This is excellent work Luis !

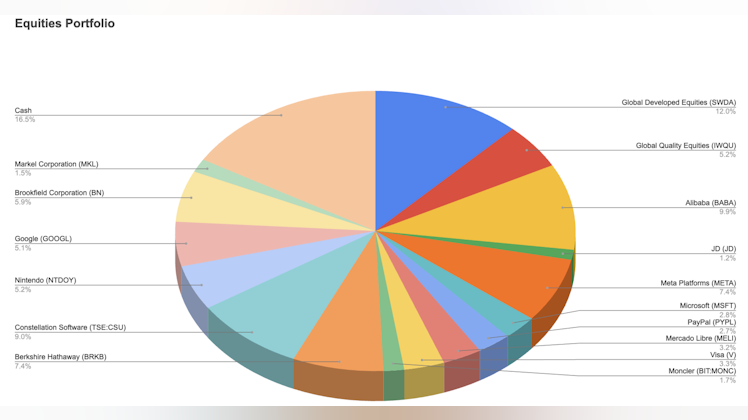

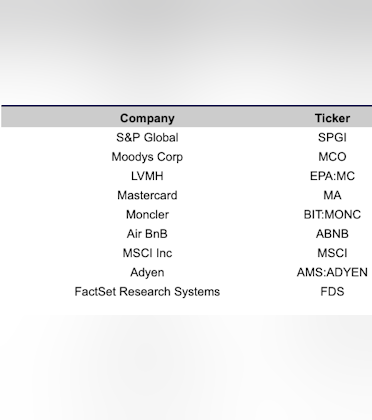

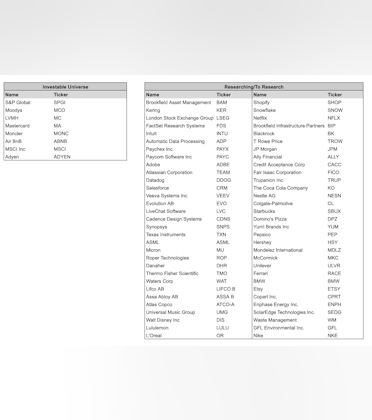

You have excellent global spread with index funds SWDA and IWQU and you have your active manager bet with PSH.

I love how you don't have a direct holding in Apple given it's a 41% position in Berkshire Hathaway and the largest positions in both SWDA and IWQU.

I've seen plenty of portfolios where there's what I consider to be a bit of a double up in Apple.

When we look at the composition of other people's portfolios, there are definite telltale signs which era the investor started building out their portfolios.

Most portfolios of the last 10 years have a bias weighting towards tech. If you look at ours and exclude our massive allocation to index fund VTI, we're still heavily weighted towards staples like KO, JNJ, MCD. DIS, MKC and WM.

It will be interesting to see if you add any of these types of staple businesses to your portfolio given that you've listed plenty of them in your "to research" list. Without looking at current valuations (and not a current recommendation), I'm always partial to MKC. I just can't imagine a world without spices and condiments, and MKC is the dominant global player. This is one stock I've always been comfortable holding through any challenging times to the point where I don't actually monitor it much anymore. It's one of my very few set and forget stocks.

Keep up the great work !