Trending Assets

Top investors this month

Trending Assets

Top investors this month

American Express $AXP back to cruise

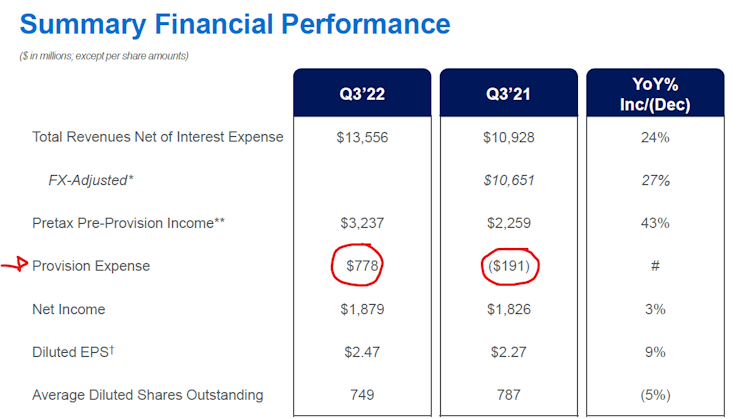

Loan related companies has a turbulent COVID period, since they had big provisions in 2020, then reverted in 2021 and now are coming back to normality. You can see that even returning provisions, earnings remained flat, with EPS increasing after massive buybacks last year.

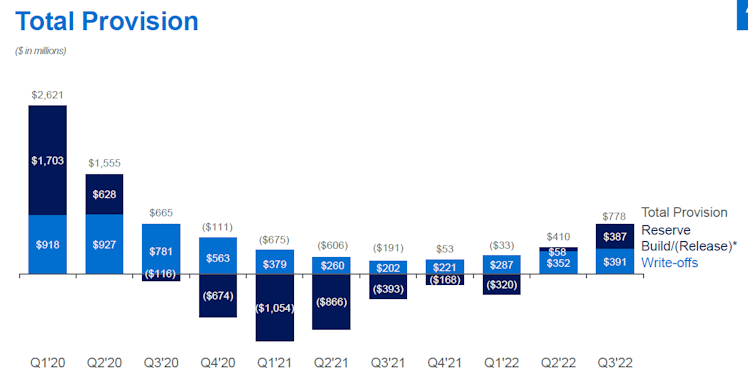

Provision dynamics are fundamental to understand $AXP business development:

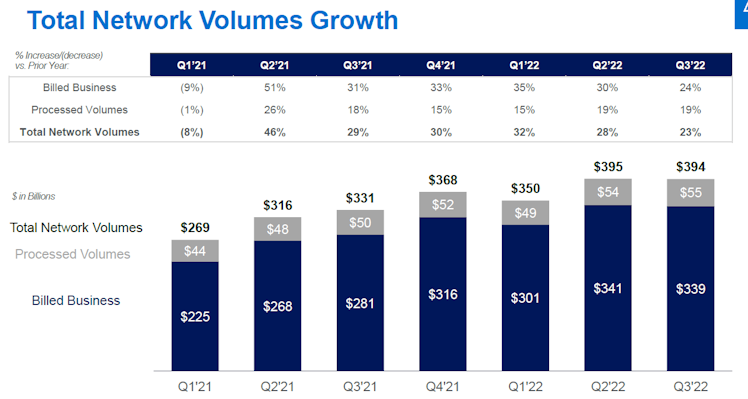

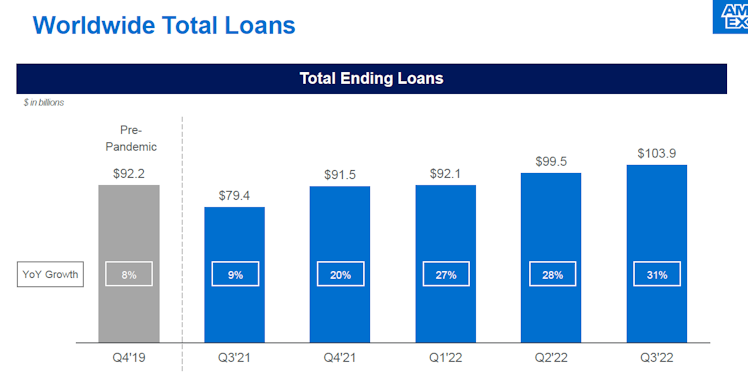

Overall, other business indicators are going well too, like network volumes and total loans:

In conclusion, $AXP is a value company, with a steady growth, good capital returned, nice premium positioning, verticalized, in a segment that doesn't stop growing. It is a nice addition to a solid portfolio.

Already have an account?