Trending Assets

Top investors this month

Trending Assets

Top investors this month

I try to think about my portfolio in terms of the strategy I had in mind at the beginning of the year. On 1/3/22, I had large positions in Cathie Wood stocks like $TDOC, $COIN, and $TWLO. We all know what happened to Cathie’s stocks. They have been the worst performers. COIN being the worst, down 70%. I still hold them, however. I haven’t completely lost faith.

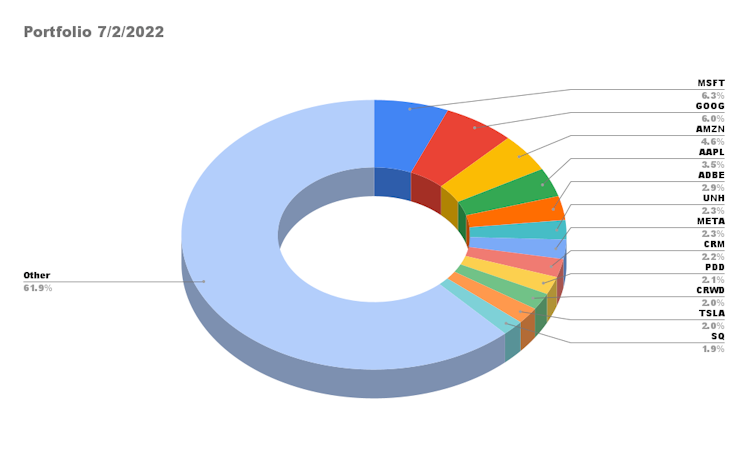

Earlier in the year, I stated that I wanted to build heavier positions in MSFT, GOOG, and META because I did not think they would be affected as much by the economic downturn. I did indeed build up heavier positions in $MSFT, $GOOG, and $META as can be seen on the chart. META would be in a higher position but is down significantly on the year. I do believe that META is attractively priced right now.

Another thing I mentioned earlier in the year is how I was heavy in ecommerce and fintech. My ecom and fintech holdings are down significantly. I haven’t sold, still holding on. I am slowly accumulating. $ETSY and $UPST are some of my favorites for these areas. Also, like $RVLV.

I did add what I consider to be safer positions to my portfolio in an effort to preserve value. These types of additions included $UPS, $UNH, and $CNC. I am either up a little or down a little on these. They’ve done the job I’ve asked of them.

Back in January, I also said I would slowly keep buying Chinese stocks. Interestingly, these are my best performers for the year. $FUTU up 38%. $VIPS up 19%. $PDD up 27%.

A few weeks ago or so, I did some panic trading. It was hard to think clearly with all the down days. I was in and out of a few stocks over a period of a few days. I’m at a better place mentally now. I’m going to stick to my convictions. Will my strategy work? I don’t know, but I’m enjoying the process of learning and growing as an investor. Green days inspire hope. Red days are instructive and build discipline.

Already have an account?