Trending Assets

Top investors this month

Trending Assets

Top investors this month

Highlights from the Berkshire Letter 2022

Each year, investors eagerly await the latest shareholder letter from Buffett's Berkshire Hathaway.

With a 4% return (vs -18.1% for the S&P) in 2022, $BRKA has compounded at 19.8% since 1965 vs the S&P's 9.9%.

Here are the 14 key takeaways from this year's letter.

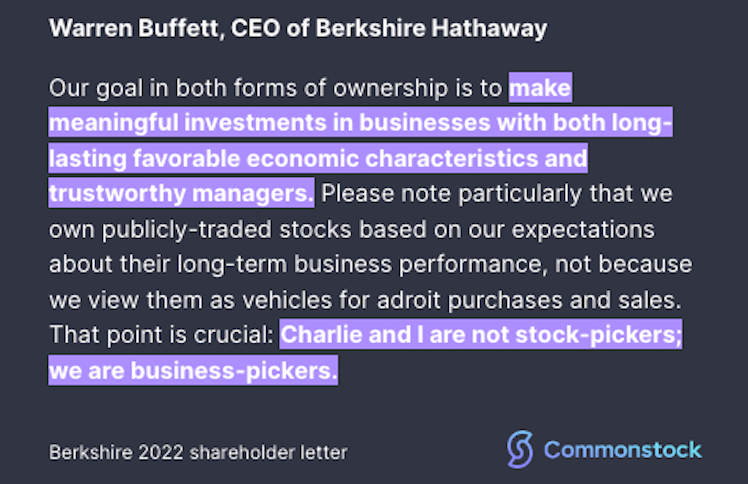

- Be a business picker, not a stock picker.

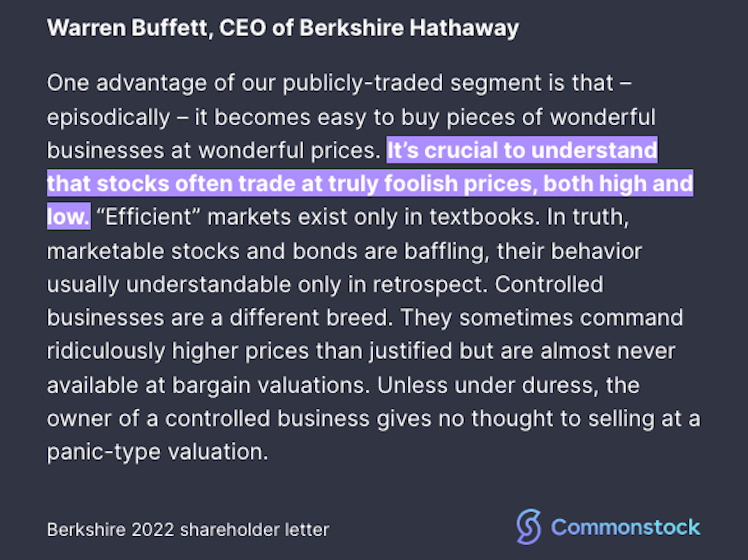

- Efficient markets only exist on paper.

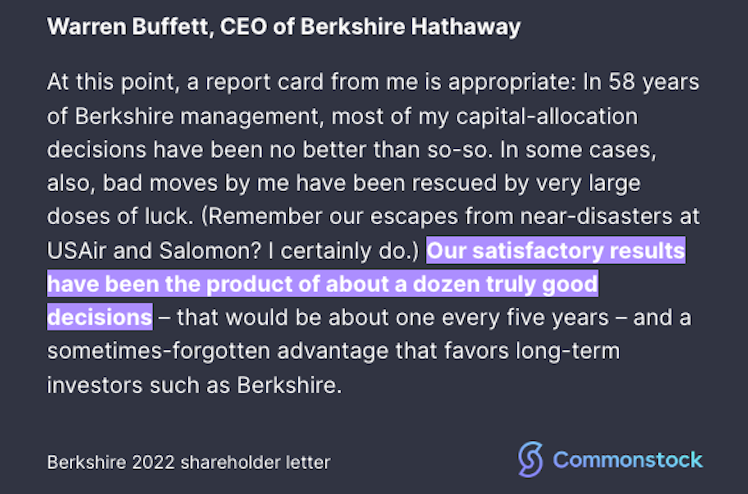

- Never underestimate the importance of good luck, and you only need a few great decisions to pay for the bad ones.

- Being a long-term investor pays dividends, literally.

• In 1994, the $KO position had a cost basis of $1.3b and yielded $75m annually.

• By 2022 it was valued at $25b and kicked off $704m per anum.

- Water the flowers, not the weeds.

- Creative destruction.

- Share repurchases can be wonderful.

- But not all share repurchases are created equal.

- Be wary of the rise in imaginative accounting.

• Buffett calls this practice "disgusting".

- Focus on what you can know.

• Buffett doesn’t know how the US Government’s deficit will cause problems, just that it will eventually.

- Berkshire pays…. a lot of tax.

• But Buffett claims he'd like to pay even more in the future.

- Advice on finding an investment partner.

• "Find a very smart high-grade partner – preferably slightly older than you – and then listen very carefully to what he says”.

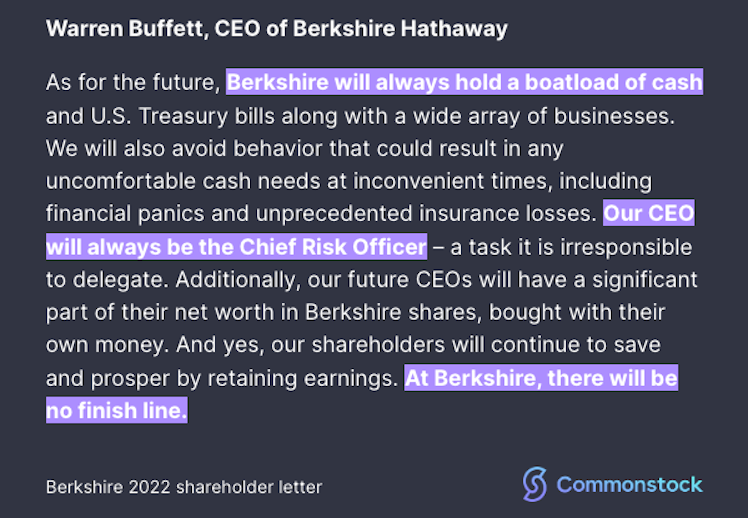

- The future of Berkshire has no finish line.

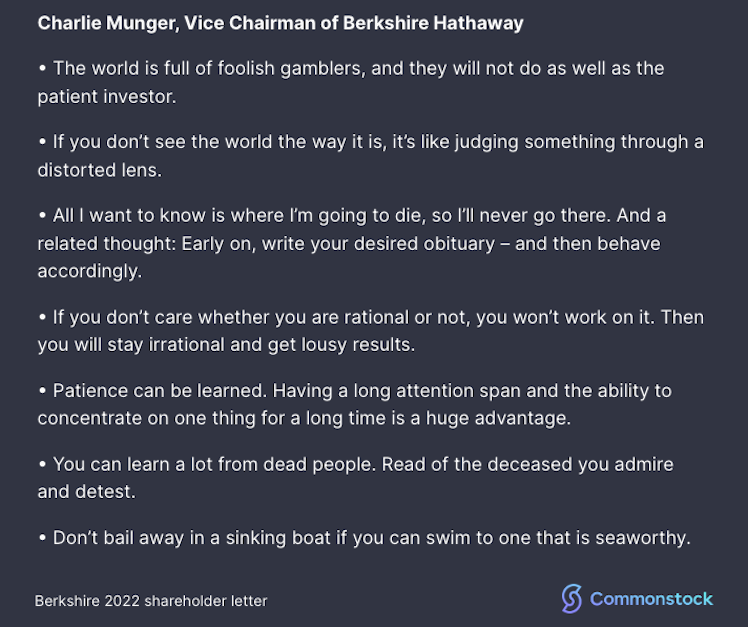

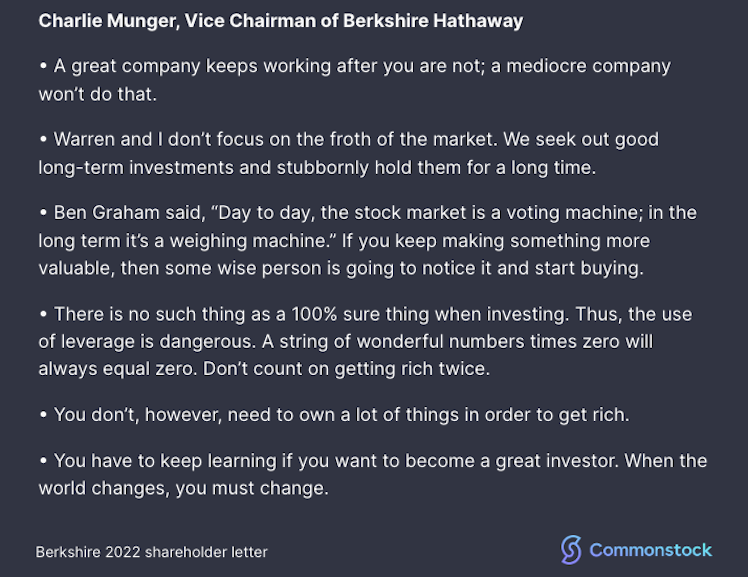

- Lastly, here are some sage pieces of advice from Buffett's right-hand man, Charlie Munger.

Already have an account?