Trending Assets

Top investors this month

Trending Assets

Top investors this month

Netflix 2Q Results $NFLX

While many are focusing only in subscriptions' growth/decline, the most important take about $NFLX future are these two paragraphs:

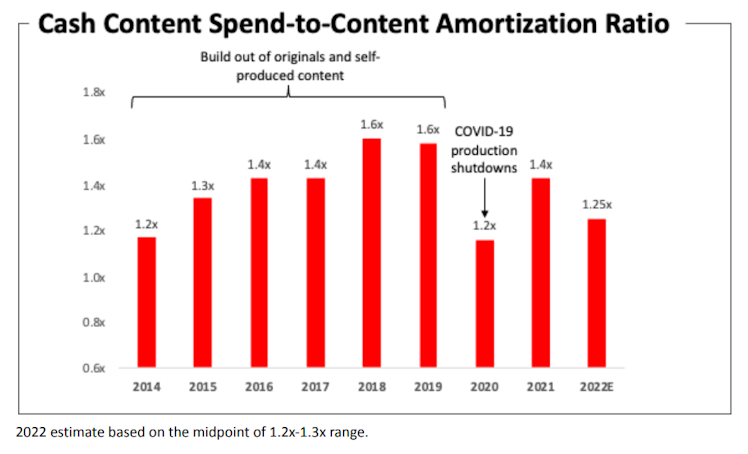

The big question is whether $NFLX will balance revenues with content production/licensing expenses. This point is what is really hurting $NFLX profitability. They need not only self-fund themselves, but also increase a lot their FCF, since we are talking about an $80 billion company. Of course subscriptions growth, advertising, other increase revenue measures are important on the revenues side, but perhaps the major challenge is spending more wisely in content

The outlook for 2022 is $1 billion FCF. It is already a great improvement to a cash burner company, but is still a very low number considering $NFLX market cap. Meanwhile, $8.5 billions in debt can get pretty ugly if the company fails to be a positive FCF.

Already have an account?