Trending Assets

Top investors this month

Trending Assets

Top investors this month

September Idea Competition: Hibbet ($HIBB)

Introduction

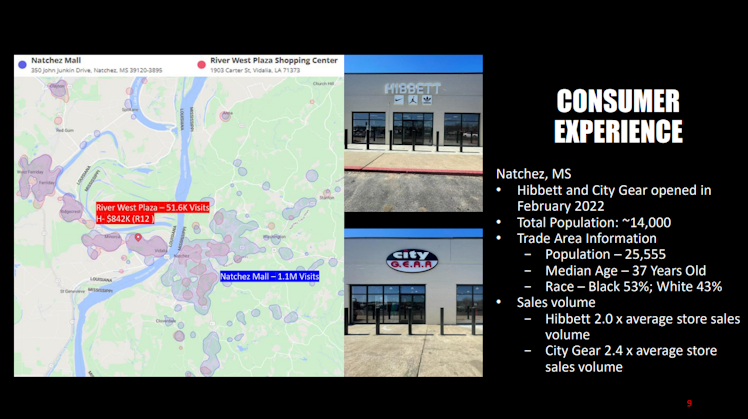

Hibbet ($HIBB) is a sports shoes and apparel retailer, which main characteristic is being located in underserved communities. As of July 30, 2022, $HIBB operated 1117 stores of three different brands: Hibbett, City Gear and Sports Additions. Most stores are located in strip centers, next to major retailers. They provide a broad assessment of premium brand name footwear, apparel, accessories and team sports equipment at competitive prices in a full service omnichannel environment.

Main competitive advantages

Sports retail does not look fancy, unless you can do something different. Hibbet´s trick is to strategically locate stores far away from competitors, in communities that demand their products, close to large traffic retail stores, with premium assortment of products that competitors can't handle. It looks simple, but works! Cherry-picked store locations sell very well, even in a very tough american retail environment.

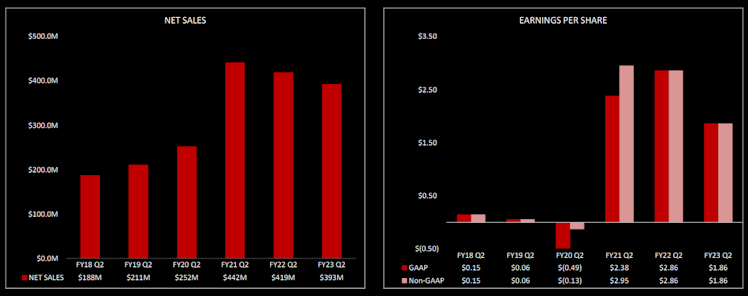

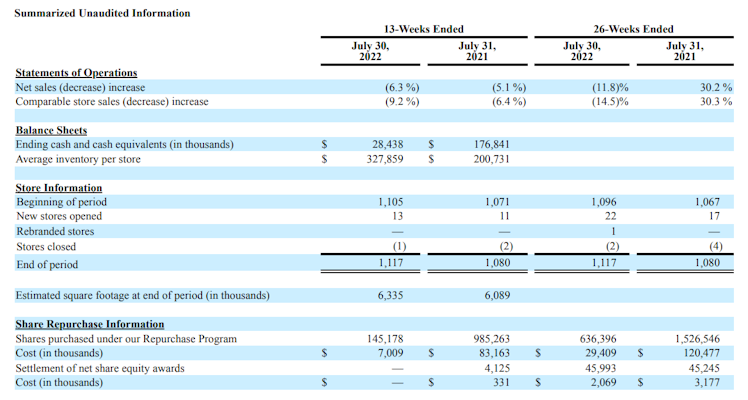

The main competitive advantages are best in class omnichannel business model, superior costumer services in stores and a compelling merchandise assortment. They create a differentiation among competitors, even considering a relatively competitive retail business. Sports goods are also performing well when compared with other retail specialties. Those advantages can be accounted when you check business performance. Right now, Hibbet has a negative comparable sales decline of -9% from previous year, but a very strong 54.4% increased from 3 years ago (pre-pandemic).

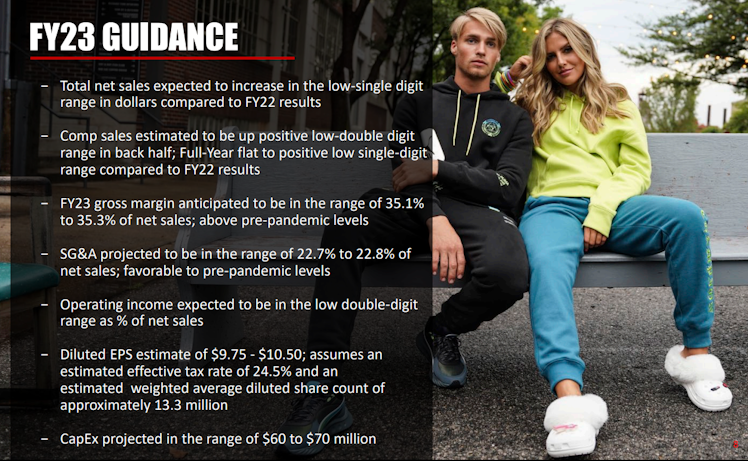

Year-over-year comparisons are tough, because of lapping stimulus, deteriorated retail conditions, margins pressures (freight, transportation, wages, launch delays), but $HIBB is still performing great from pre-pandemic levels and most important, still has a strong EPS result, while other retail players are struggling a lot more. Other good business signs are: $HIBB is opening more stores, e-commerce is growing and increasing participation (15% of total sales), inventories are full and fresh. Full 2023 guidance is positive, aiming for higher gross margins in the back half, positive comp sales and better operating margin.

Financial numbers

Right now, $HIBB margins are a little bit compressed. Gross margin is 34.4% and operating margin 8.4%. Still, operating results granted a fair 4.72 EPS YTD, which looks good considering circumstances. For the remainder of the year, the company expects an overall improvement in all areas, that will probably boost bottom line and cash flows. Meanwhile, $HIBB keeps strongly repurchasing shares, that will reflect in future EPS. New stores capex is relatively low, and when working capital starts to normalize, even more cashflow could be returned to shareholders. The company has almost no debt other than operating lease obligations.

Company Risks

The great risk of $HIBB is ordinary retail execution. Positive cashflow, no debt and modest capex maintain corporate risk very manageable. Retail is going through rough times, but the forecast is promising. Freight and transportation are normalizing and store count leveraging should return. Comparable sales will start to face a better situation as long as the year goes. Most competitors are suffering far more and should take long to recover.

Valuation consideration

Hibbet is a small cap business, with a roughly $750 million market cap, with almost no debt (depending on how you consider operating lease obligations). Operational results are hard to evaluate right now, since quarter over quarter results are very volatile and FCO is compromised with inventory's increase. However, we can estimate an interval of 150-250 EBITDA, trending up, resulting in a 3x - 5x EV/EBITDA multiple interval. That is an attractive multiple, specially considering recovering business, growth potential, operating leverage and strong share repurchase.

Investment thesis summary

- $HIBB established a differentiated business model with strategic placed stores, premium assortment and appealing products;

- Comparable sales skyrocket during pandemic time and are holding strong levels after. Margins are pressured right now, but are expected to return and surpass pre-pandemic levels as the year rolls out;

- Eventually, brick-and mortar retail will recover. The company is well positioned to regain long-term growth, since competitors are probably going much worse and Hibbet resumed new stores opening and kept e-commerce growth;

- Multiples are low and there is a strong growth potential. Even in a harsh environment, $HIBB remained profitable. Meanwhile, aggressive share repurchase is being conducted in interesting prices;

- Risk/return relation is pretty favorable, with $HIBB proving its business model in hard conditions, retaining growth capabilities and generating value for shareholders.

Already have an account?