Trending Assets

Top investors this month

Trending Assets

Top investors this month

End of the Week Portfolio Update: Ouch

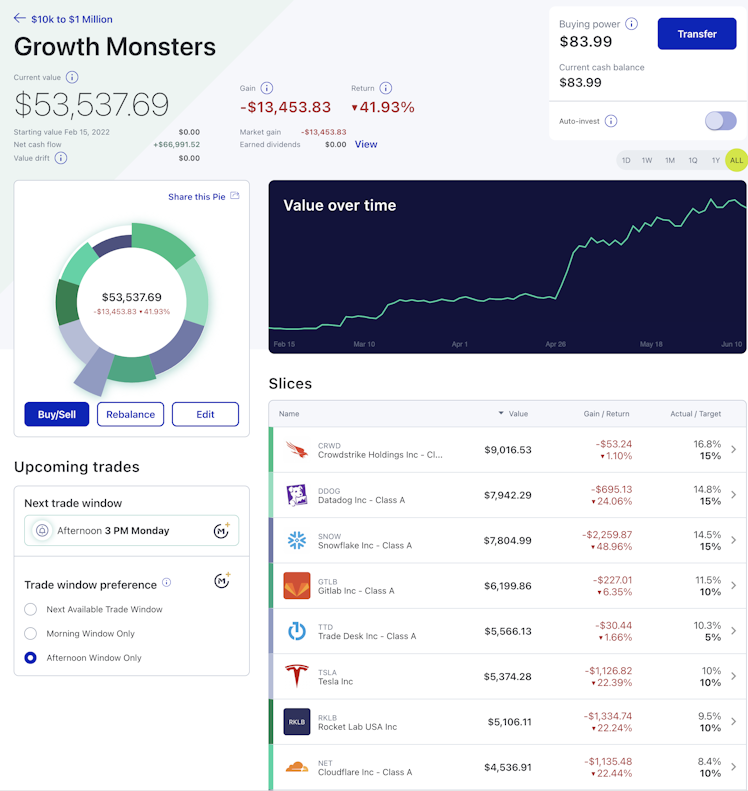

Having an issue with my brokerage so I disconnected it from Commonstock... but don't worry, I'm not hiding my horrible returns! will manually share for now

Long $CRWD $DDOG $SNOW $GTLB $TTD $TSLA $RKLB $NET and one more stock I just added today. Will update next week.

Portfolio strategy & market volatility

Here is the current portfolio and positions. As a reminder, this portfolio is designed to receive a total of $370,000 in contributions from 2022 - 2032. Since inception, the portfolio has received $65,500 so we are at roughly 18% of the lifetime contributions.

That’s why I’m comfortable with position sizes up to 20% right now. A 20% position would be roughly $11,000 which would only be 3% of the $370,000 that will eventually be contributed.

We have a long way to go before I’m concerned about portfolio concentration. This is my approach and people need to make their own decisions, but I feel it’s helpful to give context around how I’m structuring this portfolio.

On the current volatility and $13,450 loss. Does it feel good? Nope. Every day I share my positions and portfolio I get comments from the experts who have timed everything and hedged perfectly telling me how bad I am.

I’m not concerned. The money I have invested is one aspect of our broader financial plan. We are conservative with our personal finances and this portfolio is designed with a 10+ year time horizon. That’s my margin of safety and I have no investors pressuring me if I’m in the negative for three years.

As long as I can keep adding to the portfolio monthly, that’s what I’ll do. With that in mind, the market going sideways or down is a GOOD thing for this portfolio and for our future finances. If I own the right businesses, they will likely be stronger after volatility in the market and economic downturns. If the businesses keep performing well, the stock prices will catch up at some point.

The caveat that DIY investors HAVE to be aware of is the fact that their earnings and savings power could be negatively impacted in the case of a severe economic downturn, job loss, etc. If this happens, it complicates things, but the buffer we have from living below our means and the emergency savings we have should help.

Portfolio Company News

Cloudflare (NET)

- Cloudflare names former President and Chief Financial Officer of Salesforce (CRM) to Board of Directors: “During his more than 7-year career at Salesforce, Hawkins helped the company grow its revenue from $4 billion to $26 billion. Hawkins will lend his 35+ years of experience leading finance organizations at global software and technology companies including Salesforce, Autodesk, Logitech, Dell, and Hewlett Packard to support Cloudflare on its continued path of growth.”

Crowdstrike (CRWD)

- Crowdstrike introduces Humio for Falcon, Redefining Threat Hunting with Unparalleled Scale and Speed: “The new capability gives security teams the ability to store security and IT telemetry from the Falcon platform, which is enriched and contextualized across endpoints, workloads and identities to address the challenge of operationalizing the ever-growing volumes of data.”

- Crowdstrike introduced Asset Graph to Help Organizations Proactively Identify and Eliminate Blind Spots Across Attack Surface: “CrowdStrike Asset Graph, a new graph database powered by the CrowdStrike Security Cloud that provides IT and security leaders with a 360-degree view into all assets (both managed and unmanaged) alongside unprecedented visibility into their attack surface across devices, users, accounts, applications, cloud workloads, operational technology (OT) and more to simplify IT operations and stop breaches.”

Question: Why do you win?

Answer: “Nobody wants more agents. Everybody wants less. So we come in, we rip out a whole bunch of different agents. We charge you less than what you were paying before. We actually come in and do hard math. We do something called a business value assessment, where we come in and show you, here's what you're spending today. Here's what you would spend with us. And on average, there's 150% ROI in the first year. We've done 3,000 of these. So the data that we have is not N of one, it's a real end. And so we're super proud of being able to show how we're different than everybody else. And that's basically why we win.”

Datadog (DDOG)

- Datadog Management at 42nd William Blair Growth Stock Conference: Question: “What is it about Datadog's functionality that allows it to grow at 80% and with 30% free cash flow margin in what is otherwise a tough software environment?”

Answer: “Datadog is designed to monitor applications delivered in public and hybrid clouds, and it's used to handle the complexity of modern DevOps. And by that, I mean containers orchestrated by Kubernetes, microservices, et cetera. So that's what its use case is for. It was built for that. And some of the reasons why it's been able to be adopted so frictionlessly is the way the product was designed means that clients can import their data, use our integrations and can be up and live with reports very quickly, so no professional services.”

Question: “You've recently introduced new functionality around security. How should we think about the opportunity there?”

Answer: “Most of the security market, as investors know it is in the areas of endpoint e-mail and network. And that's not where we are. We're in cloud security and application. And so when you look at that that sort of spectrum, we're trying to add value to DevOps and provide additional monitoring signals related to security topics, cybersecurity. And so that's where we're focused. We're not looking into their markets. We're focused on our market.”

GitLab (GTLB)

- GitLab reports Q1 2023 Financial Results: The company reported $87.4 million in revenue, up 75% year over year (YoY) which beat analyst expectations by $9.28 million. Non-GAAP EPS was -$0.18 compared to -$0.44 in Q1 2022, which beat analyst expectations by $0.08.

- Scotiabank started coverage on GitLab with Outperform: “Regarding the valuations of many software companies, and that share prices could still decline. However, Altman added that "software assets" are in a better position than earlier in the year even though companies are acting more cautious with their outlooks.”

Rocket Lab (RKLB)

- Rocket Lab selected by Ball Aerospace to Power NASA’s GLIDE Spacecraft: “The SAP will utilize SolAero by Rocket Lab’s high-efficiency, radiation-hardened, quadruple-junction Z4J solar cells, laid down on carbon composite facesheet panels manufactured at the company’s facilities in Albuquerque, New Mexico.”

“Rocket Lab has provided power to multiple spacecraft as part of NASA’s Heliophysics Division missions including the Parker Solar Probe, the first-ever mission to “touch” the Sun that launched in 2018, and the Magnetospheric Multiscale (MMS) mission, a robotic space mission to study Earth’s magnetosphere that launched in 2015.”

Snowflake (SNOW)

"Snowflake’s new Cybersecurity workload provides a unified, secure, and scalable data platform for helping security teams eliminate blind spots and respond to threats at cloud-scale.”

"Customers like CSAA Insurance Group, DoorDash, Dropbox, Figma, and TripActions are leveraging Snowflake’s Cybersecurity workload to unify data, gain near-unlimited visibility, and combat threats faster with powerful analytics.”

Tesla (TSLA)

- UBS upgrades Tesla to “Buy” from “Hold”: "We expect Tesla’s vertical integration in semiconductors, software and battery to result in superior absolute growth and profitability in the years ahead"

- Tesla sells $32,165 China-made vehicles in May, production up 200% M/M: “The Shanghai plant reopened on April 19 after 22 days of city-wide lockdown and resumed exports on May 11 but has struggled to get production back to pre-lockdown levels.”

The Trade Desk (TTD)

- No significant news

Seeking Alpha

Tesla expands store presence in China to Mongolia

Tesla (TSLA) opened its first physical store in Inner Mongolia with the location in Hohhot now operational

Already have an account?