Trending Assets

Top investors this month

Trending Assets

Top investors this month

DELL - Parts > Whole?

$DELL is the eponymous brain child of Michael Dell, one of America's most prolific entrepreneurs and one of the leading manufacturers of personal computers across the world. However, since their spin-off of VMWare ($VMW) in '21, Dell has spiraled down to a $50B enterprise value & a $25B market cap - only a tad higher than its take-private valuation in 2013. While there are plenty of headwinds to Dell's business (which I will detail below), I have reason to believe that the Dell story is misunderstood, and could potentially provide ample upside for patient investors.

- What's Wrong with DELL today?

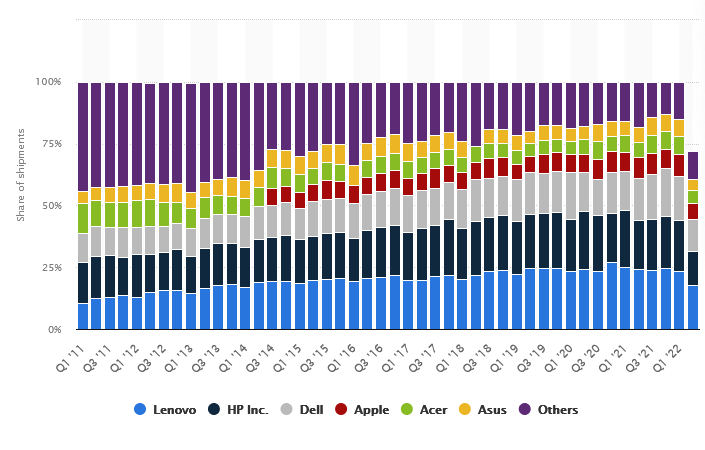

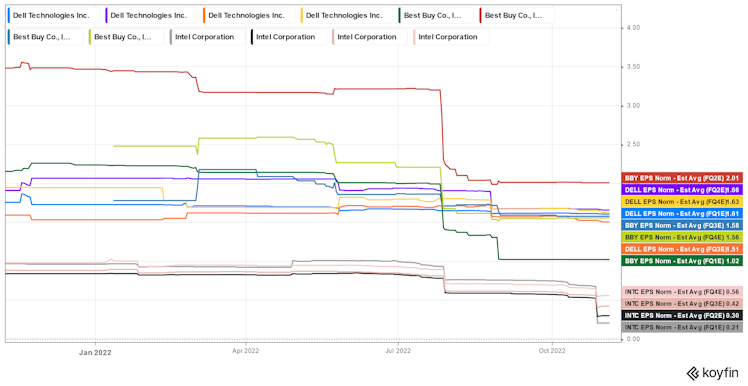

At just about 6x NTM earnings, Dell appears to be priced like a mining company, much less a leader in infrastructure solutions and personal computing. Then again, is this multiple justified? There sufficient evidence that points to a massive "pull-forward" in demand for PCs between '20-'21, thanks to the trends in remote work and to a lesser extent, a booming job market. The weakness in PC demand has been corroborated by tangential businesses such as semiconductor manufacturing (See $INTC) and technology distribution (See $BBY) who have been vocal about their forward expectations in this market. For Dell specifically, consensus estimates appear to be pricing in softer demand - with fiscal Q3 '23 sales and EPS expected to fall by -6.5% and -4.2%, respectively. Looking forward, analysts estimate DELL's FY24 sales & EBIT to come in -2% lower on the year, with EPS gaining about 2.4% over the same period.

Forward EPS Estimates - DELL, INTC, BBY

In addition to slowing PC demand, DELL can be scrutinized for their enormous debt load - roughly $27B as of the latest quarterly release. This debt load accounts for over 100% of the total capitalization and about 50% of the enterprise value. Of course, while this debt isn't a fatal risk to DELL's viability (EBITDA covers interest expense 7x over), this burden will prevent the business from being aggressive in M&A and returning cash to shareholders. As we'll get to in a second, Dell's M&A activity has helped the company identify avenues to unlock shareholder value, including the spin-off of VMWare.

Koyfin Markets - Performance since earliest tradable date (Summer '19)

- Where is the opportunity in Dell?

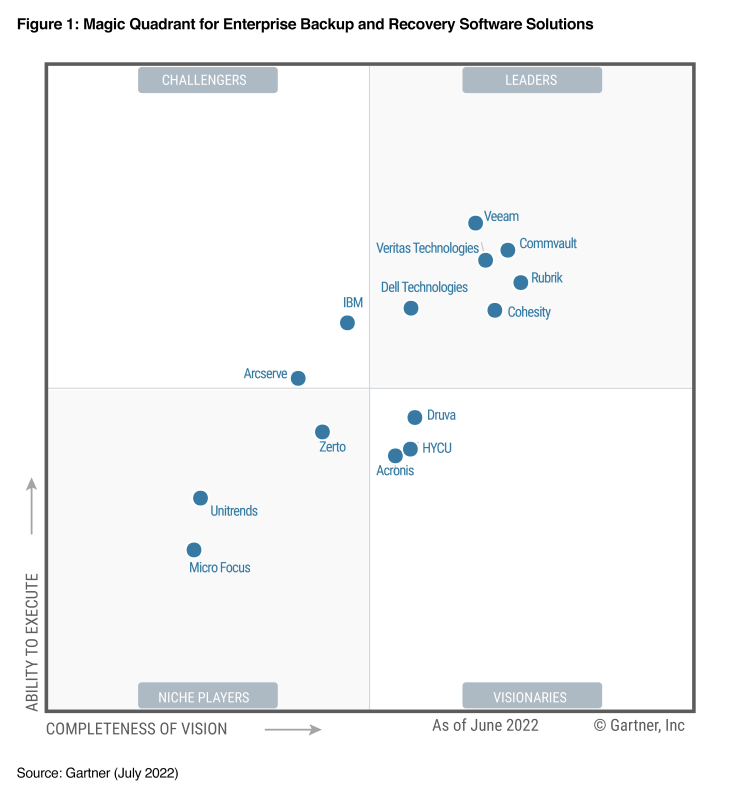

Dell breaks their operations into two segments - the Client Solutions Group (CSG), which includes hardware offerings like PCs, monitors, printers, desktop PCs, and similarly related products, and the Infrastructure Solutions Group (ISG), which encapsulates the "EMC" franchise and provides digital services like networking, data backup & storage, analytics, and cloud services. CSG accounts for 55-65% of quarterly sales, with the difference attributed to the ISG segment. While the CSG story appears to be dragging on the company's performance, I don't believe the market is fully pricing-in the strength of the ISG segment. Gartner's Magic Quadrant named Dell a leader in enterprise recovery and backup solutions, alongside exciting startups like Rubrik (~$5B valuation), Cohesity (~$4B valuation), and legacy players like Commvault ($CVLT), Veeam, & Veritas. Given rising prevalence and severity of ransomware attacks, services like Dell's Data Protection should see significant demand over the coming years.

Gartner Magic Quadrant - 2022

In FY22, Dell's ISG segment yielded an operating profit of $3.7B (11% margin) on $34B in sales. Assuming 8-10% growth in this segment running into the back end of the year, the ISG business can surpass $4.4B in EBIT on $38B in sales. If we look at comparable infrastructure solutions businesses (Legacy players like $IBM, $CSCO, $HPE - in addition to niche/newcomers like $PSTG, $NTAP), the average business trades between 10-12x NTM EBIT. Assigning a similar multiple to DELL's ISG segment produces a "breakaway" valuation greater than $45B, or nearly 2x the current market capitalization.

It's important to emphasize here that this is merely one segment of DELL's business! If we run a similar function on the CSG segment, we get breakaway valuations ranging between $15-$25B, contingent on a 4-6x forward EBIT multiple, or greater than $30B using EV/S comparisons. These two segments collectively could support a sum-of-the-parts valuation for DELL that is at minimum, $65B, or over $85/share.

There is a lot more to unpack in this name, but I would be curious to hear from anyone who has a directional stance on $DELL in this market!

Already have an account?