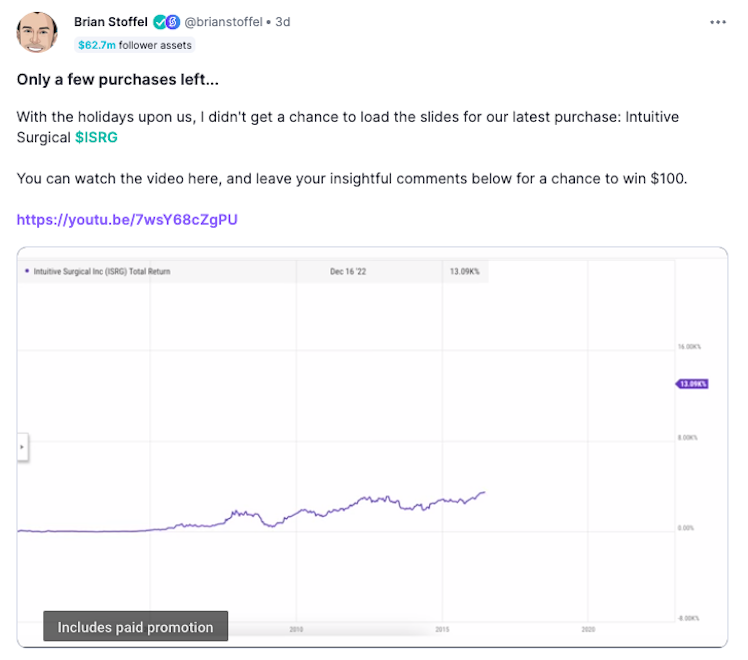

An Update on Zoom $ZM

Since Zoom is part of the portfolio @brianferoldi and I have built here on Commonstock, we wanted to give a brief update following earnings.

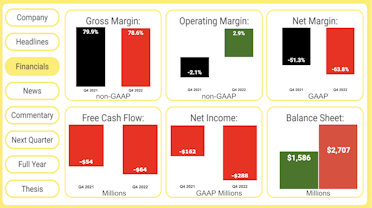

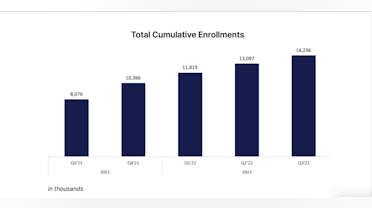

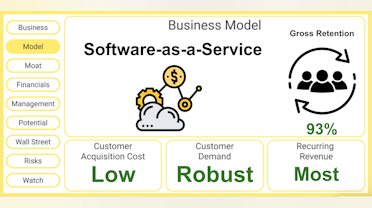

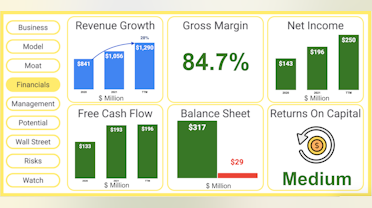

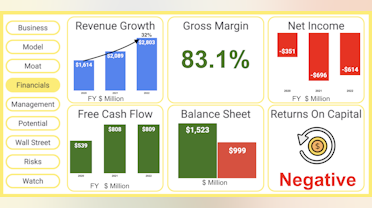

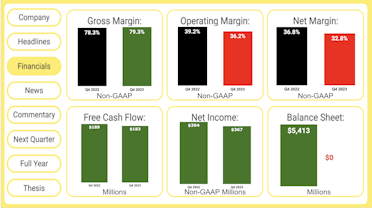

The headline numbers were solid across the board

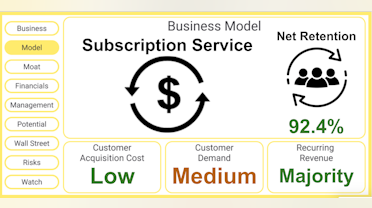

Though the margins contracted somewhat, this remains a company that is absolutely printing cash

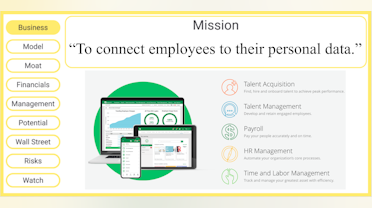

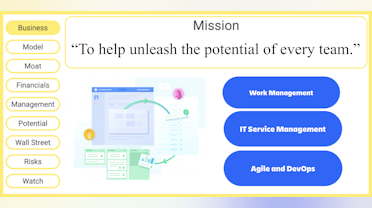

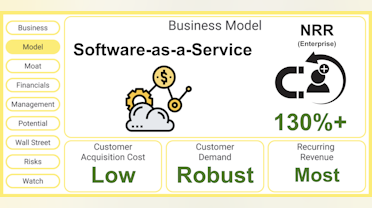

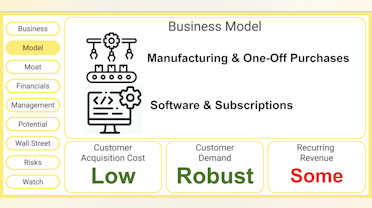

Here's where things get interesting. Zoom was NEVER meant to be a consumer-facing tool. The pandemic changed that, and momentarily super-charged business.

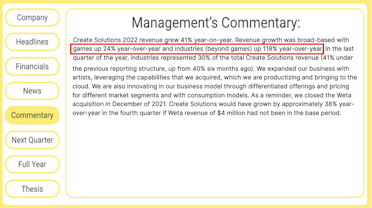

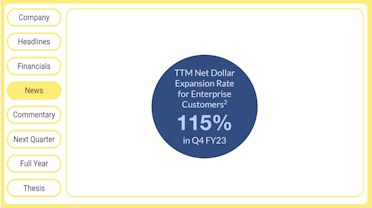

But now, consumers are leaving. That's as it was always meant to be. But it can be a drag on results. That's why focusing on ENTERPRISE (read: big company) business is so important.

Not only that, clients are signing bigger contracts that cover a longer cycle

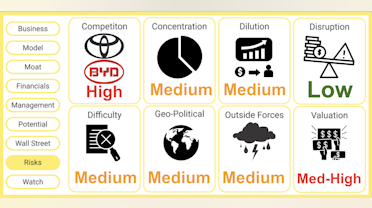

Yes, stock based compensation is pretty egregious (some of this is being phased out), but...

Diluted shares outstanding actually FELL because of buybacks over the past year.

Looking ahead, management doesn't expect much growth (remember, consumers down -- enterprise up) but profitability is expected to come in well ahead of Wall Street's estimates

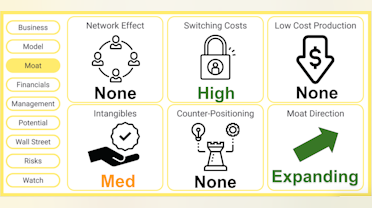

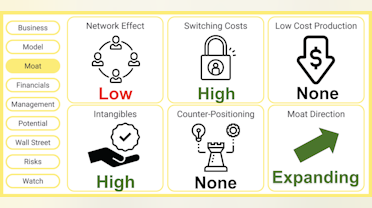

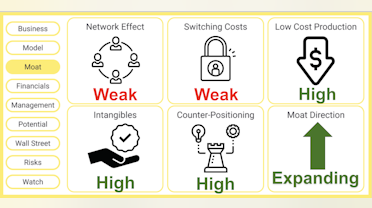

In valuing the company, it's important to note where in its growth lifecycle the company sits

And while valuation isn't everything to us, it's hard to deny what a good deal investors can get on shares right now

Overall, here's what we're watching moving forward

But enough from us, what did YOU think of the quarter?

Similar thoughts. Once that 600 mil in enterprise revenue growing at >20% makes up 80-90% of revenue then $ZM with 80% gross margins will start to take off