Silver Linings Playbook

This post is to outline why I am investing in Silver for both the short and long term and specifically how I am doing it.

Why Silver:

- It is a traditional store of value that has kept up with inflation for centuries. Not many assets can say the same.

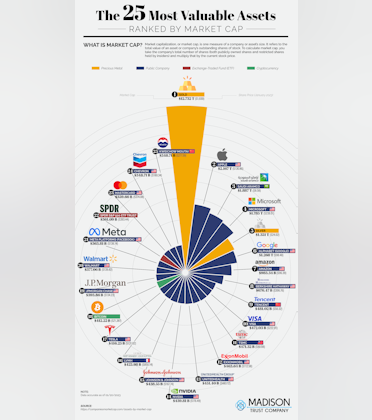

- The Precious Metal's market is far larger than you might expect as illustrated by the 25 largest assets by market cap below:

As you can see Gold is the number one asset in the world at a whopping $12.7T value. Silver is #5 on the list behind Saudi Aramco at $1.35T in value. Prior to my research I had no idea that these assets were as large as they are this market is no joke when it comes to size. Now, I know your next question is going to be, well why not just do this on Gold since it is literally king of the hill when it comes to available assets. Don't worry.. I am going to address that a little later in this post!

- Incredible demand: Silver is in your hand as you read this. Here is a direct quote from a Lehigh University Study :"Silver has the highest electrical conductivity of all metals. In fact, silver defines conductivity - all other metals are compared against it. On a scale of 0 to 100, silver ranks 100, with copper at 97 and gold at 76. Because of this property, and because it doesn't spark easily, silver is commonly used in electrical circuits and contacts. Silver is also utilized in batteries where dependability is mandatory and weight restrictions apply, such as those for portable surgical tools, hearing aids, pacemakers and space travel." So, aside from investors seeking an inflation protected store of value, over 50% of the demand is actually commercial.

- There is a physical shortage: In a prior post about this topic I outlined how the market is at a severe deficit. I will link this post later actually under the risks of my thesis.

Why Not Gold?: The answer to this is simply the "GSR" or Gold to Silver Ratio. This is simply a measure of how many Troy Ounces of silver to equal a Troy Ounce of Gold. (Note metals are measured in Troy ounces not metric ounces)

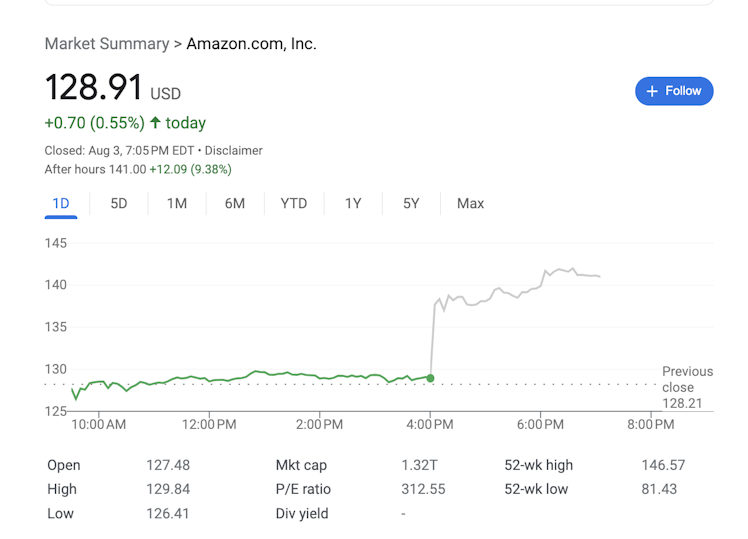

- The current GSR is 81:1 since a picture speaks a thousand words this is what that looks like

This is not normal. Historically, the range has been between 10-15:1 indicating the metal is significantly undervalued. In fact, this lines up almost exactly with the elements ratios in the earths crust of 11:1. Said another way, in normal mining operations, 11 ounces of silver are extracted for every ounce of gold.

How I am Investing: Physically for the long run and via ETF's in the short run.

My Current Trade: I have 2 January 19th 2024 $AGQ calls at a $32 strike. It is currently trading at $29.56

Thesis of this trade:

- The value proposition above for the underlying asset

- Technical patterns (Using the $PSLV for the analysis as it is based on the physical while $AGQ is a 2x leveraged ETF)

A: A series of higher highs

B: Large buys and small sells

C: The MACD has just crossed bullishly

Risks: My Prior Post

- GSR could be held down based on the paper market artificially suppressing the price.

What Changed My Mind?:

- I do not believe that derivatives can hold the price down forever of a physical commodity.

- The buying in large quantities and physical demand, should, outweigh creating more contracts eventually.

- I am taking a smaller position than before.

I hope you enjoyed this post and find the information useful! Please let me know what you think in the comments!