Trending Assets

Top investors this month

Trending Assets

Top investors this month

Insights from Joel Greenblatt

Joel Greenblatt founded a hedge fund, Gotham Capital in 1985 that would return a 30% CAGR over the next decade. He made his name focussing on spinoffs, corporate restructurings, and other special situations.

These 12 insights will make you a better investor.

But first, did you know that Gotham still exists? Today it's called Gotham Funds.

Outside of managing capital, you may know Greenblatt from his two most popular books:

• You can be a stock market genius and;

• The little book that beats the market

Greenblatt has a long history of educating investors. In the mid-90s, he taught value & special situations class at Columbia University.

His goal was to give students "the course that I never had and that I wish I had".

If you'd like to get access to those lectures, then look no further 👇

Now, onto the insights.

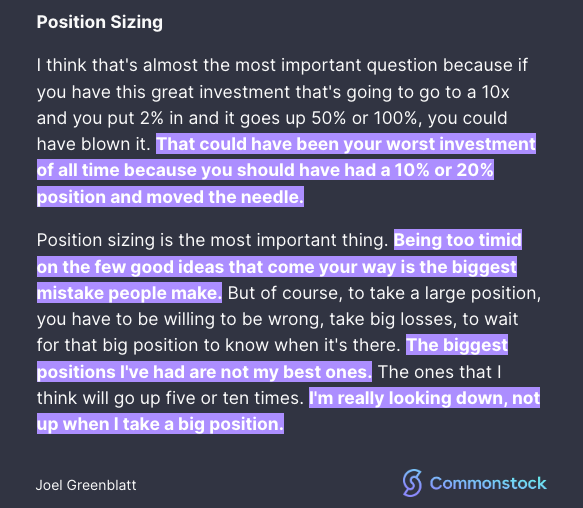

- "Position sizing is the most important thing. Being too timid on the few good ideas that come your way is the biggest mistake people make".

- Investing mistakes are not limited to the ones that you lose money in. Incorrectly sizing multibaggers can be just as costly.

- "Choosing individual stocks without any idea of what you're looking for is like running through a dynamite factory with a burning match. You may live, but you're still an idiot".

- Know what you are looking to find before you start researching companies.

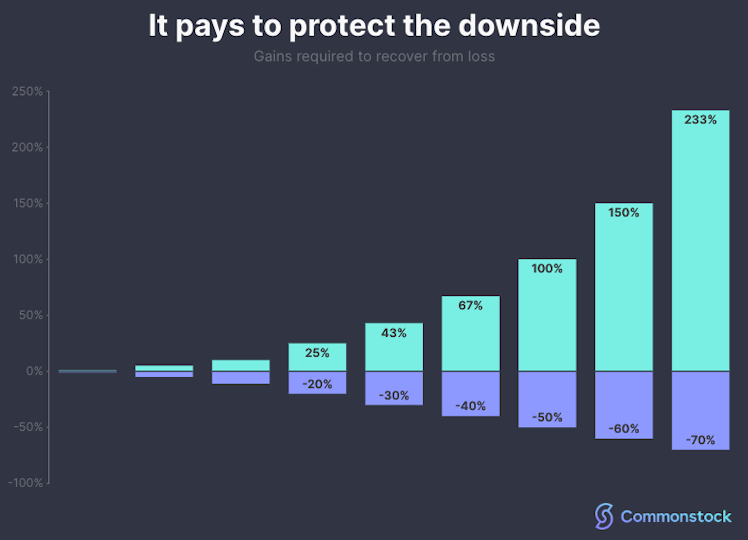

- "Look down, not up, when making your initial investment decision. If you don’t lose money, most of the remaining alternatives are good ones".

- Instead of asking "what's the upside?", ensure to think just as hard about the potential downside.

- "If you spend your energies looking for and analysing situations not closely followed by other informed investors, your chance of finding bargains greatly increases".

- Don't follow the herd if you are looking for market-beating returns.

- "I wait until an investment idea is so good, it hits me over the head like an anvil. Figure out what something is worth and pay a lot less".

- You don't have to be first into an idea. Exercise patience for obvious ideas.

- "Something out of the ordinary course of business creates an investment opportunity - spinoffs, mergers, restructurings, rights offerings, bankruptcies, liquidations, asset sales, distributions".

- Keep an eye out for one-off events as they can "result in big profits".

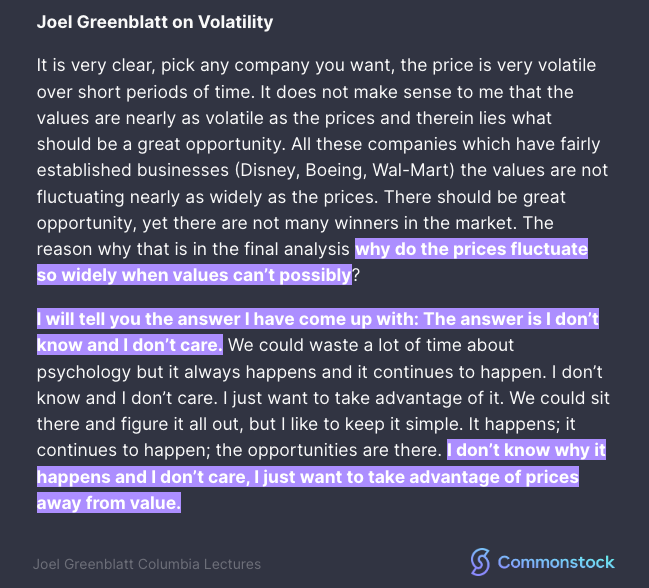

- "Why do the prices fluctuate so widely when values can’t possibly? I don’t know and I don’t care. I just want to take advantage of it".

- Don't let the noise distract you from finding opportunities.

- "The market's very emotional but over time, doing something logical and systematic does work. The market eventually gets it right".

- As Ben Graham would say, the market votes in the short term, and weighs over the long term.

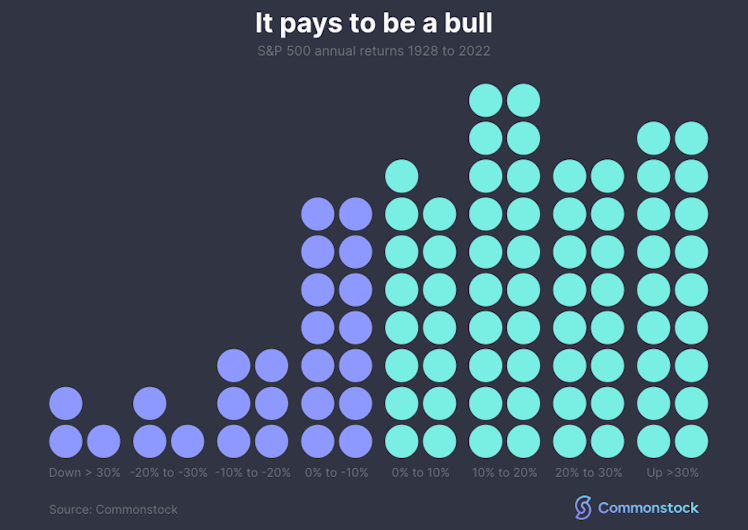

- "Over the long term, despite significant drops from time to time, stocks will be one of your best investment options. The trick is to GET to the long term. Think in terms of 5 years, 10 years and longer".

- It pays to think long-term.

- "Sticking to investing in only a small number of companies that you understand well, rather than moving down the list to your 30th or fiftieth 50th pick, would create a much greater potential to earn above-average returns".

- Develop a core circle of competence.

- "When it comes to long-term investing, doing "less" is often "more".

- The urge to do something is the enemy of the long-term investor. Good investing can sometimes be boring.

- "Remember, it’s the quality of your ideas, not the quantity that will result in the big money".

- Quality > Quantity

Already have an account?