Trending Assets

Top investors this month

Trending Assets

Top investors this month

Qualcomm ($QCOM): good value in a predictable growth tech company

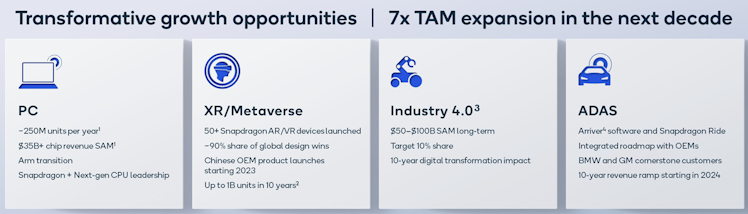

I am not a chipmaker expert to understand business nuances, but Qualcomm ($QCOM) looks a very safe bet right now. $QCOM has a strong market participation with smartphone processor Snapdragon, but it is also relevant (and fast-growing) in other areas live RF front-end, IoT and autonomous vehicles. All business segments are performing very well, have long-term potential growth, and $QCOM has an established market position.

Other companies are also performing well in this business, but I specially like $QCOM. First of all, sales are expected to remain high for a long time (Snapdragon is the main option in premium android smartphones, 5G transition is only beginning and IoT will only get bigger and bigger). Unlike other tech stocks, $QCOM already is very profitable and doesn't have high multiples. The company is making more than $10 billion in cash every year and is returning most of it to shareholders.

This is a very unusual (and powerful) combination of great business, moats, profitability, fair multiples and return to shareholders. Even with short-term difficulties to slow business down, long-term seems to remain unchanged. It is hard to not like $QCOM, either from a growth, value or business point of view.

Already have an account?