favorable long term guidance. Multiples are in the market lower end for sure. We don't need to make detailed DCF calculations to draw the conclusion that value upside is huge.

Pairing with a relatively low business risks, it is very difficult to imagine a scenario where the stocks keep underperforming. The financial numbers are already very good and probably will continue to increase. Even if the numbers deteriorate and projected growth is not achieved in the future, the actual results already support current valuation.

Investment thesis summary

- $CROX has a strong brand, an iconic product, desired among youngers and more accepted among adults, associated with fashion brands and fast-growing in other casual shoes;

- Financial numbers are great, good margins, profitable products, efficient SG&A, solid cashflow, low capex needs, debt exists only because of recent acquisition;

- Long term tailwinds of shift to casual, good social media presence, diverse and personalized products and awareness among youngsters, consumers of future;

- Recent acquisition of Heydude´s complement business, becomes a multi-branded company, gain other casual shoes share, leverages and synergies to capture and costed a fair price;

- Actual multiples are very low for all the potentialities and relatively low risks, since price is already low for current results and a strong growth is expected for the future.