Trending Assets

Top investors this month

Trending Assets

Top investors this month

PayPal Earnings Tomorrow 2/3 $PYPL

In light of tomorrow's earnings and the events of last week I thought I would shed some light on their current position and then expand on it tomorrow. It seems to me that fintech and the adoption of digital wallets has been one of the most talked about subjects across the broader investing community over the last year. Cathie Wood has been vocal about her bullishness on mobile payments, Chamath Palihapitiya has been an incredible salesman for his $IPOE SPACquisition :) of SoFi, and increasing relevance of cryptocurrencies naturally boosts conversation/adoption of digital wallets. On top of that, countries like China are practically cashless with "over 90% of people in China’s largest cities [using] WeChat Pay and Alipay as their primary payment method, with cash second, and card-based debit/credit a distant third" (Brookings Institute). This type of tech adoption in a country with ~4x the US population will most definitely spread to the entire globe even if it takes multiple decades. I think this makes intuitive sense to most of us but I also believe we still have an incredible amount of digital wallet adoption and consolidation of financial services companies in the next 4-7 years as so many different brokerages and services are coming out it is hard to keep track of.

Services

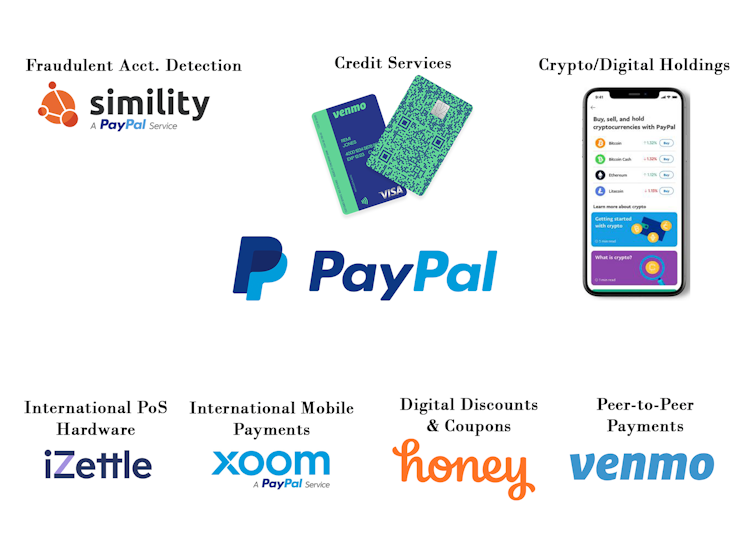

This image shows the primary subsidiaries of PayPal that are essential for the ecosystem they are trying to foster of a global mobile-payments service

Performance

**The latest Investor Update was for Q3 '20 on November 2nd

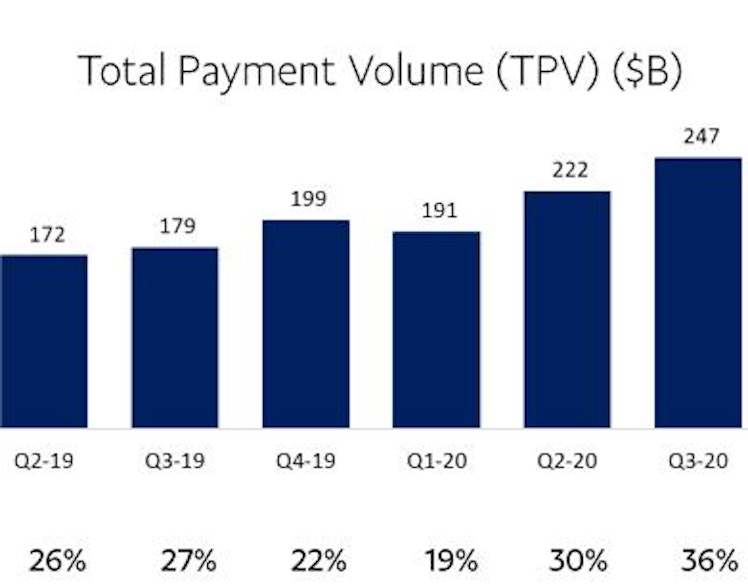

Despite the drastic shifts in consumer behavior due to Covid precautions, PayPal achieved the highest TPV [Total Payment Volume] in its history across all platforms in Q3 of 2020.

Source: Q3'20 Investor Update

**Note that 41B of this 247B is Venmo related volume

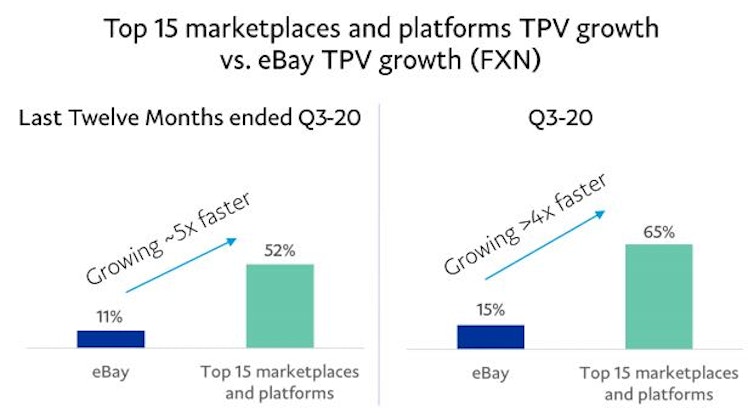

*eBay's TPV grew; however, this is misleading relative to competition -

While eBay is not doing well compared to its competitors, all other services under the PayPal umbrella are flourishing in the pandemic bringing in Billions of free cash flow to the firm [YTD free cash flow was 3.97 Billion [Q1'20 - Q3'20].

Discussion

With all of the media attention on brokerages like Robinhood and other fintech products, it seems as if they are more widely used than what is actually the case. There is Chime, SoFi, CashApp, PayPal, Venmo, and a million other services; however, I still believe Square and PayPal can utilize their low customer acquisition cost and network effects/seamless app experience to beat all of the competitors in offering lending services and other financial products. Because the financial system is so complicated and there are a lot of moving parts I would love to hear from you all what services you use/like/dislike and what you think will happen to these fintech companies in the next few years?? hopefully can expand some more tomorrow

Great memo @jays - To me the future mobile wallet and P2P market in the US will be a two person race between PayPal's Venmo and Square's Cash App.

I also found it interesting that Venmo recently rolled out Business Profiles for businesses to accept payments. Business Profiles creates a separate profile from Venmo user's personal profile to easily track business transactions. It allows customer to pay with Venmo App, or in-person via QR Code. Venmo currently isn't charging any transaction fees until April 2021, but will then charge 1.9% and $0.10 per transaction.

$PYPL $SQ

Already have an account?