Trending Assets

Top investors this month

Trending Assets

Top investors this month

@jays

Jay Schlesinger

$19.6M follower assets

80 following116 followers

Great memo and reminds me to always be observant of little details in the advertising world that can clue me into trends

Thanks! The shift to electric vehicle advertising really woke me up to the larger concept.

I certainly overlooked a lot, like how the United States and New Zealand are the only 2 countries to allow direct to consumer pharmaceutical advertising. I'm sure years of watching these ads has some effect on us.

Curious if drrachelstocks has any input on this topic?

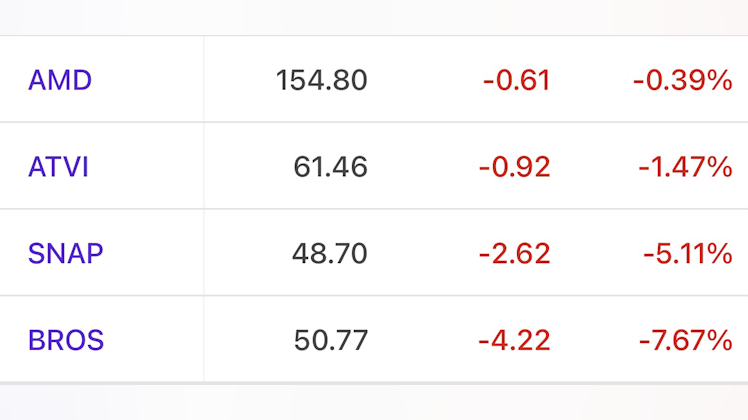

Watchlist 👀

What do you like about $BROS?

I've seen their coffee stands in the Northwest. What stands out to you about them?

Potential Fallout of Bitcoin & El Salvador

Over the weekend at the Bitcoin Conference the president of El Salvador, Nayib Bukele, announced he will propose legislation to make bitcoin legal tender throughout the country. Despite the praise from many in the crypto community, the move has not been without criticism; many quickly pointed out the authoritarian and corrupt nature of his presidency citing negotiated deals with the country's largest criminal gangs as well as a call to remove several judges from the Supreme Court of El Salvador with history of opposing him.

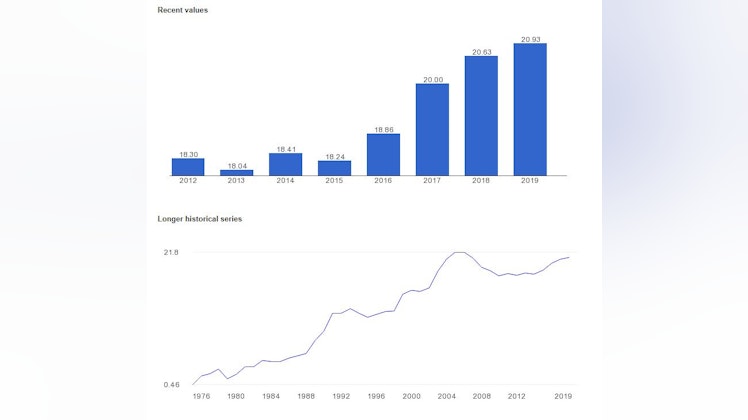

Right off the bat some of the potential positive outcomes could be a big increase in GDP for El Salvador coming from a sizeable reduction in remittance fees, a reduction of transaction times, and an increase in the 'banked' population (currently 70% of the country is unbanked). Currently remittances (generally money sent from abroad from a family member/other connection) account for a little over 20% of El Salvador's GDP. On top of this, the inflow of crypto entrepreneurs and and crypto capital could significantly boost the economy of a country with a GDP of ~27 Billion USD. Finally, given the nature of bitcoin's supply and the cult like following of bitcoin owners, this could highly incentivize leaders in the bitcoin community to make sure this works to prove the value of the network and drive the price per coin up.

On a global level, the designation of bitcoin as legal tender in a foreign nation could also alter the way bitcoin is accounted for in other nations. Under US GAAP, bitcoin has generally been labeled as an "indefinite-lived intangible asset" which implies that it cannot be treated like cash (or a foreign currency). Moreover this makes it so that current US companies holding bitcoin on their balance sheet must record an impairment if the price goes down, but cannot record any gains until they sell the coins if the price goes up.

If El Salvador and other nations begin to classify bitcoin as legal tender, this could make it so that companies across the globe can hold bitcoin on their balance sheet and account for it in the exact way they would account for any other currency. As innovation speeds forward, the taxing and accounting standards around cryptocurrencies will keep iterating and it will be interesting to see how it plays out.

Some negative outcomes could be that crypto entrepreneurs and businesses have trouble dealing with the distrust in the political system and are not able to effectively operate. Volatility in the price of bitcoin could be a massive deterrent for El Salvadorian citizens to utilize it for transactions or paying taxes and there is potential for a massive crash in the price of bitcoin if this legislation does not proceed. Moreover, I am not fully convinced that this is not simply a PR stunt for the president and other El Salvadorian parliamentary members. For Bitcoin to become a dominant currency in El Salvador, a country that adopted solely using USD in 2001, there will need to be many years of gradual changes in the legal code and adjustment - a process that I believe will have to endure many massive price swings and I am not confident it can. Currently I am very skeptical of this news but -

Does the CS community think this will go well? Seems to me that positive sentiment is quickly shifting over to Ethereum

this shows remittances as a percent of GDP in El Salvador

Couple things you pointed out (corruption and sanctions, PR) were things I also heard from a few El Salvadorans. The volatility is also a huge concern, especially now.

From a more global view, it’s a step forward but there’s still many steps to go. To me it currently seems more of a PR thing both for El Salvador and others using it to boost Bitcoin morale.

The Fragility of our Monetary System

*The Commonstock community is very well informed and many of you may hear/read a lot about inflation, the fed printing money, etc. Regardless this is a brief essay I thought I would post. I do not talk about any individual equities

The goal of this piece is to uncover how we arrived in our current monetary system and how it could fail much easier than most people realize. With extremely low trust in our institutions and growing class divides, it is imperative to understand how our fiscal and monetary policy exacerbates these issues. If we as a society want to solve these problems it is also crucial to be radically transparent around the intricacies of our financial system and to make financial education widely understood in an attempt to minimize information asymmetry that leads to wealth creation for some, but not all. Moreover, wealth creation is not a zero sum game and so this objective is something I believe is achievable. This piece is also relevant given the massive returns in the equity and real estate markets over the last year and the meteoric rise of digital assets. I begin with a simple explanation of the Gold Standard, move to the Bretton Woods system and then our fiat currency system of today, and highlight a few other things I believe indicate why we need fiscal and monetary policy changes soon to avoid the US losing its grip on the number one global superpower status. I do not propose my own policy solutions even if I should, however I believe the problems and indicators I point out are relevant and important. I intend to shed light on the idea that our entire global monetary system is still an experiment that is rife with problems and should be discussed much more so that we can minimize the wealth gap, understand how the government and Fed can wield policy to change course, and come up with outside of the box solutions. It seems to me that governments across the globe are stuck repeating lessons learned from the 1900s; however, I am optimistic that the US will adapt and lead the world through a paradigm shift driven by innovation that democratizes almost everything, primarily information. Radical transparency can start the process of rebuilding trust in our institutions and active widespread discussion of personal finance and financial management can begin to help close the gap between, for example, the 45% of Americans who own no public equities as of April 2020 and the rest that do.1

**The Gold Standard**

To frame this essay with the most context possible, I will begin by shedding light on the use of gold in trade and its role in the development of our current global currency standard. For thousands of years resource allocation has been governed by supply and demand and thus our economies have been spurred by trade. Gold and other precious metals enter the picture simply for ease of use. Due to the fact that gold is a tangible and desired asset that can be physically manipulated relatively easily, it functions well as a proxy for commodities being traded. In other words, gold can act as an intermediary means of exchange for goods and services that represents a certain (albeit relative) purchasing power in any given nation.

Paper currency arises because dense metals like gold cannot be transferred between owners constantly as it is expensive, inefficient, not to mention, has to be mined from the earth to increase supply. So, paper is then issued by a sovereign government representing some portion of gold that can be exchanged as if it is gold itself, all relying on the assumption that the sovereign backing the paper currency has the gold safely stored somewhere to back it. One should note that what seems like a simple solution in paper money still has issues being backed; the global supply of gold is inherently scarce, not perfectly estimated, and mining comes with alternative consequences, therefore it is useless to finance a growing industrialized world economy after it reaches a certain size. The use of paper currency has roots in middle ages Asia, but truly gained acceptance from the 17th to 19th centuries as European nations began the transition to solely exchanging paper currency. While this explanation is an over simplification that leaves out many facets of this discussion including supplementary metals like silver, the relevant macroeconomic point is that countries exported and imported goods in exchange for gold and paper currency backed by gold, which consequently placed power in the hands of nations with the largest supplies of it. Those countries also often had the most advanced technology and military authority. People of any country were confident enough that the international hegemonic powers of the time had the gold to back their currency and therefore trade and debt issuance most often occurred in their currencies. This would go on for some time with gold stores and trade balances recalibrating periodically until a major historic event shifted power to another part of the world; “The Dutch guilder was the dominant currency during the 17th and 18th centuries,” before being replaced by the British Pound and then the US Dollar.2 Regardless, being the dominant currency in the world has its problems as well. As the primary holder of gold, countries tend to also be the biggest spenders until they are no longer the primary holder. If a country imports more goods in relative dollar terms than it exports, the country will have a steadily decreasing supply of gold, also known as a trade deficit. If a country exports more than it imports, then it has a trade surplus and will accumulate gold as long as this positive ratio of exports to imports holds. In theory, market functions prevent this from going on forever as a country that has consistently run a trade deficit and is approaching a devastatingly small gold supply becomes desperate enough that they are forced to export more than they import to be competitive on the international stage. Regardless, this model does not precisely reflect reality and trade is impacted by countless other variables including wars. This dominant currency and trading position under a gold standard evolved over the centuries into what is known today as the reserve currency system.

**Rise of the Reserve Currency**

Prior to 1944, the gold standard and bi-metallic standard (gold & silver) struggled as power shifted between countries relatively often and currency devaluations were common. In the hectic decades of the 19th century, many economies also shuttered from various shocks, mostly banking system panics. Fast forward to the end of the Great Depression and Theodore Roosevelt signed executive order 6102 which permitted citizens to have their gold be purchased by the government for the pegged rate of $20.67 per ounce. Immediately following, the Gold Reserve Act of 1934 was passed which changed the exchange rate to $35.00 per ounce. The culmination of the Gold Reserve Act and dovish monetary policy (low interest rates & intended growth of the money supply) was meant to alleviate debts but only further delayed a harsh correction in the value of the USD. Our economy oscillated through small bull and bear markets until joining World War 2 which drastically increased our industrial economic productivity after the war. We still suffered a colossal net loss from the war, but were able to repurpose our wartime infrastructure to boost economic productivity afterwards.3 Moreover, for geographic reasons the land mass of the United States was kept incredibly safe from physical attacks, and therefore other countries stored their gold on our soil to protect it, coincidentally placing the US in the position to reorganize the global monetary system. The losing nations of the war were hit hardest economically but nearly all countries involved were in some form of debt from funding the war effort, including the US. Regardless, as every global economic power has in the past, we looked out for our best interests in the organization of the next global monetary system – the Bretton Woods system.

**Bretton Woods - A True Reserve Currency**

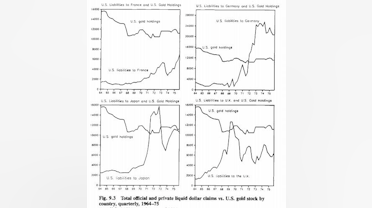

Coined after Bretton Woods, New Hampshire, the Bretton Woods agreement was a global monetary system agreed upon by 44 countries in an attempt to foster stable exchange rates to promote international trade in a rapidly growing, globalized society. The Bretton Woods system is not a complete abandonment of the Gold Standard, but a quasi-gold standard that gave the United States a few decades to run a new experiment. From 1944 – 1971 the US Dollar was pegged to gold and every other nation’s currency was pegged to the USD making virtually all goods and services denominated in US Dollars. While having considerable quantities of gold was a privilege prior to the 40s, the Bretton Woods system gave the United States the status of being the first true nation to maintain the position of global reserve currency. As put by Ray Dalio, “US dollar-denominated debt is the most fundamental building block for the world’s capital markets and the worlds’ economies”. When our currency is in demand, US citizens can travel internationally with comfort that their currency holds purchasing power, and our government can simply print money while other countries have to actually exchange goods in exchange for our money. When functioning this is a privilege for American citizens, but it can only go on for so long. There was simply not enough gold to grow our economy and other nation’s economies using debt because the amount of gold in the US became far less than the amount of gold-denominated dollars owed to foreign investors.4 Quite soon after its inception, this new global monetary system began falling apart, and not without warning. Famous economists throughout the 50s and 60s warned US policymakers of the obvious downward trajectory of our gold stockpiles. Nevertheless, the United States consistently issued dollar-denominated debt to fund all of its endeavors; while academics debate the causal factors, as the end of the Vietnam War loomed, countries across the globe began seriously questioning the United States’ ability to repay gold for paper dollars that the world had been demanding for so long. In the charts below it is apparent that we did not even have enough gold to repay Germany once we reached the early 1970s. Fast forward to 1971, and Richard Nixon temporarily suspended the ability for foreign nations to exchange US Dollars for gold which was never reversed and eventually became a permanent change. Two tumultuous years later with currency devaluations going on in every major country, the Bretton Woods system collapsed creating an opportunity for the next global monetary system to be structured and enacted. Contradicting historical precedent, the US was able to retain its position as global reserve currency, except backed by something distinct from a precious metal like gold.

**The Military Industrial Complex and our Fiat Currency Economy**

In 1971, in the wake of the breakdown the Bretton Woods system and a gold standard itself, the world’s once “fixed exchange rates failed, and by March 1973 the major currencies began to float against each other”.5 In simpler terms, this means that currencies that were once backed by gold were now backed by nothing other than the word of the sovereign that can print said currency. “As a result of going off the gold-linked monetary system that constrained money and credit growth, there was a massive acceleration of money and credit, inflation, oil and commodity prices, and a panic out of bonds and other debt assets that drove interest rates up and caused a run into hard assets like real estate, gold, and collectibles for most of the next 10 years, from 1971 to 1981”.6 Given that the United States had defaulted on their debt so recently, it makes sense that people would not want to store their wealth in a ‘fiat-currency’ backed solely by faith in the US government even if that debt centered system is the exact mechanism that allows for economic growth. Despite a crippled reputation, the United States was able to utilize our unmatched military strength and the reliance of global industry on oil to center the world economy around ourselves once again and remain the reserve currency. The way the United States was able to do this is because of our close relationship with oil producing nations that are endowed with immense quantities of oil within their borders. For example, if Saudi Arabia prices the oil they plan to export only in US Dollars, then a country like Spain must possess US Dollars to purchase the oil. In this fashion the US Dollar still behaves like a reserve currency because countries that cannot produce oil demand USD as long as they demand oil, just as they would demand USD before in exchange for gold that the US had so much of. In our example, Saudi Arabia receives our military protection, consideration in global affairs, and guaranteed imports from the US. This example is not far off at all from the truth of the situation; after we buy copious amounts of oil, the producing countries often just recycle the money back into US treasury bonds which props the system up. Just like during the Bretton Woods system, the US is constantly operating under trade deficits so that increasing amounts of debt are issued to be used mostly for purchasing oil and other energy sources, and for dollar-denominated debt to be repaid.7 Despite the exchange rates between currencies varying throughout the years, the persistent necessity for more and more USD to fund international economic growth that often gets invested back into US treasuries will ultimately repeat the same outcome as previous times in history if nothing changes; for decades the US will feel steady but decreasingly powerful and will seem to be stagnating until a paradigm shift occurs where US military power and technological innovation is rivaled and the leverage over global oil production and consumption ceases to exist. Then we would most likely lose our position as reserve currency. This does not have to be a negative outcome for our country or our currency, but our proportion of global GDP is shrinking and does not seem to be reversing course any time soon, so it is something to look out for. The time horizon for this downfall is incredibly ambiguous; I expect it to be further in the future than dollar bears predict because I believe a major global catastrophe or other event would be a necessary catalyst to truly shake up the system.

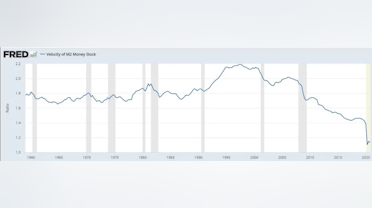

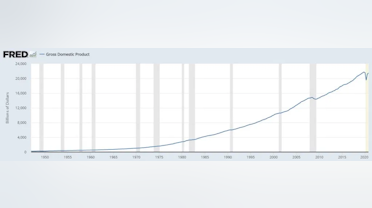

**Our Declining Velocity of M2 Money Supply - A Slow Killer**

The velocity of money is calculated by dividing GDP by M2 Money Supply. M2 money supply put simply is the total amount of money available in the economy at a given time and the GDP is the value of the aggregate goods and services produced in a country in a given period of time. If the ratio increases because GDP increases, then more economic activity is occurring in the economy relative to the money in the economy which would be inflationary in nature. If the ratio decreases because M2 money supply is increasing faster than GDP, then this most likely means the fed is injecting more money into the economy that must not be escaping into the broader economy (meaning we do not see improved infrastructure, social programs, etc.).

As shown below, the US velocity of M2 money supply has been declining for the decade leading up to the sharp dip due to Covid-19. The US GDP has steadily increased for the most part during this same period which points to the fact that “the unprecedented monetary base increase driven by the Fed’s large money injections through its large-scale asset purchase programs has failed to cause at least a one-for-one proportional increase in nominal GDP”.8 According to Lyn Alden, the money used to bail out banks through quantitative easing after the 2008 financial crisis was “anti-deflationary” rather than inflationary, and “remained mostly internal to the banking system, at higher reserve levels”.9 Increases in the M2 money supply that do make it into the broader economy quickly are things like the stimulus bills passed during 2020 which sent checks directly to people (though inefficiently).

M2 money supply also increased as our government sells bonds to foreign and domestic investors. If M2 is increasing, and velocity is decreasing, than GDP must not be rising at a proportional rate to M2 money supply. Thus, with more USD in circulation but not a proportional increase in GDP, each individual dollar is worth less and there is no visible or usable public good from issuing debt (i.e. a public transportation system). This is why for decades citizens across the United States have complained that our infrastructure is dated and collapsing. This does not take away from the fact that the money we raise from our current taxes and debt could be utilized for true economic growth (infrastructure, research innovation grants) versus “paper” economic growth (on the Fed balance sheet), but the fact is that the United States is rapidly increasing debt and money supply, without spending to reflect this increase in the manufacturing/productivity growth of the country. On top of that, our number one geopolitical rival has had higher GDP growth than us on average for decades and is gunning for our position as the most powerful economy and military.

At this rate given the policies in place, our political divide and wealth gap will continue to widen. Some argue that income gaps are actually decreasing, but that sentiment of wealth inequality is increasing as shown below. “The Gini coefficient encapsulates the share of aggregate income held by each person or household. If everyone has the same income, or the same share of aggregate income, the Gini coefficient equals zero. If the income distribution is perfectly unequal, a single person or household holds all aggregate income, the Gini coefficient is equal to one”.10 The yellow line represents the responses from people about perceived income inequality versus the true numbers shown on the black line, after subtracting income tax. This means people are actually earning more income relative to their richer counterparts than in previous decades; however, as mentioned before, approximately half the country does not have their USD stored in some appreciating asset whether equities, bonds, real estate or anything else. This is what brings about the wealth gap and exacerbates it greatly during years like 2020 where money is injected into the economy by the Fed and then asset prices increase, only benefiting the half of the nation exposed to financial assets. If you put $1,000 dollars into even an S&P index at the beginning of 2020 you would have made about a 16% return by the end of the year.

**Takeaway**

For all of my life I lived under a system where you can reliably use US dollars anywhere in the country and can take physical cash out of an ATM without ever fearing it will not be accepted. It is difficult for us to fathom a massive currency devaluation or other economic shock that rattles the actual currency we use. In poorer and developing countries this is much more common, which is why we see the rise of Bitcoin adoption by citizens in countries like Nigeria. Regardless, even my parents have only ever lived in our current fiat currency system that is still a global monetary experiment that we as a civilization are running for the very first time. Most people in the country are not well educated on personal finance and how wealth is created which is why we are incredibly susceptible to drawbacks of our current fiscal and monetary policy. In my opinion, most people feel more comfortable keeping their money in a savings account earning next to zero interest out of some sort of fear that other stores of value are a trick or far too risky. With higher interest rates this would not be as important because people would have a risk free alternative investment, but with interest rates being near zero for almost ten years and the government having printed almost a fourth of all of the dollars in circulation just in 2020, every single day millions of Americans are waking up to weaker purchasing power per dollar they possess. At the same time the wealthier portion of the population has their money allocated to myriad assets; in the last year real estate and equity valuations have risen to record highs, but this is only beneficial for people with exposure to said assets. Combined with the larger issue that we as a country are not productive enough to remain a high enough percentage of the entire world’s share of GDP, which threatens our position as reserve currency, millions of Americans could be in for a sudden rude awakening even if it is not for decades. If we lose control of our fiscal and monetary policy, it will be worst for people who have only lived under a system where the government can control the supply of the currency at any time and are not educated on personal finance and basic economics. It is a simple starting solution to a massive problem that will need to be addressed on every level from primary education to government.

So what does this all mean for us as normal people just trying to plan for the future. While I have stuck to talking about the economics, these events and decisions by our government are closely tied to the rise of populism in our country and directly has to do with the wealth gap. Social unrest can point to the end of these debt cycles that often outlive most people and are thus difficult to spot. Despite the fact that there are policy changes that need to be implemented at the top level to make sure our financial system does not go off of the rails in the coming decades, a simpler place to start is by normalizing the conversation around our monetary system, how wealth is created, how it has been wiped out in the past, and how it could be wiped out in the future. It is also important to make finance more transparent because it is not a zero sum game; more collaboration around wealth creation will only beget more wealth creation and does not need to be a taboo and competitive subject. Our monetary system is still an experiment and it is too fragile for us as a society to avoid asking questions about how to minimize the wealth gap without dampening the entrepreneurial spirit and restricting markets. Decentralized finance applications as well as social media-like fintech apps are popping up all over the place and it is obvious that the trend towards complete financial transparency with simultaneous collaboration at scale is impending. I believe the way out of this is to debate and iterate with radical transparency around our financial system so we can at least attempt to head in the right direction. Currently it seems things are stable, but Covid-19 exposed our government’s lack of control and ability to react quickly to situations, and I believe we must keep an eye out for anything thing that could break down our fragile monetary system. Maybe something new is necessary, but the volatility of living through that time is something I would like to minimize.

Disclaimer: This is not a recommendation to purchase any securities or making any claims. This is strictly for entertainment purposes. *

www.linkedin.com

Populism: The Phenomenon

Ray Dalio Steven Kryger Jason Rogers Gardner Davis Populism is not well understood because, over the past several decades, it has been infrequent in emerging countries (e.g.

Terrific memo @jays! It's easy to forget that global fiat currencies are really only a 50-year experiment. This essay frames that really well. I know you don't talk about any individual equities in this, but are you a $BTC.X fan?

Also I feel like you'd really love this essay by Lyn Alden https://www.lynalden.com/fraying-petrodollar-system/

Activision-Blizzard Earnings

Activision Blizzard Notable 2020 Achievements - $ATVI

- ~400 million Monthly Active Users in 2020

- Call of Duty In-Game Net Bookings for 2020 = $4,854,000,00

- Revenues grew 25%, operating income increased 70%, and earnings per share increased 45% Y/Y

PayPal Earnings $PYPL

$PYPL "Making sure everyone can thrive in the new digital paradigm"

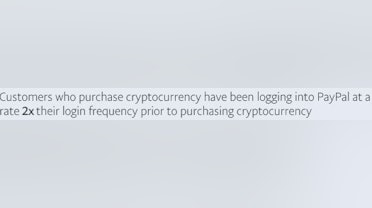

PayPal had a fantastic year in 2020 despite massive alterations to consumer behavior and purchasing behavior. They added 5.3 million new merchants, and 73 million net new active accounts. They now have over 29 million merchants interacting with ~360 million consumers.

Note**

Earnings

Revenue grew 22% to 21.45 billion on FX neutral basis

Non-GAAP EPS grew 31% year over year to $3.88

2020 Free Cash Flow hit $5 Billion, a 48% year over year increase

Strategic Initiatives for the Future:

More Crypto -

expanding crypto to Venmo, allowing crypto purchases at their merchants later this year, working with regulators to facilitate this

Buy Now, Pay Later -

Rounding Out Their Payments Ecosystem -

Venmo

Venmo TPV was 47B in Q4'20 up 60%yoy

70 million active accounts on Venmo

Added Venmo Credit Card despite PayPal credit services

eBay

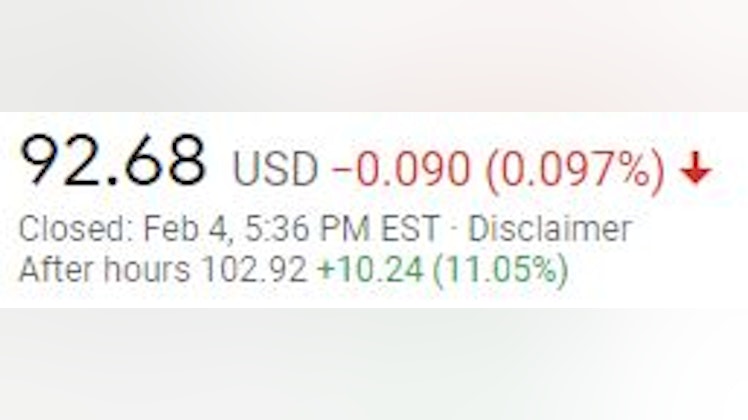

eBay is the one platform under the PayPal umbrella doing horribly against competitors; the discrepancy between eBay and its competitors is growing - eBay TPV grew 1% in Q4'20 compared to 76% avg. amongst the top 15 marketplaces -- however, eBay did beat earnings itself and the stock price is currently up ~10% after hours because they brought in

$2.9B in revenue vs. analyst expectations of $2.7B and bought back shares throughout 2020.

Discussion

Based on google search trends for CashApp and Venmo in the US, CashApp's networks seem to dominate the blue portions of the map and Venmo the red - moreover, if you look at search volume, CashApp outpaces Venmo in the United States during 2018 which sheds some light on Square's position here. However, with 45% of PayPal's accounts being foreign, does this matter? Is PayPal competing internationally at bigger scale more of a threat to the company given the amount of fintech competitors in China, Korea, India, Nigeria, etc? Are there other companies that will dominate this space in a few years that are not nearly talked about enough? Would love to hear thoughts on the broader outlook of the industry from more experienced investors

PayPal Earnings Tomorrow 2/3 $PYPL

In light of tomorrow's earnings and the events of last week I thought I would shed some light on their current position and then expand on it tomorrow. It seems to me that fintech and the adoption of digital wallets has been one of the most talked about subjects across the broader investing community over the last year. Cathie Wood has been vocal about her bullishness on mobile payments, Chamath Palihapitiya has been an incredible salesman for his $IPOE SPACquisition :) of SoFi, and increasing relevance of cryptocurrencies naturally boosts conversation/adoption of digital wallets. On top of that, countries like China are practically cashless with "over 90% of people in China’s largest cities [using] WeChat Pay and Alipay as their primary payment method, with cash second, and card-based debit/credit a distant third" (Brookings Institute). This type of tech adoption in a country with ~4x the US population will most definitely spread to the entire globe even if it takes multiple decades. I think this makes intuitive sense to most of us but I also believe we still have an incredible amount of digital wallet adoption and consolidation of financial services companies in the next 4-7 years as so many different brokerages and services are coming out it is hard to keep track of.

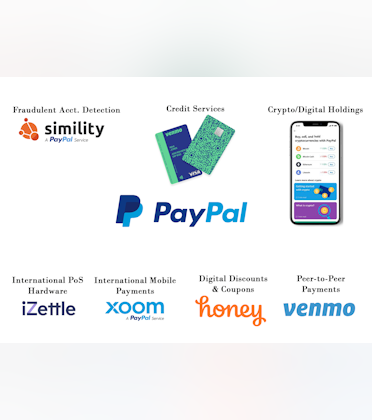

Services

This image shows the primary subsidiaries of PayPal that are essential for the ecosystem they are trying to foster of a global mobile-payments service

Performance

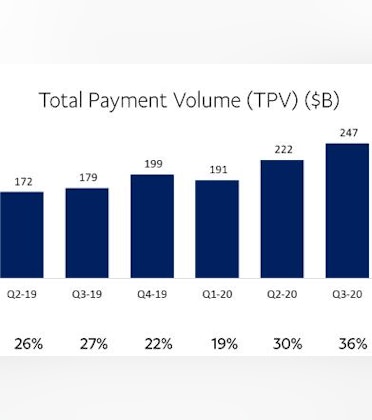

**The latest Investor Update was for Q3 '20 on November 2nd

Despite the drastic shifts in consumer behavior due to Covid precautions, PayPal achieved the highest TPV [Total Payment Volume] in its history across all platforms in Q3 of 2020.

Source: Q3'20 Investor Update

**Note that 41B of this 247B is Venmo related volume

*eBay's TPV grew; however, this is misleading relative to competition -

While eBay is not doing well compared to its competitors, all other services under the PayPal umbrella are flourishing in the pandemic bringing in Billions of free cash flow to the firm [YTD free cash flow was 3.97 Billion [Q1'20 - Q3'20].

Discussion

With all of the media attention on brokerages like Robinhood and other fintech products, it seems as if they are more widely used than what is actually the case. There is Chime, SoFi, CashApp, PayPal, Venmo, and a million other services; however, I still believe Square and PayPal can utilize their low customer acquisition cost and network effects/seamless app experience to beat all of the competitors in offering lending services and other financial products. Because the financial system is so complicated and there are a lot of moving parts I would love to hear from you all what services you use/like/dislike and what you think will happen to these fintech companies in the next few years?? hopefully can expand some more tomorrow

Great memo @jays - To me the future mobile wallet and P2P market in the US will be a two person race between PayPal's Venmo and Square's Cash App.

I also found it interesting that Venmo recently rolled out Business Profiles for businesses to accept payments. Business Profiles creates a separate profile from Venmo user's personal profile to easily track business transactions. It allows customer to pay with Venmo App, or in-person via QR Code. Venmo currently isn't charging any transaction fees until April 2021, but will then charge 1.9% and $0.10 per transaction.

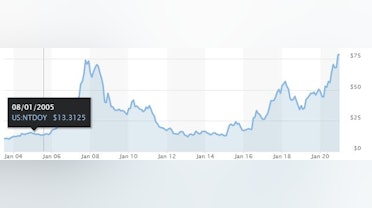

Nintendo Business Breakdown $NTDOY ADR

A brand known to provoke nostalgia in many, Nintendo is a Japanese legacy corporation that produces video game consoles, mobile games, and owns the intellectual property rights to franchises including Mario, Donkey Kong, The Legend of Zelda, Animal Crossing, and many more. Their most recent console release of the Nintendo Switch in 2017 has achieved record sales numbers and has continued to increase its sales through 2020's holiday season [Switch Lite released in 2019]. Consequently, their stock is trading higher than it ever has, comparing primarily to a huge valuation increase from 2006-2008 that eventually fell to original levels. This time however, I have a feeling Nintendo will be successful through 2021 and keep extending the rally it has had.

Revenue Streams

Hardware:

Consoles and accessory hardware make up 96% of Nintendo's revenue which might be worrying for some. Regardless, hardware sales for the fiscal year [ended March 2020] totaled 21.03 million units (24.0% increase on a year-on-year basis). Additionally, during the Fiscal Year Ending Mar. 2021 (Conference Call), President Shuntaro Furukawa stated, "Nintendo Switch is maintaining sales momentum as it enters into the holiday season of its fourth year since launch, and we are striving to extend that momentum as long as possible." Extrapolating from this I assume the 2020 holiday season was a success in terms of Switch and Switch Lite sales and I think this bodes well for the stock in the short term when the numbers get released. Hopefully throughout the Covid lockdowns they sold millions more units.

Software & IP:

all currently ~$60 games to download

Nintendo Online -

Aside from downloading a game directly to your console, Nintendo has followed the trend of companies offering a subscription service to access online play in multiplayer titles as well as extra games and features. With $3.99 a month, $7.99 for 3 months, or $19.99 for a year subscription offerings, Nintendo Online has amassed over 26 million members as of September 2020. Moreover, Nintendo understands that the video game market is rapidly shifting to a state where digital points of contact are essential to nail and micro-transactions/subscriptions are becoming a more reliable source of constant revenue. They are increasingly releasing paid downloadable content for fans to constantly expand a single game experience they pay for rather than multiple different games.

Mobile Apps -

With 7 applications released between 2016 and now, Nintendo has reached a "combined total of 650 million unique downloads." While mobile gaming is an extremely small portion of Nintendo's revenues, the growth potential of mobile apps behind IP they own is incredible. They also cleverly have subscriptions to individuals games because they know certain fans are only loyal to very few franchises but will still purchase. For example, The Animal Crossing Pocket Camp mobile game costs $7.99 per month for extra features in game like being able to "appoint your favorite animal as your camp caretaker."

Source: SensorTower

IP Expansion Initiatives -

Nintendo obviously deeply understands the relationship their customers have with their brand and characters they create. In their 'IP Expansion Philosophy' the company goes out of their way to mention they will "manage quality thoroughly" and "avoid introducing unintended attributes to characters that might limit future game development." This makes clear they intend to carefully maximize the profitability and reach of their existing IP for the long term; however, it is still a small portion of their revenues - something I think might need to shift if they want to thrive in the longer term future.

Other Visual Content -

Apparently Universal Pictures and Nintendo are working to finance The Super Mario Movie

Playing Cards -

Playing Cards accounted for 28 million dollars of their ~12 Billion in sales.

Wrap-up

There is heavy competition in the gaming hardware space, game development software space, and subscription gaming space. Despite this, Nintendo has been a household brand name for decades and has consistently produced consoles that change how individuals and families game [Nintendo DS, Nintendo Wii, Nintendo Switch]. Currently, Nintendo holds a unique position of selling the Switch which is a semi-mobile console built for multiplayer interactions. Sony and Microsoft have their own battle going on, so Nintendo has been able to lock in its position as a sort of alternative console maker for games they own and developers who want to release their games to the Switch audience. There are pros and cons to this approach, but contingent on them constantly improving their servers, service, and games, I believe Nintendo is in a great spot to capitalize on IP like Fire Emblem, Pokémon, etc. I believe the brand power behind those names is some of the strongest of any brands in the world and will serve as the base for the future of their business. They must still allow popular titles that they do not own to be accessible on the Nintendo E-Shop, but otherwise I think they can continue to grow their user base until the Nintendo Switch 2 model is released. They have been forward looking, investing in R&D for the future, and have been profitable so I am going to keep an eye on Nintendo this year given all of the hype around gaming.

Tom's Guide

Nintendo Switch 2 — latest rumors and everything we know so far

Nintendo has confirmed a Switch successor is on the way

Insightful!

Watchlist

Something went wrong while loading your statistics.

Please try again later.

Please try again later.

Already have an account?