Trending Assets

Top investors this month

Trending Assets

Top investors this month

Eight Takeaways from François Rochon's Annual Letter

François Rochon is the founder and Giverny Capital and is one of the most underrated investors actively managing today.

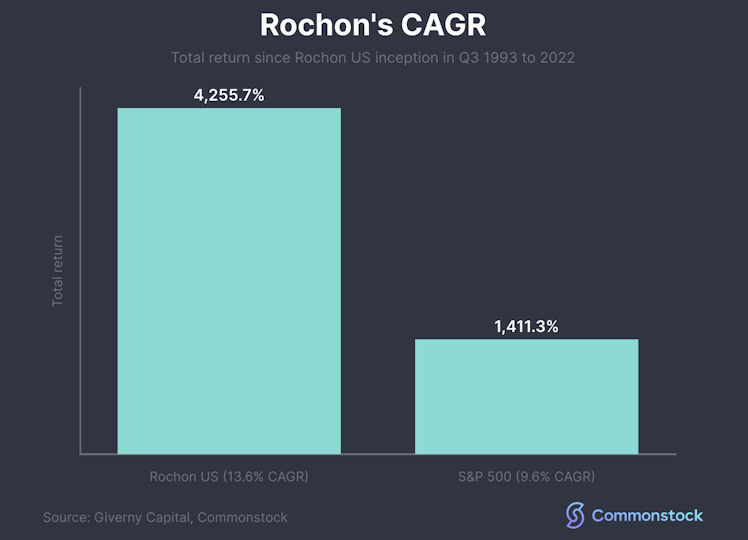

Since launching his fund in 1993, Giverny has beaten their indexes by a wide margin.

Here are eight takeaways from their recent annual letter.

- Rochon's Global & US portfolios underperformed their respective indexes in 2022, but the long-term CAGRs of each are still unquestioned.

Since 1998

- Rochon US 13.6% vs 9.6%

- Rochon Global 14.5% vs 9.0%

Since 2007

- Rochon CA 15.8% vs 5.7%

- "Inflation is an inherent part of our capitalist system - we have always favoured businesses with competitive advantages which enable them to increase the price of their products and services in an inflationary environment".

Acquire businesses that can survive inflation.

- "Speculation creates situations of exaggerated valuations which are inevitably rectified by the invisible hand of capitalism. Governments can temporarily obstruct this invisible hand [but] cannot fundamentally alter its nature".

Durability businesses >

- "If the stock drops 70% to $30 in a bear market, that doesn’t automatically make it a bargain".

Be wary of catching falling knives in bear markets.

"In our view, several popular stocks in 2021 that fell sharply in 2022 could follow a similar course in the years to come".

- "We still believe that owning quality companies, acquired at reasonable prices, and paying little attention to the vicissitudes of the economy, geopolitics and financial markets is a winning long-term strategy".

To get rich in the stock market, you must first be in it.

- The valuations of crypto currencies and the companies associated with them remain "arbitrary" in Rochon's opinion.

- Giverny has a tradition of sharing a podium of errors in each annual letter and this year the gold medal was awarded to $LVMH, the world’s largest luxury conglomerate. The error lies in his decision not to acquire the company when he had the chance to in 2011.

- Why is humility so important in life and even more so in the stock market?

Here's what Rochon has to say:

"Humility is necessary to recognize that the stock market and the economy cannot be predicted in the short term".

Already have an account?